a.1

Classify the items that will come under the product cost and calculate the amount of cost of goods sold for the year 2014-income statement.

a.1

Answer to Problem 2ATC

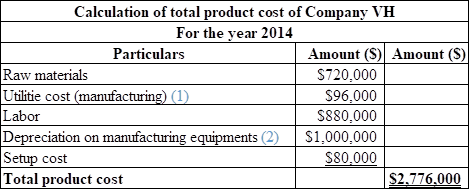

The items that will be classified under the product cost is as follows:

Table (1)

Hence, the total product cost of Company VH is $2,776,000.

Calculation of cost of goods sold is as follows:

Hence, the cost of goods sold is $2,400,000.

Explanation of Solution

Cost of goods sold:

Cost of goods sold is the total of all the expenses incurred by a company to sell the goods during the given period

Working notes:

Calculate the per square foot:

Hence, the per square foot value is $1.60.

Calculate the utility cost for manufacturing:

Hence, the utility cost for manufacturing is $96,000

…… (1)

Calculate the depreciation on manufacturing equipments:

Hence, the depreciation cost is $1,000,000.

…… (2)

Calculate the cost per unit:

Hence, the cost per unit is $40.

…… (3)

2.

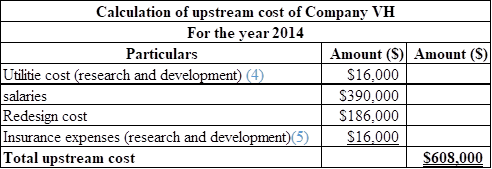

Classify the items that will come under the upstream cost and calculate the amount of upstream cost expensed for the year 2014-income statement.

2.

Answer to Problem 2ATC

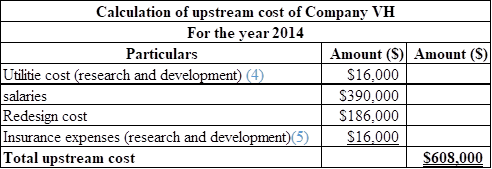

The items that will be classified under the upstream cost is as follows:

Table (2)

Hence, the total upstream expenses is $608,000.

Explanation of Solution

Upstream cost:

This cost is incurred before starting manufacturing process for example research and development and product design.

Working notes:

Calculate the per square foot:

Hence, the per square foot value is $1.60.

Calculate the utility cost for manufacturing:

Hence, the utility cost for manufacturing is $16,000

…… (4)

Calculate the amount of prepaid insurance:

Hence, the prepaid insurance is $48,000.

Calculate the rate for insurance expenses:

Hence, the rate for insurance expenses per employee is $4,000.

Calculate the insurance expenses on research and development:

Hence, the insurance expenses on research and development is $16,000.

…… (5)

Note:

Accrued engineer’s salary $10,000 comes under the upstream cost but it is not considered for calculating upstream cost because it is previous years.

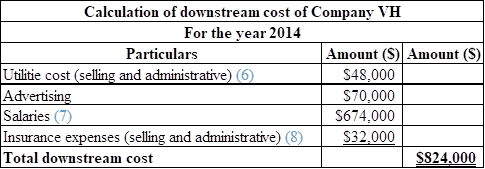

3.

Classify the items that will come under the downstream cost and calculate the amount of downstream cost expensed for the year 2014-income statement.

3.

Answer to Problem 2ATC

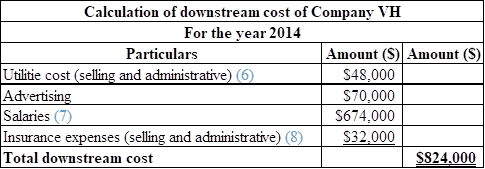

The items that will be classified under the downstream cost is as follows:

Table (3)

Hence, the total downstream expenses is $824,000.

Explanation of Solution

Downstream:

This cost is incurred after starting manufacturing process for example marketing, distribution, and customer service

Working notes:

Calculate the per square foot:

Hence, the per square foot value is $1.60.

Calculate the utility cost for selling and administrative:

Hence, the utility cost for selling and administrative cost is $48,000

…… (6)

Calculate the amount of prepaid insurance:

Hence, the prepaid insurance is $48,000.

Calculate the total salary:

Hence, the total salary is $674,000.

…… (7)

Calculate the rate for insurance expenses:

Hence, the rate for insurance expenses per employee is $4,000.

Calculate the insurance expenses on selling and administrative:

Hence, the insurance expenses on selling and administrative is $32,000.

…… (8)

b.

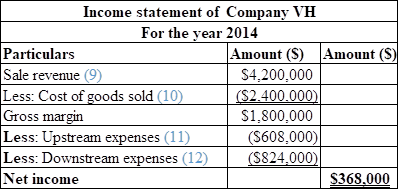

Prepare the income statement.

b.

Answer to Problem 2ATC

Calculation of income statement is as follows:

Table (4

Hence, the net income of the Company VH is $368,000.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Working notes:

Calculate the revenue:

Hence, the revenue is $4,200,000.

…… (9)

Calculation of cost of goods sold is as follows:

Hence, the cost of goods sold is $2,400,000.

…… (10)

Calculate the upstream expenses:

Table (5)

Hence, the total upstream expenses is $608,000.

…… (11)

Calculate the downstream expenses:

Table (6)

Hence, the total downstream expenses is $824,000.

…… (12)

Want to see more full solutions like this?

Chapter 1 Solutions

Fundamental Managerial Accounting Concepts

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education