Principles of Accounting

12th Edition

ISBN: 9781133626985

Author: Belverd E. Needles, Marian Powers, Susan V. Crosson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 3EA

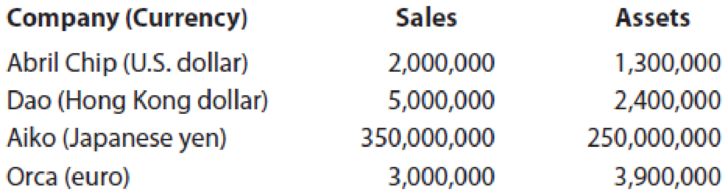

You have been asked to compare the sales and assets of four companies that make computer chips to determine which company is the largest in each category. You have gathered the following data, but they cannot be used for direct comparison because each company’s sales and assets are in its own currency:

Assuming that the exchange rates in Exhibit 2 are current and appropriate, convert all the figures to U.S. dollars (multiply amount by exchange rate) and determine which company is the largest in sales and which is the largest in assets.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Consider two fictional economies, one called domestic country and the other the foreign country. Given the transactions listed in (a) through (f), construct the trade balance, current account balance and capital account balance for each country. If necessary, include a statistical discrepancy.

A.The domestic country purchased $100 in computer parts from the foreign country.

B.Foreign tourists spent $25 in seeing a Broadway show.

C.Foreign investors were paid $15 in interest in their holding of domestic bonds.

D.Domestic residents remitted $25 to their relatives abroad.

E.Domestic businesses borrowed $65 from foreign banks.

F.Foreign investors purchased $50 of domestic corporate bonds

Suppose that Salem Co, a U.S.-based MNC that both purchases supplies from Canada and sells exports in Canada, is seeking to measure the economic

exposure of its cash flows. Salem wishes to analyze how its cash flows might change under different exchange rates for the Canadian dollar (the only

foreign currency in which it deals).

Salem estimates it's cash flows from both the U.S., in dollars, and Canada, in Canadian dollars. These figures are summarized in the following table.

U.S. Canada

Sales

-Cost of materials

$315

C$5

$45

C$150

-Operating expenses

$55

-Interest expenses

$5

C$10

Cash flows

$210

-$C155

Salem believes that the value of the Canadian dollar will be $0.70, $0.75, or $0.80, and seeks to analyze its cash flows under each of these scenarios.

The following table shows Salem's cash flows under each of these exchange rates.

For each exchange rate scenario, fill in rows (2), (3), (5), (6), (9), and (10). Finally, fill in the last row for net cash flows in U.S. dollars for each…

Suppose that Salem Co, a U.S.-based MNC that both purchases supplies from Canada and sells exports in Canada, is seeking to measure the economic exposure of its cash flows. Salem wishes to analyze how its cash flows might change under different exchange rates for the Canadian dollar (the only foreign currency in which it deals).

Salem believes that the value of the Canadian dollar will be $0.70, $0.75, or $0.80, and seeks to analyze its cash flows under each of these scenarios.

The following table shows Salem’s cash flows under each of these exchange rates.

Use the table to answer the question that follows.

Exchange Rate Scenario

Exchange Rate Scenario

Exchange Rate Scenario

C$1=$0.70

C$1=$0.75

C$1=$0.80

(Millions)

(Millions)

(Millions)

Sales

(1) U.S. Sales

$315

$315

$315

(2) Canadian Sales

$3.50

$4.00

$4.00

(3) Total Sales in U.S. $

$318.50

$318.75

$319.00

Cost of Materials and Operating Expenses

(4)…

Chapter 1 Solutions

Principles of Accounting

Ch. 1 - What makes accounting a valuable discipline?Ch. 1 - Prob. 2DQCh. 1 - Prob. 3DQCh. 1 - How are expenses and withdrawals similar, and how...Ch. 1 - How do generally accepted accounting principles...Ch. 1 - Why do managers in governmental and not-for-profit...Ch. 1 - Prob. 1SECh. 1 - Match the descriptions that follow with the...Ch. 1 - Determine the amount missing from each accounting...Ch. 1 - Use the accounting equation to answer each...

