FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

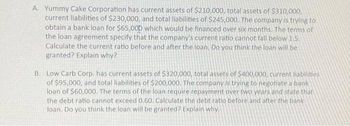

Transcribed Image Text:A. Yummy Cake Corporation has current assets of $210,000, total assets of $310,000,

current liabilities of $230,000, and total liabilities of $245,000. The company is trying to

obtain a bank loan for $65,000 which would be financed over six months. The terms of

the loan agreement specify that the company's current ratio cannot fall below 1.5.

Calculate the current ratio before and after the loan. Do you think the loan will be

granted? Explain why?

B. Low Carb Corp. has current assets of $320,000, total assets of $400,000, current liabilities

of $95,000, and total liabilities of $200,000. The company is trying to negotiate a bank

loan of $60,000. The terms of the loan require repayment over two years and state that

the debt ratio cannot exceed 0.60. Calculate the debt ratio before and after the bank

loan. Do you think the loan will be granted? Explain why.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Your company has arranged a revolving credit agreement for up to $71 million at an interest rate of 1.40 percent per quarter. The agreement also requires your company to maintain a compensating balance of 5 percent of the unused portion of the credit line, to be deposited in a noninterest-bearing account. Your company's short-term investment account at the same bank pays an interest rate of .54 per quarter. What is the effective annual interest rate if your company borrows $36 million for one year?arrow_forward1. Write the Formula for the equation for the payment on the Loans (you do NOT need to evaluate) (a) 30 year house loan where you borrow $125,000 at 4.2% interest with monthly payments. (b) 20 year house loan where you borrow $125,000 at 4.2% interest with monthly payments (c) A company borrows $12,000,000 at 2.8% with quarter payments over 10 years. (d) You buy a new car at $15,000 that you make a $1,500 down payment. You finance the rest at 3.6% interest with monthly payments over 4 years.arrow_forwardCook Security Systems has a $37,500 line of credit, which charges an annual percentage rate of prime rate plus 4%. The starting balance on October 1 was $9,700. On October 4 they made a payment of $1,200. On October 13 the business borrowed $2,900, and on October 19 they borrowed $4,800. If the current prime rate is 6%, what is the new balance (in $)? (Round your answer to the nearest cent.)arrow_forward

- Van Buren Resources Inc. is considering borrowing $100,000 for 182 days from its bank. Van Buren will pay $6,000 of interest at maturity, and it will repay the $100,000 of principal at maturity. a. Calculate the loan’s annual financing cost. b. Calculate the loan’s annual percentage rate. c. What is the reason for the difference in your answers to Parts a and b?arrow_forwardA Company borrowed money from a local bank. The note the company signed requires five annual installment payments of $11,500 not due for three years. The interest rate on the note is 7%. What amount did the company borrow? Note: Use tables, Excel, or a financial calculator. Round your intermediate and final answers to nearest whole dollar amount. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Step 1: Calculate the PV of the Ordinary Annuity Component: Payment: $ n = Present Value: Step 2: Convert the Annuity to a Single Sum: Payment: Present Value: n = i = $ NEVE 11,500 5 7% 47,152arrow_forwardABC Inc. asked your company for a 7-year loan of $50,000. The repayment of the loan will be as follows: ABC will pay $5,000 at the end of Year 1, $10,000 at the end of Year 2, and $15,000 at the end of Year 3, and fixed unspecified cash flow (assume X) at the end of each of the following years (Year 4 through Year 7). Assuming 8% as an appropriate rate of return on low risk but an illiquid 7-year loan. Find out the cash flow that this investment must provide at the end of each of the final 4 years (year 4 to year 7), that is, find out the X?arrow_forward

- A local finance company quotes an interest rate of 15.6 percent on one- year loans. So, if you borrow $36,000, the interest for the year will be $5,616. Because you must repay a total of $41,616 in one year, the finance company requires you to pay $41,616/12, or $3,468.00 per month over the next 12 months. a. What rate would legally have to be quoted? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. b. What is the effective annual rate? Note: Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16. a. APR b. EAR % %arrow_forwardCook Security Systems has a $37,500 line of credit, which charges an annual percentage rate of prime rate plus 4%. The starting balance on October 1 was $9,300. On October 4 they made a payment of $1,800. On October 13 the business borrowed $2,500, and on October 19 they borrowed $4,200. If the current prime rate is 8%, what is the new balance (in $)? (Round your answer to the nearest cent.)arrow_forwardU.S. Fax has been granted a loan from a commercial finance company for $1 million at a stated interest rate of 10 percent. The loan requires that interest payments be made at the end of each of the next 5 years. At the end of 5 years, the entire loan balance must be repaid. The finance company requires U.S. Fax to pay a $25,000 loan-processing fee at the time the loan is approved. What is the effective cost of this loan?arrow_forward

- Gingerbread Corp was issued a $220,000 loan at 6%. The amortization schedule created by the company accountant is presented below. If Gingerbread Corp decided to pay off the entire principle balance left on the loan of $119,590 at the end of period 3 how much would the company save in interest expense? Interest expense saved ?arrow_forwardYou are in negotiations to make a 7-year loan of $22,000 to DeVille Corporation. To repay you, DeVille will pay $2,500 at the end of Year 1, $5,000 at the end of Year 2, and $7,500 at the end of Year 3, plus a fixed but currently unspecified cash flow, X, at the end of each year from Year 4 through Year 7. You are confident the payments will be made, since DeVille is essentially riskless. You regard 8% as an appropriate rate of return on a low risk but illiquid 7-year loan. What cash flow must the investment provide at the end of each of the final 4 years, that is, what is X? A.3558.55 B.3,603.35 C.3,580.95 D.3,592.15 E. 3,569.75arrow_forwardVigo Vacations has $200 million in total assets, $5 million in notes payable, and $21 million in long-term debt. What is the debt ratio? Do not round intermediate calculations. Round your answer to the nearest whole number.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education