Financial and Managerial Accounting - CengageNow

15th Edition

ISBN: 9781337911979

Author: WARREN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 25E

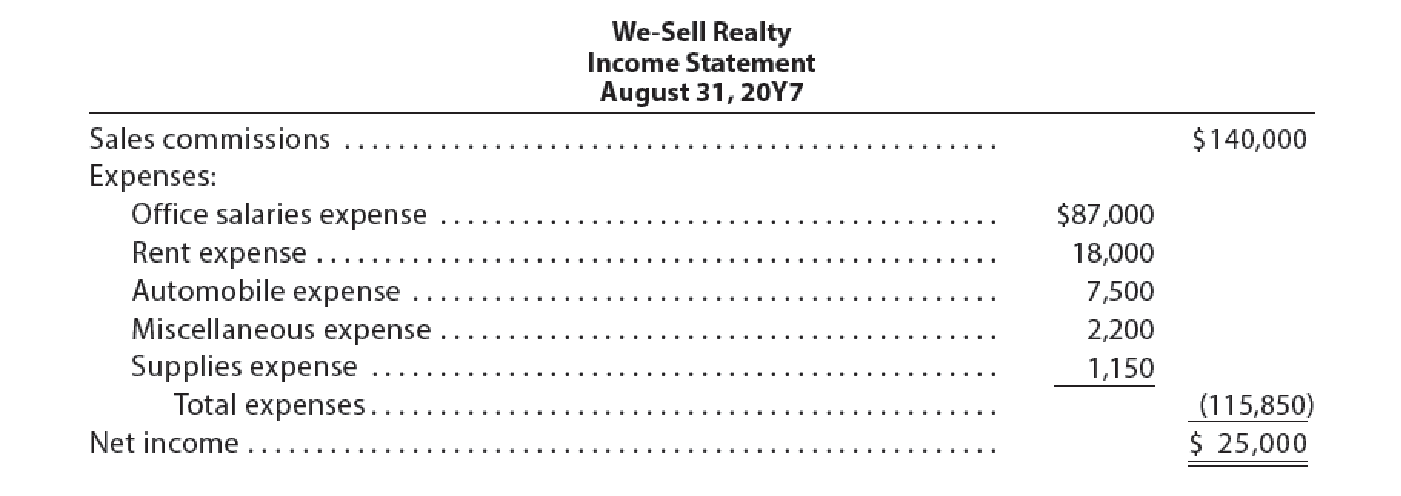

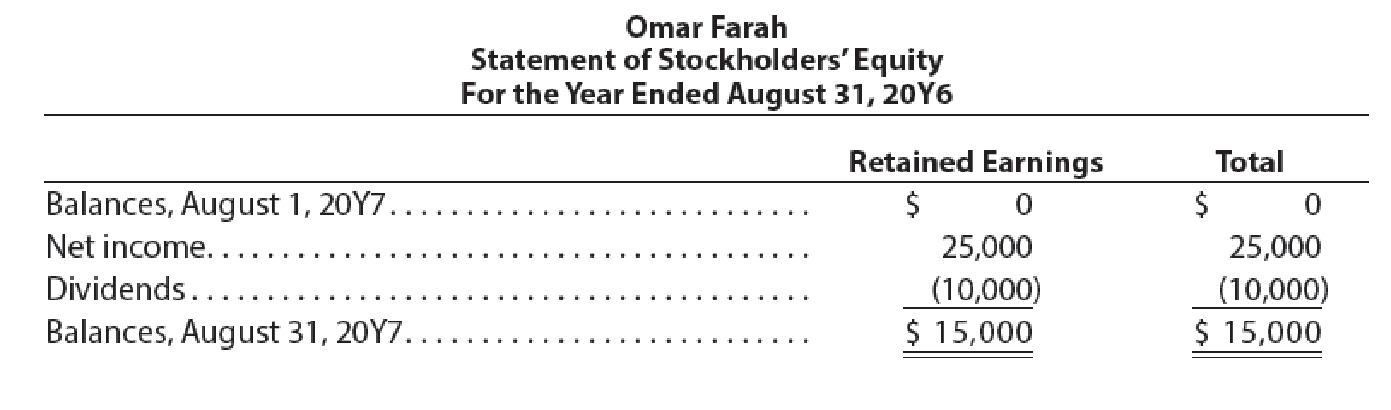

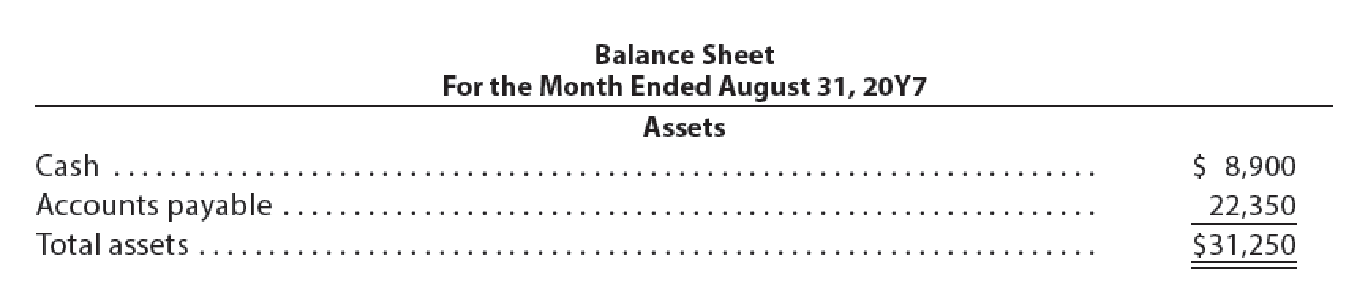

Financial statements

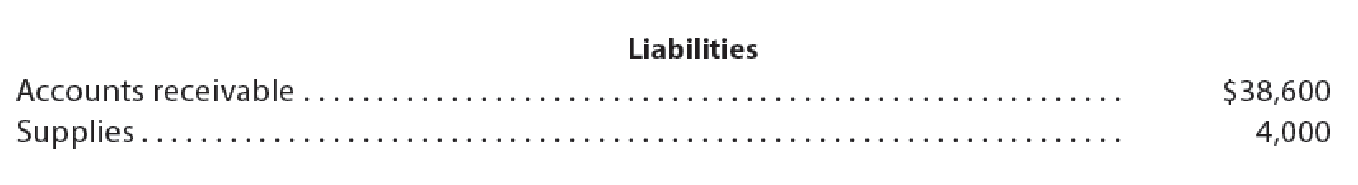

We-Sell Realty was organized as a corporation on August 1, 20Y7, by the issuance of common stock of $15,000. We-Sell Realty is owned and operated by Omar Farah, the sole stockholder. The following statements for We-Sell Realty were prepared after its first month of operations:

a. Identify the errors contained within the presented financial statements for We-Sell Realty.

b. Prepare a corrected set of financial statements for We-Sell Realty.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

please answer part d. include rates for amortization and MACRS.

General Accounting question

Provide correct option general Accounting

Chapter 1 Solutions

Financial and Managerial Accounting - CengageNow

Ch. 1 - Prob. 1DQCh. 1 - Prob. 2DQCh. 1 - Prob. 3DQCh. 1 - Josh Reilly is the owner of Dispatch Delivery...Ch. 1 - On July 12, Reliable Repair Service extended an...Ch. 1 - Prob. 6DQCh. 1 - Describe the difference between an account...Ch. 1 - A business had revenues of 679,000 and operating...Ch. 1 - A business had revenues of 640,000 and operating...Ch. 1 - The financial statements are interrelated. (A)...

Ch. 1 - Prob. 1BECh. 1 - Accounting equation Be-The-One is a motivational...Ch. 1 - Transactions Interstate Delivery Service is owned...Ch. 1 - Income statement The revenues and expenses of...Ch. 1 - Statement of stockholders equity Using the income...Ch. 1 - Balance sheet Using the following data for...Ch. 1 - Statement of cash flows A summary of cash flows...Ch. 1 - Ratio of liabilities to stockholders equity The...Ch. 1 - Prob. 1ECh. 1 - Prob. 2ECh. 1 - Prob. 3ECh. 1 - Accounting equation The total assets and total...Ch. 1 - Prob. 5ECh. 1 - Accounting equation Determine the missing amount...Ch. 1 - Accounting equation Inspirational Inc. is a...Ch. 1 - Asset, liability, and stockholders equity items...Ch. 1 - Effect of transactions on accounting equation What...Ch. 1 - Effect of transactions on accounting equation A. A...Ch. 1 - Effect of transactions on stockholders equity...Ch. 1 - Transactions The following selected transactions...Ch. 1 - Nature of transactions Teri West operates her own...Ch. 1 - Net income and dividends The income statement for...Ch. 1 - Net income and stockholders equity for four...Ch. 1 - Balance sheet items From the following list of...Ch. 1 - Income statement items Based on the data presented...Ch. 1 - Statement of stockholders equity Financial...Ch. 1 - Income statement Imaging Services was organized on...Ch. 1 - Prob. 20ECh. 1 - Balance sheets, net income Financial information...Ch. 1 - Financial statements Each of the following items...Ch. 1 - Statement of cash flows Indicate whether each of...Ch. 1 - Statement of cash flows A summary of cash flows...Ch. 1 - Financial statements We-Sell Realty was organized...Ch. 1 - Transactions On April 1 of the current year,...Ch. 1 - Financial statements The assets and liabilities of...Ch. 1 - Financial statements Seth Feye established...Ch. 1 - Transactions; financial statements On August 1,...Ch. 1 - Transactions; financial statements DLite Dry...Ch. 1 - Missing amounts from financial statements The...Ch. 1 - Transactions Amy Austin established an insurance...Ch. 1 - PR 1-2 B Financial statements The assets and...Ch. 1 - Financial statements 1. Net income: 10,900 Jose...Ch. 1 - Transactions; financial statements 2. Net income:...Ch. 1 - Transactions; financial statements Bevs Dry...Ch. 1 - Missing amounts from financial statements The...Ch. 1 - Peyton Smith enjoys listening to all types of...Ch. 1 - Prob. 1MADCh. 1 - Analyze The Home Depot for three years The Home...Ch. 1 - Analyze Lowes for three years Lowes Companies,...Ch. 1 - Compare The Home Depot and Lowes Using your...Ch. 1 - Compare Papa Johns and Yum! Brands The following...Ch. 1 - Prob. 1TIFCh. 1 - Prob. 2TIFCh. 1 - Prob. 4TIFCh. 1 - Prob. 5TIFCh. 1 - Prob. 6TIF

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

The KEY to Understanding Financial Statements; Author: Accounting Stuff;https://www.youtube.com/watch?v=_F6a0ddbjtI;License: Standard Youtube License