Concept explainers

Transactions; financial statements

Bev’s Dry Cleaners is owned and operated by Beverly Zahn. A building and equipment are currently being rented, pending expansion to new facilities. The actual work of dry cleaning is done by another company at wholesale rates. The assets, liabilities, and common Mock of the business on November 1, 2018, are as follows: Ca.sh, $39,000.

- A. A Beverly Zahn invested additional cash in exchange for common stock with a deposit of $21,000 in the business bank account.

- B. B Purchased land adjacent to land currently owned by Bev’s Dry Cleaners to use in the future as a parking lot, paying cash of $35,000.

- C. Paid rent for the month, $4,000.

- D. Charged customers for dry cleaning revenue on account $72,000.

- E. Paid creditors on account $20,000.

- F. Purchased supplies on account, $8,000.

- G. Received cash from customers for dry cleaning revenue, $38,000.

- H. Received cash from customers on account. $77,000.

- I. Received monthly invoice for dry cleaning expense for November (to be paid on December 10), $29,450.

- J. Paid the following: wages expense, $24,000; truck expense, $2,100; utilities expense, $ 1,800; miscellaneous expense, $1,300.

- K. Determined that the cost of supplies on hand was $11300; therefore, the cost of supplies used during the month was $7,200.

- L. Paid dividends, $5,000

Instructions

- 1. Determine the amount of

retained earnings as of November 1. - 2. Slate the assets, liabilities, and stockholders’ equity as of November 1 in equation form similar to that shown in this chapter. In tabular form below the equation, indicate increases and decreases resulting from each transaction and the new balances after each transaction.

- 3. Prepare an income statement for November, a retained earnings statement for November, and a

balance sheet as of November 30. - 4. (Optional) Prepare a statement of

cash flows for November.

a)

Accounting equation: Accounting equation is an accounting tool expressed in the form of equation, by creating a relationship between the resources or assets of a company, and claims on the resources by the creditors and the owners. Accounting equation is expressed as shown below:

Assets = Liabilities + Shareholders Equity

To Determine: The retained earnings for BD Cleaners as on November 1, 2018.

Explanation of Solution

Calculate the retained earnings for BD Cleaners as on November 1, 2018.

The retained earnings, for BD Cleaners as on November 1, 2018 are $98,500.

b)

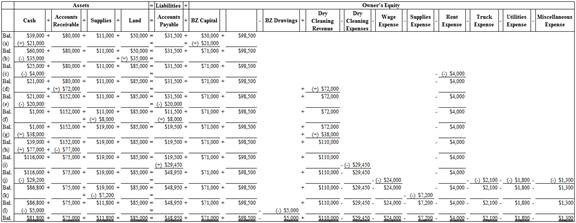

To Indicate: The effect of each given transaction of BD Cleaners on the accounting equation.

Explanation of Solution

Business transaction: Business transaction is a record of any economic activity, resulting in the change in the value of the assets, the liabilities, and the Shareholder’s equities, of a business. Business transaction is also referred to as financial transaction.

Indicate the effect of the given transactions of BD Cleaners.

(Figure – 1)

c)

To Prepare: The financial statements for BD Cleaners for the month ended November 30, 2018.

Explanation of Solution

Financial statements: Financial statements refer to those statements, which are prepared by the Company according to particular formats in accounting to show its financial position.

Financial statements include the following statements:

Income statement: Income statement is a financial statement that shows the net income or net loss by deducting the expenses from the revenues and vice versa.

Prepare the income statement of BD Cleaners for the month ended November 30, 2018.

| BD Cleaners | ||

| Income Statement | ||

| For the month ended November 30 , 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues | ||

| Dry cleaning revenue | $110,000 | |

| Expenses | ||

| Dry Cleaning expense | $29,450 | |

| Wages expense | $24,000 | |

| Supplies expense | $7,200 | |

| Rent expense | $4,000 | |

| Truck expense | $2,100 | |

| Utilities expense | $1,800 | |

| Miscellaneous expense | $1,300 | |

| Total expenses | $69,850 | |

| Net income | $40,150 | |

Table (1)

Hence, the net income of BD Cleaners for the month ended November 30, 2018 is $40,150.

Statement of Retained Earnings: Statement of retained earnings shows, the changes in the retained earnings, and the income left in the company after payment of the dividends, for the accounting period.

