Concept explainers

a)

To Determine: The

a)

Explanation of Solution

Calculate the retained earnings for BD Cleaners as on November 1, 2016.

The retained earnings, for BD Cleaners as on November 1, 2016 are $98,500.

b)

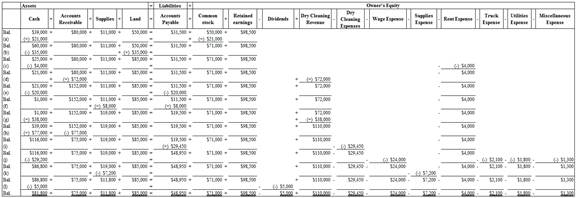

To Indicate: The effect of each given transaction of BD Cleaners on the

b)

Explanation of Solution

Business transaction: Business transaction is a record of any economic activity, resulting in the change in the value of the assets, the liabilities, and the Shareholder’s equities, of a business. Business transaction is also referred to as financial transaction.

Indicate the effect of the given transactions of BD Cleaners.

(Figure – 1)

c)

To Prepare: The financial statements for BD Cleaners for the month ended November 30, 2016.

c)

Explanation of Solution

Financial statements: Financial statements refer to those statements, which are prepared by the Company according to particular formats in accounting to show its financial position.

Financial statements include the following statements:

Income statement: Income statement is a financial statement that shows the net income or net loss by deducting the expenses from the revenues and vice versa.

Prepare the income statement of BD Cleaners for the month ended November 30, 2016.

| BD Cleaners | ||

| Income Statement | ||

| For the month ended November 30 , 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues | ||

| Dry cleaning revenue | $110,000 | |

| Expenses | ||

| Dry Cleaning expense | $29,450 | |

| Wages expense | $24,000 | |

| Supplies expense | $7,200 | |

| Rent expense | $4,000 | |

| Truck expense | $2,100 | |

| Utilities expense | $1,800 | |

| Miscellaneous expense | $1,300 | |

| Total expenses | $69,850 | |

| Net income | $40,150 | |

Table (1)

Hence, the net income of BD Cleaners for the month ended November 30, 2016 is $40,150.

Statement of Retained Earnings: Statement of retained earnings shows, the changes in the retained earnings, and the income left in the company after payment of the dividends, for the accounting period.

Prepare the statement of Retained earnings for BD Cleaners for the month ended November 30, 2016.

| BD Cleaners | ||

| Statement of Retained Earnings | ||

| For the month ended November 30 , 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Retained earnings, November 1, 2016 | $98,500 | |

| Net income for the month | $40,150 | |

| Deduct - Dividends | $5,000 | |

| Increase in Retained earnings | $35,150 | |

| Retained earnings, November 30, 2016 | $133,650 | |

Table (2)

Hence, the retained earnings of BD Cleaners for the month ended November 30, 2016 are $133,650.

Prepare the balance sheet of BD Cleaners for the month ended November 30, 2016.

| BD Cleaners | ||

| Balance Sheet | ||

| November 30 , 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Assets | ||

| Current Assets | ||

| Cash | $81,800 | |

| |

$75,000 | |

| Supplies | $11,800 | |

| Land | $85,000 | |

| Total current assets | $253,600 | |

| Liabilities and |

||

| Liabilities | ||

| Accounts payable | $48,950 | |

| Owner's equity | ||

| Common Stock | $71,000 | |

| Retained earnings | $133,650 | |

| Total stockholders’ equity | 204,650 | |

| Total liabilities and stockholders’ equity | $253,600 | |

Table (3)

The balance sheet of BD Cleaners shows asset balance of $253,600 which is same as the balance of liabilities and owner's equity.

d)

To Prepare: The statement of

d)

Explanation of Solution

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period.

Prepare the statement of cash flows for BD Cleaners for the month ended November 30, 2016.

| DD Cleaners | ||

| Statement of Cash Flows | ||

| For the month ended November 30, 2016 | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flows from operating activities: | ||

| Cash receipts from customers | $115,000 | |

| Cash payments for expenses (1) | $33,200 | |

| Payments to creditors | $20,000 | $53,200 |

| Net cash flow used for operating activities | $61,800 | |

| Cash flows from investing activities: | ||

| Cash payment for purchase of land | (-) $35,000 | |

| Cash flows from financing activities: | ||

| Cash receipt of owner’s investment | $21,000 | |

| Deduct - Withdrawals | (-) $5,000 | |

| Net cash flow from financing activities | $16,000 | |

| Net Increase in cash during November | $42,800 | |

| Cash Balance on November 1, 2019 | $39,000 | |

| Cash Balance on November 30 , 2019 | $81,800 | |

Table (4)

The statement of cash flows for BD Cleaners for the month ended November 30, 2016, shows cash balance of $81,800 on November 30, 2016

Working Note:

Calculate the expenses made through cash payments.

Want to see more full solutions like this?

Chapter 1 Solutions

Working Papers, Volume 1, Chapters 1-15 for Warren/Reeve/Duchac's Corporate Financial Accounting, 13th + Financial & Managerial Accounting, 13th

- What is the labor quantity variance?arrow_forwardHi expert please give me answer general accounting questionarrow_forwardBuilding from the Module 2 Critical Thinking assignment about your company’s water purification product and target country market, research the components needed to build the product. Use the following questions to guide your decisions about production and components, respond to the following topics for this week’s critical thinking assignment. What does the target country produce and export? What does the target country import; what are the imports used for? To what degree does the target country have relevant and cost-effective component manufacturing capabilities? Does the target country have relevant and cost-effective manufacturing/assembly capabilities to create products of acceptable quality? If the target country does not have relevant component and manufacturing skills, where will the water purification components/devices be sourced from given the target country’s trade agreements? How do trade profiles and trade relationships enter into your decision about manufacturing…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education