Concept explainers

Cost Data for Managerial Purposes—Budgeting

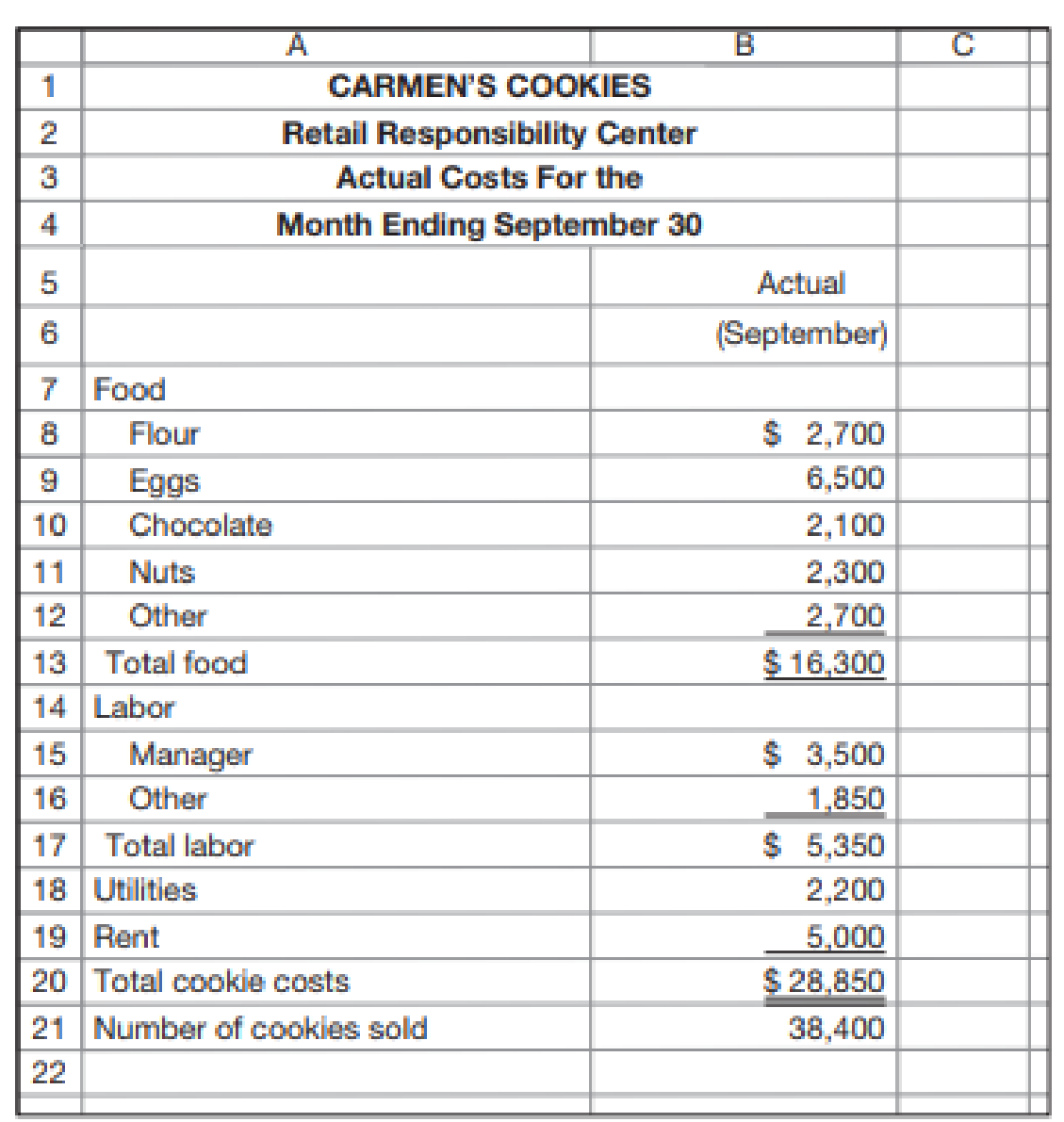

Refer to Exhibit 1.5. Assume that Carmen’s Cookies is preparing a budget for the month ending September 30. Management prepares the budget by starting with the actual results for April that appear in Exhibit 1.5. Then, management considers what the differences in costs will be between April and September.

Management expects cookie sales to be 20 percent greater in September than in April, and it expects all food costs (e.g., flour, eggs) to be 20 percent higher in September than in April because of the increase in cookie sales. Management expects “other” labor costs to be 25 percent higher in September than in April, partly because more labor will be required in September and partly because employees will get a pay raise. The manager will get a pay raise that will increase the salary from $3,000 in April to $3,500 in September. Utilities will be 5 percent higher in September than in April. Rent will be the same in September as in April.

Now, fast forward to early October and assume the following actual results occurred in September:

Required

- a. Prepare a statement like the one in Exhibit 1.5 that compares the budgeted and actual costs for September.

- b. Suppose that you have limited time to determine why actual costs are not the same as budgeted costs. Which three cost items would you investigate to see why actual and budgeted costs are different? Why would you choose those three costs?

a.

Prepare a statement like the one in Exhibit 1.5 that compares the budgeted and actual costs for September.

Explanation of Solution

Budgeted costs: The costs which are pre-determined at the beginning of the year are termed as the budgeted costs. These costs are considered as standard during the year while performing business activities.

Actual costs: The costs which are actually incurred during the year are termed as the actual costs. These costs are the actual figure of costs for the particular period.

The statement that compares the budgeted and actual costs for September is as follows:

| Company C | |||

| Retail Responsibility Center | |||

| Budgeted versus Actual Costs | |||

| For the Month Ending September 30 | |||

| Actual | Budget | Difference | |

| (September) | (September) | ||

| Food | |||

| Flour | $ 2,700 | $ 2,520 (1) | $ 180 |

| Eggs | $ 6,500 | $ 6,240 (2) | $ 260 |

| Chocolate | $ 2,100 | $ 2,400 (3) | $ (300) |

| Nuts | $ 2,300 | $ 2,400 (4) | $ (100) |

| Other | $ 2,700 | $ 2,640 (5) | $ 60 |

| Total food | $ 16,300 | $ 16,200 | $ 100 |

| Labor: | |||

| Manager | $ 3,500 | $ 3,500 | $ - |

| Other | $ 1,850 | $ 1,875 (6) | $ (25) |

| Total labor cost | $ 5,350 | $ 5,375 | $ (25) |

| Utilities | $ 2,200 | $ 1,890 | $ 310 |

| Rent | $ 5,000 | $ 5,000 | $ - |

| Total cost of cookies | $ 28,850 | $ 28,465 | $ 385 |

| Number of cookies sold | 38,400 | 38,400 | |

Working note 1:

Compute the budgeted cost of flour in September:

Working note 2:

Compute the budgeted cost of eggs for September:

Working note 3:

Compute the budgeted cost of chocolate for September:

Working note 4:

Compute the budgeted cost of nuts for September:

Working note 5:

Compute the other budgeted costs for September:

Working note 6:

Compute the other labor costs for September:

b.

Identify the three cost items which would be investigated to see why actual and budgeted costs are different and why those three costs would be chosen.

Explanation of Solution

The three cost items which would be investigated to see why actual and budgeted costs are different are as follows:

- • The cost of chocolates

- • The cost of eggs

- • The cost of utilities

The three items are having more difference between the budgeted and the actual figures. Thus, these items should be investigated, and the reason for such difference should be observed.

Want to see more full solutions like this?

Chapter 1 Solutions

Fundamentals of Cost Accounting

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning