Concept explainers

ZZZ company has $27 million of current assets and $29 million of noncurrent assets. It

Required:

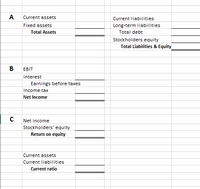

A. For a maturity mix of 60% current and 40% long-term debt, prepare the company's abbreviated

B. For a maturity mix of 60% current and 40% long-term debt, prepare the company's financial half of its income statement.

C. Based on the financial statements above, calculate the (1)

I also would love to see the excel formulas please

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 2 images

- K Avicorp has a $11.5 million debt issue outstanding, with a 5.8% coupon rate. The debt has semi-annual coupons, the next coupon is due in six months, and the debt matures in five years. It is currently priced at 93.67% of par value a. What is Avicorp's pretax cost of debt? b. If Avicorp faces a 28% tax rate, what is its after-tax cost of debt? Note Assume that the firm will always be able to utilize its full interest tax shield. BECER a. The cost of debt is % per year. (Round to two decimal places)arrow_forwardAvicorp has a $10.8 million debt issue outstanding, with a 6.1% coupon rate. The debt has semi-annual coupons, the next coupon is due in six months, and the debt matures in five years. It is currently priced at 93.65% of par value. a. What is Avicorp's pretax cost of debt? b. If Avicorp faces a 35% tax rate, what is its after-tax cost of debt? Note: Assume that the firm will always be able to utilize its full interest tax shield. a. The cost of debt is % per year. (Round to two decimal places.)arrow_forwardBadger Corp. has an issue of 6% bonds outstanding with 6 months left to maturity. The bonds are currently priced at $993.02, and pay interest semiannually. The firm's marginal tax rate is 40%. The estimated risk premium between the company's stock and bond returns is 5%. The firm's expects to maintain a capital structure with 40% debt and 60% equity going forward. The company's W.A.C.C. is ____%.arrow_forward

- Badger Corp. has an issue of 6% bonds outstanding with 6 months left to maturity. The bonds are currently priced at $1,008.11, and pay interest semiannually. The firm's marginal tax rate is 40%. The estimated risk premium between the company's stock and bond returns is 5%. The firm's expects to maintain a capital structure with 40% debt and 60% equity going forward. The company's W.A.C.C. is %. Margin of error for correct responses: +/-.10(%) Rounding and Formatting instructions: Do not enter dollar signs, percent signs, commas, X, or any words in your response. Do not round any intermediate work, but round your "final response to 2 decimal places (example: if your answer is 12.3456, 12.3456%, or $12.3456, you should enter 12.35).arrow_forwardAvicorp has a $12.3 million debt issue outstanding, with a 6.1% coupon rate. The debt has semi-annual coupons, the next coupon is due in six months, and the debt matures in five years. It is currently priced at 96% of par value. a. What is Avicorp's pre-tax cost of debt? Note: Compute the effective annual return. b. If Avicorp faces a 40% tax rate, what is its after-tax cost of debt? Note: Assume that the firm will always be able to utilize its full interest tax shield.arrow_forwardPlease answer ASAParrow_forward

- (Cost of debt) Sincere Stationery Corporation needs to raise $459,000 to improve its manufacturing plant. It has decided to issue a $1,000 par value bond with an annual coupon rate of 11.2 percent with interest paid semiannually and a 15-year maturity. Investors require a rate of return of 8.6 percent. a. Compute the market value of the bonds. b. How many bonds will the firm have to issue to receive the needed funds? c. What is the firm's after-tax cost of debt if the firm's tax rate is 34 percent? a. The market value of the bonds is $ (Round to the nearest cent.)arrow_forwardIf I could please get help with Part D, would be greatly appreciated. Thanks so much!arrow_forwardGoldtiger is issuing a CMO with 2 tranches:- Tranche A has $29 million in principal and a 3.9% coupon.- Tranche B has $20 million in principal and a 3.9% coupon. The mortgages backing the security issued are FRM at a mortgage rate of 3.9% with 10 year maturities and annual payments. There is no guarantee/servicer fee. Prepayment is assumed to be 5% CPR.In year 1, what is the cash flow to investors in Tranche B? Round your answer to two decimal points (e.g. if your answer is $50,999.4532, write 50999.45).arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education