Ch. 1 - Use the accounting equation to answer each...Ch. 1 - Prob. 6SECh. 1 - Use the following accounts and balances to prepare...Ch. 1 - Randall Company engaged in activities during the...Ch. 1 - Prob. 9SECh. 1 - Prob. 10SECh. 1 - Prob. 1EACh. 1 - Financial accounting uses money measures to gauge...Ch. 1 - You have been asked to compare the sales and...Ch. 1 - Use the accounting equation to answer each...Ch. 1 - Daiichi Companys total assets and liabilities at...Ch. 1 - 1. Indicate whether each of the following accounts...Ch. 1 - Listed in random order are some of Oxford Services...Ch. 1 - Dukakis Company had the following accounts and...Ch. 1 - Prob. 9EACh. 1 - Prob. 10EACh. 1 - Complete the financial statements that follow by...Ch. 1 - Prob. 12EACh. 1 - Match the terms that follow with the appropriate...Ch. 1 - Prob. 14EACh. 1 - Prob. 15EACh. 1 - Prob. 1PCh. 1 - The following three independent sets of financial...Ch. 1 - Fuel Designs financial accounts follow. The...Ch. 1 - The accounts of Frequent Ad, an agency that...Ch. 1 - Athena Riding Clubs financial statements follow.Ch. 1 - A list of financial statement items follows....Ch. 1 - Three independent sets of financial statements...Ch. 1 - Prob. 8APCh. 1 - Prob. 9APCh. 1 - Aqua Swimming Clubs financial statements follow....Ch. 1 - Costco Wholesale Corporation is Americas largest...Ch. 1 - Prob. 2CCh. 1 - Prob. 3CCh. 1 - Prob. 4CCh. 1 - Refer to the CVS annual report and the financial...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You are the manager of a U.S. company situated in Los Angeles and manages the import/export division of the company. The company distributes (resells) a variety of consumer products imported to the U.S.A from Europe and also exports goods manufactured in the U.S.A. to Canada. Therefore, your company is very much dependent an the impact of current and future exchange rates on the performance of the company. Scenario 1: You have to estimate the expected exchange rates between your home currency and the other currencies of the major other countries that you deal with in terms of bath imports and exparts. The reason is that increases in the values of other currencies compared to the U.S. Dollar may impact your imports negatively, whilst it may on the other hand, be good for exports. To do this estimate, you obtain the following spot exchange rate information: €/S CADS/S 0.87616 1.30779 You also obtain the following annual risk free rates applying in the countries: U.S.A. 2.660% France…arrow_forwardShava specializes in cross-rate arbitrage. He notices the following quotes: Swiss franc/dollar = SFr1.5987/$ Australian dollar/U.S. dollar = A$1.8233/$ Australian dollar/Swiss franc = A$1.1452/SFr Ignoring transaction costs, does Shava have an arbitrage opportunity based on these quotes? If there is an arbitrage opportunity, what steps would he take to make an arbitrage profit, and how much would he profit if he has $1,000,000 available for this purpose?arrow_forwardDoug Bernard specializes in cross-rate arbitrage. He notices the following quotes: Swiss franc/dollar = SFr1.6077/$ Australian dollar/U.S. dollar = A$1.8345/$ Australian dollar/Swiss franc = A$1.1521/SFr Ignoring transaction costs, does Doug Bernard have an arbitrage opportunity based on these quotes? If there is an arbitrage opportunity, what steps would he take to make an arbitrage profit, and how much would he profit if he has $1,000,000 available for this purpose?arrow_forward