Prepare the statement of Retained earnings for BD Cleaners for the month ended November 30, 2018.

| BD Cleaners | ||

| Statement of Retained Earnings | ||

| For the month ended November 30 , 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Retained earnings, November 1, 2018 | $98,500 | |

| Net income for the month | $40,150 | |

| Deduct - Dividends | $5,000 | |

| Increase in Retained earnings | $35,150 | |

| Retained earnings, November 30, 2018 | $133,650 | |

Table (2)

Hence, the retained earnings of BD Cleaners for the month ended November 30, 2018 are $133,650.

Balance Sheet: Balance Sheet summarizes the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare the balance sheet of BD Cleaners for the month ended November 30, 2018.

| BD Cleaners | ||

| Balance Sheet | ||

| November 30 , 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Assets | ||

| Current Assets | ||

| Cash | $81,800 | |

| Accounts receivable | $75,000 | |

| Supplies | $11,800 | |

| Land | $85,000 | |

| Total current assets | $253,600 | |

| Liabilities and Stockholders’ Equity | ||

| Liabilities | ||

| Accounts payable | $48,950 | |

| Owner's equity | ||

| Common Stock | $71,000 | |

| Retained earnings | $133,650 | |

| Total stockholders’ equity | 204,650 | |

| Total liabilities and stockholders’ equity | $253,600 | |

Table (3)

The balance sheet of BD Cleaners shows asset balance of $253,600 which is same as the balance of liabilities and owner's equity.

d)

To Prepare: The statement of cash flow for BD Cleaners for the month ended November 30, 2018.

Answer to Problem 1.5BPR

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period.

Prepare the statement of cash flows for BD Cleaners for the month ended November 30, 2018.

| DD Cleaners | ||

| Statement of Cash Flows | ||

| For the month ended November 30, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flows from operating activities: | ||

| Cash receipts from customers | $115,000 | |

| Cash payments for expenses (1) | $33,200 | |

| Payments to creditors | $20,000 | $53,200 |

| Net cash flow used for operating activities | $61,800 | |

| Cash flows from investing activities: | ||

| Cash payment for purchase of land | (-) $35,000 | |

| Cash flows from financing activities: | ||

| Cash receipt of owner’s investment | $21,000 | |

| Deduct - Withdrawals | (-) $5,000 | |

| Net cash flow from financing activities | $16,000 | |

| Net Increase in cash during November | $42,800 | |

| Cash Balance on November 1, 2019 | $39,000 | |

| Cash Balance on November 30 , 2019 | $81,800 | |

Table (4)

The statement of cash flows for BD Cleaners for the month ended November 30, 2018, shows cash balance of $81,800 on November 30, 2018

Explanation of Solution

Working Note:

Calculate the expenses made through cash payments.

Want to see more full solutions like this?

Chapter 1 Solutions

CengageNOWv2, 2 terms Printed Access Card for Warren/Reeve/Duchac’s Financial & Managerial Accounting, 14th

Additional Business Textbook Solutions

Financial Accounting, Student Value Edition (4th Edition)

Principles of Accounting Volume 2

FINANCIAL ACCT.FUND.(LOOSELEAF)

Horngren's Accounting (12th Edition)

Intermediate Accounting (2nd Edition)

Financial Accounting (11th Edition)

