Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

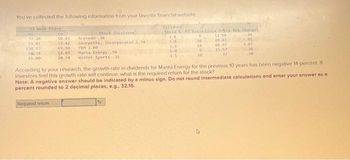

Transcribed Image Text:You've collected the following information from your favorite financial website.

52-Week Price

Lo

10.43 Acevedo 36

33.42

Georgette, Incorporated 1,54

69.50

YBH 2.00

14.09

Manta Energy .94

20.74 Winter Sports 32

Hi

77.40

55.81

130.93

50,38

35.00

Stock (Dividends

Required retum

Dividend

Yield PE Ratio Close Price liet Change

.24

2.6

3.0

2.2

6.0

4.5

6

10

10

60

13.90

40.43

68.97

15.57

22

-.01

3.07

.26

.18

According to your research, the growth rate in dividends for Manta Energy for the previous 10 years has been negative 14 percent. If

Investors feel this growth rate will continue, what is the required return for the stock?

Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and enter your answer as o

percent rounded to 2 decimal places, e.g., 32.16.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- gageNOWv2 | Online teach x b Answered: Wonder Sales is aut x cakeAssignment/takeAssignmentMain.do?invoker%3&takeAssignmentSessionLocator=&inprogress=false Update еВook Show Me How Print Item Statement of stockholders' equity Noric Cruises Inc. began the month of October with the following balances: Common Stock, $120,000; Additional Paid-In Capital, $3,125,000; and Retained Earnings, $13,000,000. During June, Noric issued for cash 50,000 shares of common stock (with a stated value of $1) at $17 per share. Noric reported the following results for the month ended October 31: Net income $2,400,000 Cash dividends declared 485,000 Prepare a statement of stockholders' equity for the month ended October 31. If there is a net loss or there has been a decrease in stockholders' equity, enter that amount as a negative number using a minus sign. If an amount box does not require an entry, leave it blank. Noric Cruises Inc. Statement of Stockholders' Equity For the Month Ended October 31 Additional…arrow_forward2:19 scribd.com = S SCRIBD Search Q Download Now 21. Given the following information, calculate the weighted average cost of capital for Hamilton Corp. Line up the calculations in the order shown in Table 11-1. Percent of capital structure: Debt... Preferred stock.. Common equity..... 30% 15 55 Additional information: Bond coupon rate..... Bond yield to maturity... Dividend, expected common.... Dividend, preferred.. Price, common. Price, preferred... Flotation cost, preferred... Growth rate... Corporate tax rate.. 13% 11% $3.00 $10.00 $50.00 $98.00 $5.50 8% 30% S11-18arrow_forwardssibility. Investigate r Search % 2. Dividends were paid in the amount of $125. STNP decreased by $213, accounts receivables increased by $222, inventory decreased by $114, and LTD decreased by $80. AP increased by $100. What is the cash flow from financing activities? 5 /^6 T G 4- V B Y H J+ & 87 N thp * KAA 8 M Ⓒ M 19 K DII f10 W DDI L O > P F11 P alt X ? Focus F12 insert L 1 + EE prt sc ] pause ctrl backspace entarrow_forward

- * CengageNOWv2 | Online teachin x E Login engagenow.com/ilm/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogre.. * еВook Show Me How Earnings per share Financial statement data for the years 20Y5 and 20Y6 for Black Bull Inc. follow: 20Υ5 20Y6 Net income $1,688,000 $2,459,000 Preferred dividends $50,000 $50,000 Average number of common shares outstanding 90,000 shares 110,000 shares a. Determine the earnings per share for 20Y5 and 20Y6. Round to two decimal places. 20Y5 20Υ6 Earnings per Share b. Is the change in the earnings per share from 20Y5 to 20Y6 favorable or unfavorable? Check My Workarrow_forwardPlease solve sub-parts a,b,c in 30-60 minutes max. Thank u 5. Explain what is meant by: a. Cost of debt b. Cost of preferred stock C. Cost of equityarrow_forwardCalculate the missing value. (Round your answer to the nearest whole number.) Earnings per share Closing price per share Price-earnings ratio Company BellSouth 3.15 $ 40.13arrow_forward

- Examus student.use.examus.net/?ridban=1&sessi. ACCT101 FEX_2021_2_Male e18 Stockholders' equity consists of: 96 18 - 34 a. Long-term assets 11 18c Contributed capital and 95abe18 b. 95 par value 95abe18 C. Retained earnings and cash d. 95abe18ce33 Contributed capital and retained earnings Sabe18ce 33 95abe18ce33 95a 95abe18ce33 96abe18ce33 95abe18ce33 MacBook Pro F3 000 000 F4 つ 4 F5 F6 50 F7 67 & DII 7 V FS 8 A 9 9 个 IIarrow_forwardCan you do parts 1 to 3a thank youarrow_forwarddocs.google.com/forms 0 choose the right answer In order to find out the value of the closing stock during the end of the financial year we, deduct opening stock from the cost of goods sold look in the stock account C deduct the cost of goods sold from sales do this by stocktaking O choose the right answer Which of the following transactions would have no impact on stockholders' equity? Purchase of the land from the proceeds of bank loan Investment of cash by stockholders Net loss Dividends to stockholders O •..arrow_forward

- Your team was asked to compute for the cost of equity for prospect companies using CAPM method and the manager provided you the following information: Cisco Co. Salesforce Co. 3% Risk free rate Beta Market return Cost of equity 1.25 12% 14.50% 119 15% SAP SE Co. 4% 1.3 11.80% What is the market return for SAP SE Co? Answer: Adobe Co. 5% 1.4 8%arrow_forward1 please check if The Beta value is correct and answer those 4 question in bottom thank you very much.arrow_forwardCalculate the return on equity (ROE) for a company with a net income of $50,000, total equity of $500,000, and total assets of $1,000,000 ----@@@ This question already posted and got correct answer. dont answer this question, i will give 10 dislikes, do not copy from chatgpt or any ai @@@arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education