- Kittle estimates it's cash flows from both the U.S., in dollars, and Canada, in Canadian dollars, for a typical quarter. These figures are summarized in the following table. U.S. Canada Sales $310 C$3 -Cost of materials $50 C$200 -Operating expenses $60 -Interest expenses $5 C$10 Cash flows $195 -$C207 Kittle believes that the value of the Canadian dollar will be either $0.80 or $0.90 and seeks to analyze its cash flows under each of these scenarios. The following table shows Kittle's cash flows under each of these exchange rates. Sales (1) U.S. Sales (2) Canadian Sales (3) Total sales in U.S. $ Cost of Materials and Operating Expenses (4) U.S. Cost of Materials (5) Canadian Cost of Materials (6) Total Cost of Materials in U.S. $ (7) Operating Expenses Interest Expense Exchange Rate Scenario C$1=$0.80 Exchange Rate Scenario C$1=$0.90 (Millions) (Millions) $310 $310 C$3 X $0.80 = $2.40 C$3 X $0.90 = $2.70 $312.40 $312.70 $50 $50 C$200 X $0.80 = $160.00 C$200 X $0.90 = $180.00 $210.00…arrow_forwardSuppose a U.S. firm builds a factory in China, staffs it with Chinese workers, uses materials supplied by Chinese companies, and finances the entire operation with a loan from a Chinese bank located in the same town as the factory. This firm is most likely trying to greatly reduce, or eliminate, which one of the following? Interest rate disparities Short-run exposure to exchange rate risk Long-run exposure to exchange rate risk Political risk associated with the foreign operations Translation exposure to exchange rate riskarrow_forward1.) Harris Incorporated had the following transactions: On May 1, Harris purchased parts from a Japanese company for a U.S. dollar–equivalent value of $6,200 to be paid on June 20. The exchange rates were May 1 1 yen = $0.0070 June 20 1 yen = 0.0075 On July 1, Harris sold products to a Brazilian customer for a U.S. dollar equivalent of $10,200, to be received on August 10. Brazil’s local currency unit is the real. The exchange rates were July 1 1 real = $0.20 August 10 1 real = 0.22 Required: - Assume that the two transactions are denominated in the applicable LCUs of the foreign entities. Prepare the entries required for the dates of the transactions and their settlement in the LCUs of the Japanese company (yen) and the Brazilian customer (real). For Part B: 1 Record the foreign purchase denominated in Japanese yen. 2 Record the revaluation of the foreign currency payable to the U.S. dollar equivalent value. 3 Record the purchase of Japanese yen to…arrow_forward

- 1.) Harris Incorporated had the following transactions: On May 1, Harris purchased parts from a Japanese company for a U.S. dollar–equivalent value of $6,200 to be paid on June 20. The exchange rates were May 1 1 yen = $0.0070 June 20 1 yen = 0.0075 On July 1, Harris sold products to a Brazilian customer for a U.S. dollar equivalent of $10,200, to be received on August 10. Brazil’s local currency unit is the real. The exchange rates were July 1 1 real = $0.20 August 10 1 real = 0.22 Required: - Assume that the two transactions are denominated in the applicable LCUs of the foreign entities. Prepare the entries required for the dates of the transactions and their settlement in the LCUs of the Japanese company (yen) and the Brazilian customer (real). For Part B: 1 Record the foreign purchase denominated in Japanese yen. 2 Record the revaluation of the foreign currency payable to the U.S. dollar equivalent value. 3 Record the purchase of Japanese yen to…arrow_forwardDoug Bernard specializes in cross-rate arbitrage. He notices the following quotes: Swiss franc/dollar = SFr1.5971/$ Australian dollar/U.S. dollar = A$1.8215/$ Australian dollar/Swiss franc = A$1.1440/SFr Ignoring transaction costs, does Doug Bernard have an arbitrage opportunity based on these quotes? If there is an arbitrage opportunity, what steps would he take to make an arbitrage profit, and how much would he profit if he has $1,000,000 available for this purpose? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Arbitrage profitarrow_forwardPlease answer both subparts. 1. XYZ, an Australian exporter, has entered into a contract to sell goods in 6 months time and will receive USD 1 million for these goods. What type of exposure is this an example of and why? (a) Economic exposure (b) Translation exposure (c) Transaction exposure (d) Competitive exposure 2. How can a firm protect itself against economic exposure? (a) Money market hedges (b) Geographical diversification (c) Forward contract hedges (d) Futures market hedgingarrow_forward

- For each of the following transactions, determine which U.S balance of payments account is credited and which is debited and by how much. Assume payments for all transactions are deposited into a U.S dollar-denominated bank account. Calculate for c and d.arrow_forwardAssume your firm has transferred you to Zurich Switzerland. You work in the triangular arbitrage division. View the following exchange rates. Is an arbitrage opportunity available? If not, explain why an opportunity does not exist. If so, from the Swiss point of view show how to exploit the opportunity. CHF .8976 = $1.00, $.0130 = INR 1.00, INR 92.7904 = CHF 1 Now say instead of working in Zurich, you were employed in Mumbai, India. How does that change your thinking on the arbitrage? PLEASE ANWSER CORRECTLY AND SHOW WORKarrow_forwardVikramarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Foreign Exchange Risks; Author: Kaplan UK;https://www.youtube.com/watch?v=ne1dYl3WifM;License: Standard Youtube License