FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

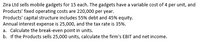

Transcribed Image Text:Zira Ltd sells mobile gadgets for 15 each. The gadgets have a variable cost of 4 per unit, and

Products' fixed operating costs are 220,000 per year.

Products' capital structure includes 55% debt and 45% equity.

Annual interest expense is 25,000, and the tax rate is 35%.

a. Calculate the break-even point in units.

b. If the Products sells 25,000 units, calculate the firm's EBIT and net income.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Includes step-by-step video

Learn your wayIncludes step-by-step video

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Flamengo Co is a sporting goods manufacturing company. Last year, report the following information: Sales S700,000 Cost of goods sold $130,000 Selling and administrative expense $260,000 At the beginning of the year, the value of operating assets was $800,000. At the end of the year, the value of operating assets was $1,200,000. Flamengo- Co. requires a minimum rate of return of 15%. Calculate the Margin. Round all numbers to two decimal places. Do not answer as a percentage. For example, if the Margin is 17.63%, you should type 0.18.arrow_forwardReveen Products sells camping Equipment. One of the company'sproducts a camping lantern, sells for $ 90 a unit. Variableexpenses are $ 63 per lantern, and fixed expenses associated withthe lantern total $ 135,000. per month. Required: A: compute the company's break even point in number of lanternsand in number of lanterns and in total sales dollars. B: If the variable expenses per lantern increase as a percentageof the selling price, will it result in a higher or lower breakeven point? Why? (Assume that the fixed expenses remainunchanged) C: At present the company is selling 8,000 per month. The salesmanager is convinced that a 10% reduction in the selling price willresult in a 25% increase in the number of lanterns sold each month.Prepare two contribution income statements, one under presentoperating conditions and one as operations would appear after theproposed changes. Sho both total and per unit data on yourstatements and determine if the proposed changes will be beneficialto…arrow_forwardsuppose you sell 8,000 of the 3 pack lenses described in question 3 above in one year. You cost on each 3 pack is $29.95 and you sell them for $59.95. if your operating expenses for the year total $144.080, what are your Net Income and Net profif margin percentage?arrow_forward

- Lucid Images Ltd manufactures premium high definition televisions. The firm’s fixed costs are$4,000,000 per year. The variable cost of each TV is $2,000, and the TVs are sold for $3,000 each. Thecompany sold 5,000 TVs during the previous year. (In the following requirements, ignore income taxes)Required:Treat each of the requirements as independent situations:a) Calculate the break-even point in units.b) What will the new break-even point be if fixed costs increase by 10 per cent? c) What was the company’s net profit for the previous year? (4 marks)d) The sales manager believes that a reduction in the sales price to $2,500 will result in orders for 1,200 more TVs each year. What will the break-even point be if the price is changed?arrow_forwardBohr Paint Company has annual sales of $12 million per year. If there is a profit of $5000 per day with 7 days per week operation, what is the total yearly business expense? All calculations are on a before-tax basis.arrow_forwardSpeckle Delivery Systems can buy a piece of equipment that is anticipated to provide an 8% return and can be financed at 5% with debt. Later in the year, the company turns down an opportunity to buy a new machine that would yield a 15% return but would cost 17% to finance through common equity. Assume debt and common equity each represent 50% of the company’s capital structure. Compute the weighted average cost of capital (WACC). Which product(s) should be accepted in your opinion? Why?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education