- Integrity operates a branch in Laoag City. At close of the business on December 31, 2022. Laoag Branch account in the home office books showed a debit balance of P234,900. The inter-office accounts were in agreement at the beginning of the year. For purposes of reconciling the interoffice accounts, the following facts were ascertained.a. Computer equipment costing the home office P27,000 was sent to Laoag branch. The home office will maintain the records of the asset used by the branch. Meanwhile back at the branch, no entry was made.b. The branch acquired a machinery costing P18,000. The home office will maintain the records of the asset used by the branch. The home office was not yet notified.c. The home office charged the branch for freight amount to P2,220. It should have been charged to its customer.d. The home office inadvertently recorded a Laoag branch remittance of P4,200, as collection from its customers on account.e. On December 24, 2022,…arrow_forwardRequired Information [The following Information applies to the questions displayed below.] On January 1, 2021, the general ledger of ACME Fireworks Includes the following account balances: Accounts Cash Debit. Credit Accounts Receivable Allowance for Uncollectible Accounts $ 27,100 50,200 $ 6,200 Inventory 22,000 Land 66,000 Equipment 25,000 Accumulated Depreciation 3,500 Accounts Payable 30,500 Notes Payable (6%, due April 1, 2022) 70,000 Common Stock 55,000 Retained Earnings 25,100 Totals $190,300 $190,300 During January 2021, the following transactions occur: January 2 Sold gift cards totaling $12,000. The cards are redeemable for merchandise within one year of the purchase date. January 6 Purchase additional inventory on account, $167,000. January 15 Firework sales for the first half of the month total $155,000. All of these sales are on account. The cost of the units sold is $83,800. January 23 Receive $127,400 from customers on accounts receivable. January 25 Pay $110,000 to…arrow_forwardThe balances of the ledger accounts of Beldren Home Center as of December 31, the end of its fiscal year, are as follows: Cash: 10,592 Accounts Receivable: 43,962 Merchandise Inventory: 120,838 Supplies: 1,570 Prepaid Insurance: 2,628 Store Equipment: 35,924 Accumulated Depreciation, Store Equipment: 29,420 Office Equipment: 10,436 Accumulated Depreciation, Office Equipment: 1,720 Notes Payable: 5,000 Accounts Payable: 29,822 Unearned Rent: 3,200 A.P. Beldren, Capital: 120,532 A.P. Beldren, Drawing: 29,000 Sales: 653,000 Sales Returns and Allowances: 9,748 Purchases: 519,374 Purchases Returns and Allowances: 12,440 Purchases Discounts: 8,634 Freight In: 24,724 Wages Expense: 54,200 Interest Expense: 772 Data for the adjustments are as follows: a-b. Merchandise Inventory at December 31, $102,765. c. Wages accrued at December 31, $1,834. d. Supplies inventory (on hand) at December 31, $645. e. Depreciation of store equipment, $5,782. f. Depreciation of office equipment, $1,791. g.…arrow_forward

- Integrity operates a branch in Laoag City. At close of the business on December 31, 2022. Laoag Branch account in the home office books showed a debit balance of P234,900. The inter-office accounts were in agreement at the beginning of the year. For purposes of reconciling the interoffice accounts, the following facts were ascertained. Computer equipment costing the home office P27,000 was sent to Laoag branch. The home office will maintain the records of the asset used by the branch. Meanwhile back at the branch, no entry was made. The branch acquired a machinery costing P18,000. The home office will maintain the records of the asset used by the branch. The home office was not yet notified. The home office charged the branch for freight amount to P2,220. It should have been charged to its customer. The home office inadvertently recorded a Laoag branch remittance of P4,200, as collection from its customers on account. On December 24, 2022, the branch sent a check for P9,600…arrow_forwardRequired: Compute the asset turnover ratio for 2021. (Re Asset turnover ratioarrow_forwardThe account balances for Premera Blue Cross are listed below. All balances are as of December 31, 2023, except where noted otherwise. $16,500 Rent Expense $18,000 247,500 28,800 Equipment 7,800 Furniture 66,000 3,600 Notes Payable (due 12/31/25) 105,000 6,000 Accumulated Depreciation 31,350 329,250 Cash 78,000 60,000 150,000 42,450 1200 31,350 12,600 Accounts Payable Accounts Receivable Wages Payable Prepaid Expenses Dividends Sales Revenue Notes Payable (due 4/30/24) Cost of Goods Sold Loss on Sale of Equipment Inventory Advertising Expense Insurance Expense Select one: O a. $170,850 b. $137,850 3,000 Common Stock Determine Income from Operations for 2023: c. $124,500 d. $96,000 e. $106,500 158,400 Goodwill 10,500 Retained Earnings (1/1/23) 28,500 Marketable Equity Securities 9,000 Depreciation Expense 6,000 Unearned Revenuearrow_forward

