Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

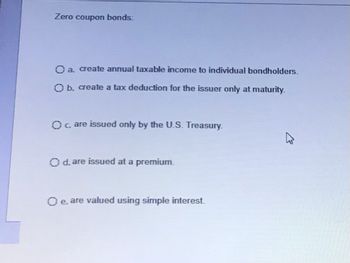

Transcribed Image Text:Zero coupon bonds:

O a. create annual taxable income to individual bondholders.

O b. create a tax deduction for the issuer only at maturity.

O care issued only by the U.S. Treasury.

O d. are issued at a premium.

O e. are valued using simple interest.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Which of the following characteristics apply to U.S. Treasury bills?I. Income taxed at both the federal and state levelII. Minimal, if any, default riskIII. Marketable, but not liquidIV. Short maturities A. I and III only B. II and IV only C. I, II, and IV only D. II, III, and IV only E. I, II, III, and IVarrow_forwardBond A is a municipal bond and Bond B is a corporate bond. If you pay a very high tax rate, which bond do you prefer? Select one: a. B b. A c. A=Barrow_forward1. If a company's bonds are selling at a discount, then Select one: a. The coupon interest rate is equal to the going interest rate b. The going rate of interest is above the coupon rate c. The current interest rates are below the coupon rate d. The YTM is below the coupon interest ratearrow_forward

- Which of the following is true about “zeroes” (i.e. zero-coupon bonds)? (Group of answer choices) Zeroes sell at a premium compared to other bonds Zeroes pay more interest than a Treasury bill Zeroes are only issued by US corporations Zeroes only receive payment from price appreciation Zeroes have a shorter maturity than other bondsarrow_forwardNonearrow_forwardWhich of the following statements is/are CORRECT? O 1 Bonds sells well below par value when the yield to maturity is higher than its coupon rate. 2) Municipal bonds interests are tax-exempt at the federal level. 3) Most bonds are trading in the OTC market. O 4) All of the statements above are correct. 5) Statements a and c are correct.arrow_forward

- 39. Help me selecting the right answer. Thank youarrow_forwardWhich of the following is FALSE regarding bonds? Long term bonds have greater interest rate risk than do short term bonds. A bond indenture describes the terms of the bond issue. Bonds represent ownership in the company. if interest rates in the market go up, the present value of existing bonds goes down. A bond issuer is legally required to make the interest payments and repay the par value at maturity. Previous Page Next Page Page 12 of 30arrow_forward1. Types of bonds Fixed-income securities consist of debt instruments and preferred stock. Bonds are debt securities in which a borrower promises to pay a specified interest rate and principal at a future date. Which of the following statements about Treasury bonds is the most accurate? O Treasury bonds have a very small amount of default risk, so they are not completely riskless. O Treasury bonds are completely riskless. O Treasury bonds are not completely riskless, since their prices will decline when interest rates rise. Based on the information given in the following statement, answer the questions that follow: In July 2009, Walmart sold 100 billion yen of five-year samurai bonds. Lead managers in the deal were Mizuho Securities, BNP Paribas, and Mitsubishi UFJ Securities. Who is the issuer of the bonds? O Mitsubishi UFJ Securities O BNP Paribas O Walmart What type of bonds are these? O Corporate bonds O Municipal bonds O Government bonds O Oarrow_forward

- You are given the following details of three default free government bonds. Assume that one can take long (buy) and short (sell) positions in these bonds. CF stands for cash flow. Bond Current price Today CF Year 1 CF Year 2 A 95.24 100 0 B 89.85 0 100 C X 70 1070 Assuming that the current market prices of Bond A and Bond B are correct, then, what should be the current theoretical (fundamental) price of Bond C, as per the no-arbitrage principle, i.e., what is the value of X? [Do not round-off any numbers. If at all you want to round-off a number, round it off at 8 decimal places.]arrow_forward1. If bonds are sold at a discount and the straight-line method of amortization is used, interest expense in earlier years will: (A) Exceed what is would have been had the effective interest rate method of amortization been used. (B) Be less than what it would have been had the effective interest rate method of amortization been used. (C) Be the same as it would have been had the effective interest rate method of amortization been used. (D) None of the above.arrow_forwardQuestion 5?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education