FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

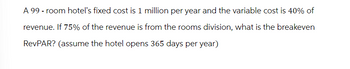

Transcribed Image Text:A 99 - room hotel's fixed cost is 1 million per year and the variable cost is 40% of

revenue. If 75% of the revenue is from the rooms division, what is the breakeven

RevPAR? (assume the hotel opens 365 days per year)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps with 14 images

Knowledge Booster

Similar questions

- Your factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $4.75 million per year. Your upfront setup costs to be ready to produce the part would be $7.91 million. Your discount rate for this contract is 7.8%. a. What is the IRR? b. The NPV is $4.38 million, which is positive, so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule?arrow_forwardYour storage firm has been offered $99,500 in one year to store some goods for one year. Assume your costs are $96,800, payable immediately, and the cost of capital is 8.9%. Should you take the contract? The NPV will be $ (Round to the nearest cent.)arrow_forwardWarren's Hats forecasts that it will sell 25,000 baseball caps next year. The company buys its caps for $3 from the wholesaler and sells them for $15 each. If the company will incur fixed costs plus depreciation and amortization of $80,000, then what is the percentage increase in EBIT if the actual sales next year equal 27,000 caps?arrow_forward

- A factory costs $970,000. You reckon that it will produce an inflow after operating costs of $187,000 a year for 15 years. a. If the opportunity cost of capital is 11%, what is the net present value of the factory? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What will the factory be worth at the end of eight years? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be $5.06 million per year. Your upfront setup costs to be ready to produce the part would be $7.97 million. Your discount rate for this contract is 8.1%. a. What is the IRR? b. The NPV is $5.05 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule?arrow_forwardExcluding maintenance, all other costs from operating the equipment will be $270 per year. Maintenance costs will be $100 in the first year of operation. As the equipment gets older, some parts will need to be replaced and the replacement will cost an additional $30 each year from year 2 to year 5 what is maintenance costs each year (from year 1 to year 5). ...arrow_forward

- ↑ Suppose River Valley Lodge incurs $70,000 of fixed costs each month Compute the (a) total fixed cost and (b) fixed cost per guest if the hotel has 14,000 guests next month. Compare the fixed cost per guest at the higher occupancy rate to the fixed cost per guest when only 1,500 guests stay during the month. (a) Compute the total fixed cost if the hotel has 14,000 guests next month. Total fixed costs to wide changes in volume, therefore, total fixed costs will (b) Compute the fixed cost per guest if the hotel has 14,000 guests next month. First, identify the formula to compute the fixed cost per guest, then compute the foxed cost per guest at (1) 14,000 guests and at (2) 1.500 guests (Round the fixed cost per quest to the nearest cent.) Fixed cost per quest Nextarrow_forwardYou are the manager of an apartment complex with 100 units. When you set the rent at $1600 per month, all apartments are rented. As you increase rent by $50 per month, on average, 2 fewer apartments are rented. Maintenance costs run $200 per month for each occupied unit. What is the rent that maximizes the total amount of profit? Answer:arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be $5.02 million per year. Your upfront setup costs to be ready to produce the part would be $7.99 million. Your discount rate for this contract is 7.6%. a. What is the IRR? b. The NPV is $5.04 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule? a. What is the IRR? The IRR is %. (Round to two decimal places.)arrow_forward

- = Your factory has been offered a contract to produce a part for a new printer. The contract would last for 3 years and your cash flows from the contract would be $4.93 million per year Your upfront setup costs to be ready to produce the part would be $7.97 million Your discount rate for this contract is 7.7% a. What is the IRR? b. The NPV is $4.80 million, which is positive, so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule? a. What is the IRR? The IRR is (Round to two decimal places)arrow_forwardYour factory has been offered a contract to produce a part for a new printer. The contract would last for three years, and your cash flows from the contract would be $5.09 million per year. Your upfront setup costs to be ready to produce the part would be $7.92 million. Your discount rate for this contract is 8.3%. a. What is the IRR? b. The NPV is $5.13 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule? a. What is the IRR? The IRR is %. (Round to two decimal places.) b. The NPV is $5.13 million, which is positive so the NPV rule says to accept the project. Does the IRR rule agree with the NPV rule? (Select from the drop-down menu.) The IRR rule with the NPV rule.arrow_forwardMachine A costs $500,000 to purchase, result in electricity bills of $100,000 per year, and last for 12 years. Machine B costs $600,000 to purchase, result in electricity bills of $85,000 per year, and last for 15 years. The discount rate is 9%. What are the equivalent annual costs for two models? Which model is more cost-effective?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education