Concept explainers

a)

To Determine: The

a)

Explanation of Solution

Calculate the retained earnings for BD Cleaners as on November 1, 2016.

The retained earnings, for BD Cleaners as on November 1, 2016 are $98,500.

b)

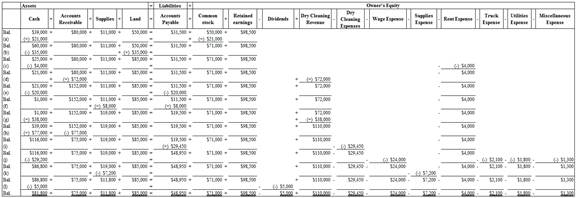

To Indicate: The effect of each given transaction of BD Cleaners on the

b)

Explanation of Solution

Business transaction: Business transaction is a record of any economic activity, resulting in the change in the value of the assets, the liabilities, and the Shareholder’s equities, of a business. Business transaction is also referred to as financial transaction.

Indicate the effect of the given transactions of BD Cleaners.

(Figure – 1)

c)

To Prepare: The financial statements for BD Cleaners for the month ended November 30, 2016.

c)

Explanation of Solution

Financial statements: Financial statements refer to those statements, which are prepared by the Company according to particular formats in accounting to show its financial position.

Financial statements include the following statements:

Income statement: Income statement is a financial statement that shows the net income or net loss by deducting the expenses from the revenues and vice versa.

Prepare the income statement of BD Cleaners for the month ended November 30, 2016.

| BD Cleaners | ||

| Income Statement | ||

| For the month ended November 30 , 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues | ||

| Dry cleaning revenue | $110,000 | |

| Expenses | ||

| Dry Cleaning expense | $29,450 | |

| Wages expense | $24,000 | |

| Supplies expense | $7,200 | |

| Rent expense | $4,000 | |

| Truck expense | $2,100 | |

| Utilities expense | $1,800 | |

| Miscellaneous expense | $1,300 | |

| Total expenses | $69,850 | |

| Net income | $40,150 | |

Table (1)

Hence, the net income of BD Cleaners for the month ended November 30, 2016 is $40,150.

Statement of Retained Earnings: Statement of retained earnings shows, the changes in the retained earnings, and the income left in the company after payment of the dividends, for the accounting period.

Prepare the statement of Retained earnings for BD Cleaners for the month ended November 30, 2016.

| BD Cleaners | ||

| Statement of Retained Earnings | ||

| For the month ended November 30 , 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Retained earnings, November 1, 2016 | $98,500 | |

| Net income for the month | $40,150 | |

| Deduct - Dividends | $5,000 | |

| Increase in Retained earnings | $35,150 | |

| Retained earnings, November 30, 2016 | $133,650 | |

Table (2)

Hence, the retained earnings of BD Cleaners for the month ended November 30, 2016 are $133,650.

Prepare the balance sheet of BD Cleaners for the month ended November 30, 2016.

| BD Cleaners | ||

| Balance Sheet | ||

| November 30 , 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Assets | ||

| Current Assets | ||

| Cash | $81,800 | |

| |

$75,000 | |

| Supplies | $11,800 | |

| Land | $85,000 | |

| Total current assets | $253,600 | |

| Liabilities and |

||

| Liabilities | ||

| Accounts payable | $48,950 | |

| Owner's equity | ||

| Common Stock | $71,000 | |

| Retained earnings | $133,650 | |

| Total stockholders’ equity | 204,650 | |

| Total liabilities and stockholders’ equity | $253,600 | |

Table (3)

The balance sheet of BD Cleaners shows asset balance of $253,600 which is same as the balance of liabilities and owner's equity.

d)

To Prepare: The statement of

d)

Explanation of Solution

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period.

Prepare the statement of cash flows for BD Cleaners for the month ended November 30, 2016.

| DD Cleaners | ||

| Statement of Cash Flows | ||

| For the month ended November 30, 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flows from operating activities: | ||

| Cash receipts from customers | $115,000 | |

| Cash payments for expenses (1) | $33,200 | |

| Payments to creditors | $20,000 | $53,200 |

| Net cash flow used for operating activities | $61,800 | |

| Cash flows from investing activities: | ||

| Cash payment for purchase of land | (-) $35,000 | |

| Cash flows from financing activities: | ||

| Cash receipt of owner’s investment | $21,000 | |

| Deduct - Withdrawals | (-) $5,000 | |

| Net cash flow from financing activities | $16,000 | |

| Net Increase in cash during November | $42,800 | |

| Cash Balance on November 1, 2019 | $39,000 | |

| Cash Balance on November 30 , 2019 | $81,800 | |

Table (4)

The statement of cash flows for BD Cleaners for the month ended November 30, 2016, shows cash balance of $81,800 on November 30, 2016

Working Note:

Calculate the expenses made through cash payments.

Want to see more full solutions like this?

Chapter 1 Solutions

Bundle: Financial & Managerial Accounting, 13th + CengageNOWv2, 2 terms (12 months) Printed Access Card

- Required: Compute the asset turnover ratio for 2021. (Re Asset turnover ratioarrow_forwardBelow are the financial data of Tulong Namin Company, a not-for-profit entity for month of June, 2017.Cash – P4,300,500Accounts Receivable – P250,500Long-Term Investment – P1,000,000Plant, Property and Equipment – P4,500,500Accounts Payable – P500,000Notes Payable – P1,500,000Transactions for the month of July, 2017 Receive a car worth – P600,000 but treated as temporary restricted net assets Partial payment of accounts payable – P250,000 Issued a promissory notes worth – P500,000 Paid the salary of employees – P25,250 5. Paid the repair of computer – P6,500Compute balance of total assets as of July, 2017 a. 10,869,740 b. 10,769,745 c. 10,869,750 d. 10,869,755 Compute the balance of unrestricted net assets as of July, 2017, if unrestricted net assets is 70% of total net as a. 5,604,300 b. 5,604,250 c. 5,604,350 d. 5,604,200 Compute the balance of total net assets as of July, 2017 a. 8,619,755 b. 8,619,750 c. 8,619,745 d.…arrow_forwardPresented below is the balance sheet of Sheffield Corporation for the current year, 2025. Current assets Investments 643,870 Property, plant, and equipment 1,723,870 Intangible assets 305,000 1. 2. 3. The following information is presented. The current assets section includes cash $153,870, accounts receivable $173,870 less $13,870 for allowance for doubtful accounts, inventories $183,870, and unearned rent revenue $8,870. Inventory is stated on the lower-of-FIFO-cost-or-net realizable value. 4. 5. Sheffield Corporation Balance Sheet December 31, 2025 $ 488,870 6. 7. $3,161,610 Current liabilities Long-term liabilities Stockholders' equity $ 383,870 1,003,870 1,773,870 $3,161,610 The investments section includes the cash surrender value of a life insurance contract $43,870; investments in common stock, short-term $83,870 and long-term $273,870; and bond sinking fund $242,260. The cost and fair value of investments in common stock are the same. Property, plant, and equipment includes…arrow_forward

- Permai Bhd is one of the main manufacturers and suppliers of industrial chemical products and equipment that had been incorporated in 2010. The following is the carrying amount of asset and liabilities of the company as at 31 December 2019: Carrying amount (RM) Property, plant and equipment 249,200 Intangible assets 138,000 Investment in fixed deposit 107,000 Account receivable 96,700 Interest receivable 10,700 Inventory 206,000 Bank 129,000 Trade payables 197,000 Accrued interest 15,600 Penalties payable 15,500 Unearned revenue 45,300 10% Loan 156,000 Additional information: The cost of the property, plant and equipment is RM356,000 when it was acquired in 2015. Depreciation expense for property, plant and equipment is calculated at the rate of 10% per year and capital allowance is 20% per year for the first three years from the…arrow_forwardPresented below are condensed data from the financial statements of Gallo Factory for 2017 and 2016. The figures are expressed in thousands. Use this information to answer the questions that follow. Accounts/Years Total current assets Property, plant & equipment (net of accumulated depreciation) Total assets Total current liabilities Long-term debt Deferred income taxes Total liabilities Total owner's equity 2020 $ 82,309 67,192 $149.501 $ 33,928 20,491 4.174 $ 58.593 90.908 $149.501 2019 $ 80,080 66,724 $146.471 $28,668 25,676 5,208 $59.552 86.919 $146.471 Total liabilities & owner's equity How much of Gallo Factory is financed by creditors at the end of December of 2020? Evaluate the change from 2019 to 2020.arrow_forwardPermai Bhd is one of the main manufacturers and suppliers of industrial chemical products and equipment that had been incorporated in 2010. The following is the carrying amount of asset and liabilities of the company as at 31 December 2019: Carrying amount (RM) Property, plant and equipment 249,200 Intangible assets 138,000 Investment in fixed deposit 107,000 Account receivable 96,700 Interest receivable 10,700 Inventory 206,000 Bank 129,000 Trade payables 197,000 Accrued interest 15,600 Penalties payable 15,500 Unearned revenue 45,300 10% Loan 156,000 Additional information: The cost of the property, plant and equipment is RM356,000 when it was acquired in 2017. Depreciation expense for property, plant and equipment is calculated at the rate of 10% per year and capital allowance is 20% per year for the first three years from the…arrow_forward