- Required information [The following information applies to the questions displayed below) On January 1, 2021, the general ledger of ACME Fireworks Includes the following account balances: Debit Credit Accounts Cash $ 25,000 Accounts Receivable 47,600 Allowance for Uncollectible Accounts $ 4,900 Inventory Land 20,700 53,000 Equipment 18,500 Accumulated Depreciation 2,200 Accounts Payable 29,200 Notes Payable (6%, due April 1, 2022) 57,000 Common Stock 42,000 Retained Earnings 30,300 Totals $165,600 $165,600 During January 2021, the following transactions occur January 2 Sold gift cards totaling $9,400. The cards are redeemable for merchandise within one year of the purchase date. January 6 Purchase additional inventory on account, $154,000. January 15 Firework sales for the first half of the month total $142,000. All of these sales are on account. The cost of the units sold is $77,300. January 23 Receive $126,100 from customers on accounts receivable. January 25 Pay $97,000 to inventory…arrow_forwardRequired information [The following information applies to the questions displayed below] Jaguar Plastics Company has been operating for three years. At December 31 of last year, the accounting records reflected the following: Cash Investments (short-term)) Accounts receivable Inventory. Notes receivable (long-term) Equipment Factory building Operating lease right-of-use assets Intangible assets $23,000 Accounts payable 2,200 Accrued liabilities payable 3,900 Notes payable (current) 29,000 Notes payable (noncurrent) 2,108 Long-term lease liabilities 52,000 Common stock 106,000 Additional paid-in capital 140,000 Retained earnings 4,700 $13,000 3,500 7,100 49,000 68,000 10,400. Required: 5. Prepare a classified balance sheet at December 31 of the current year. 93,608 118,300 During the current year, the company had the following summarized activities: a. Purchased short-term investments for $8,000 cash. b. Lent $5,900 to a supplier, who signed a two-year note. c Leased equipment that…arrow_forwardDisplayed here are the draft financial statements which have been prepared for Valerie’s business for the year ended 30 April 2021. Draft Statement of Financial Position as at 30 April 2021 Assets Non-current assets see point a. below Cost 90,000 Provision for depreciation 30,600 Net Book Value 59,400 Current assets Inventory To be advised Trade receivables 43,200 Cash 4,680 47,880 Total assets 107,280 Liabilities Current liabilities Trade payables 17,280 Non-current liabilities Bank loan 16,000 Total liabilities 33,280 Net assets 74,000 Owner’s interest Capital invested 24,000 Profit and Loss Reserve: Opening balance 34,720 Draft profit for the year…arrow_forward

- Required information [The following information applies to the questions displayed below] The following are transactions for the Sky Blue Corporation: a. Collected $2,850 rent for the period October 1 to December 31, which was credited to Deferred Revenue on October 1. b. Paid $1,560 for a two-year insurance premium on October 1 and debited Prepaid Insurance for that amount. c. Used a machine purchased on October 1 for $49,800. The company estimates annual depreciation of $4,980. quired: reach of the above transactions for the Sky Blue Corporation, give the accounting equation effects of the adjustments required at end of the month on October 31. (Enter any decreases to Assets, Liabilities, or Stockholders' Equity with a minus sign.) ansaction b. C. Assets Liabilities Stockholders' Equityarrow_forwardRequired information [The following information applies to the questions displayed below.] Assume that you are the president of Highlight Construction Company. At the end of the first year of operations (December 31), the following financial data for the company are available: Cash Receivables from customers (all considered collectible) Inventory of merchandise (based on physical count and priced at cost) Equipment owned, at cost less used portion Accounts payable owed to suppliers Salary payable (on December 31, this was owed to an employee who will be paid on January 10) Total sales revenue Expenses, including the cost of the merchandise sold (excluding income taxes) Income tax expense at 30% x pretax income; all paid during the current year Common stock (December 31) Dividends declared and paid during the current year (Note: The beginning balances in Common stock and Retained earnings are zero because it is the first year of operations.) $ 25,600 10,800 81,000 42,000 46,140 2,520…arrow_forwardOn January 1, 2021, the general ledger of Dynamite Fireworks includes the following account balances: AccountsDebit CreditCash$24,400 Accounts Receivable 5,800 Supplies 3,700 Land 56,000 Accounts Payable $3,800 Common Stock 71,000 Retained Earnings 15,100 Totals$89,900 $89,900 During January 2021, the following transactions occur: January 2 Purchase rental space for one year in advance, $7,800 ($650/month).January 9 Purchase additional supplies on account, $4,100.January 13 Provide services to customers on account, $26,100.January 17 Receive cash in advance from customers for services to be provided in the future, $4,300.January 20 Pay cash for salaries, $12,100.January 22 Receive cash on accounts receivable, $24,700.January 29 Pay cash on accounts payable, $4,600. 5. Prepare a classified balance sheet as of January 31, 2021.I am stuck because it says my answer is incomplete but I have added everything up there.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education