- Use the information provided for Harding Company to answer the question that follow. Harding Company Accounts payable $26,136 Accounts receivable 71,999 Accrued liabilities 6,575 Cash 16,008 Intangible assets 40,514 Inventory 77,552 Long-term investments 102,623 Long-term liabilities 70,943 Notes payable (short-term) 25,456 Property, plant, and equipment 674,580 Prepaid expenses 2,265 Temporary investments 32,175 Based on the data for Harding Company, what is the amount of quick assets? a.$120,182 b.$48,183 c.$800,315 d.$1,618,032arrow_forwardOn January 1, 2018, Grand Corp. purchased Minor Co., paying $250,000 cash and issuing a $50,000 note payable. On January 1, 2018, the balance sheet of Minor Co. was as follows: 1. Minor Company Balance Sheet Assets Liabilities and Owners' Equity Cash $40,000 Notes Payable $55,000 Acc. Receivable 80,000 Capital 280,000 Inventory 120,000 $335,000 Buildings(net) Eguipment(net) 50,000 30,000 Patents 5,000 Trademarks 10,000 $335,000 An appraisal indicated that the fair market value of the receivables was $75,000, and the fair market value of inventory and buildings were $110,000 and $70,000 respectively. According to the apRraisal, the patents were worthless. Required: Prepare the journal entry to be record the purchase by Grand Corp.arrow_forwardUse the information provided below to prepare the Statement of Financial Position of Lynwood Limited as at 31 August 2023. The notes to the financial statements are not required. Show all workings. INFORMATION The following balances were obtained from the accounting records of Lynwood Limited after some of the adjustments and closing transfers were completed on 31 August 2023, the end of the financial year. R Inventory 315 000 Accounts receivable 92 000 Loan: Lindor Bank (19.5%) 200 000 Equipment (Cost) 1 980 000 Accumulated depreciation on equipment? Cash float 13 500 Accounts payable 211 000 Provision for bad debts? Accrued income? Ordinary share capital 1 161 000 Retained income 540 000 Company tax payable 18 000 Bank (DR) 99 000 Accrued expenses? Dividends payable 161 000 The following adjustments must be made: The account of a debtor who owed R2 000 must be written off. The provision for bad debts must be adjusted to 5% of debtors. The rent income account reflected a total of R99…arrow_forward

- The following transactions occurred during March 2018 for the Wainwright Corporation. The company owns and operates a wholesale warehouse. 1. Issued 30,000 shares of common stock in exchange for $300,000 in cash. 2. Purchased equipment at a cost of $40,000. $10,000 cash was paid and a note payable was signed for the balance owed. 3. Purchased inventory on account at a cost of $90,000. The company uses the perpetual inventory system. 4. Credit sales for the month totaled $120,000. The cost of the goods sold was $70,000. 5. Paid $5,000 in rent on the warehouse building for the month of March. 6. Paid $6,000 to an insurance company for fire and liability insurance for a one-year period beginning April 1, 2018. 7. Paid $70,000 on account for the merchandise purchased in 3. 8. Collected $55,000 from customers on account. 9. Recorded eciation expense of $1,000 for the month on the equipment. Required: Analyze each transaction and show the effect of each on the accounting equation for a…arrow_forwardThe following transactions occurred during March 2018 for the Wainwright Corporation. The company owns and operates a wholesale warehouse. Issued 30,000 shares of capital stock in exchange for $300,000 in cash. Purchased equipment at a cost of $40,000. $10,000 cash was paid and a note payable was signed for the balance owed. Purchased inventory on account at a cost of $90,000. The company uses the perpetual inventory system. Credit sales for the month totaled $120,000. The cost of the goods sold was $70,000. Paid $5,000 in rent on the warehouse building for the month of March. Paid $6,000 to an insurance company for fire and liability insurance for a one-year period beginning April 1, 2018. Paid $70,000 on account for the merchandise purchased in 3. Collected $55,000 from customers on account. Recorded depreciation expense of $1,000 for the month on the equipment. Required:1. Analyze each transaction by indicating the cash effect and classify each as a financing, investing, and/or…arrow_forwardPermai Bhd is one of the main manufacturers and suppliers of industrial chemical productsand equipment that had been incorporated in 2010. The following is the carrying amount ofasset and liabilities of the company as at 31 December 2019:Carrying amount (RM)Property, plant and equipment 249,200Intangible assets 138,000Investment in fixed deposit 107,000Account receivable 96,700Interest receivable 10,700Inventory 206,000Bank 129,000Trade payables 197,000Accrued interest 15,600Penalties payable 15,500Unearned revenue 45,30010% Loan 156,000 Additional information:1. The cost of the property, plant and equipment is RM356,000 when it was acquired in2015. Depreciation expense for property, plant and equipment is calculated at the rateof 10% per year and capital allowance is 20% per year for the first three years fromthe cost of the assets.2. The intangible assets consist of development expenditure of Permai Bhd’s R&D projectincurred during the year that was qualified to be capitalised.3.…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education