FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

infoPractice Pack

Question

infoPractice Pack

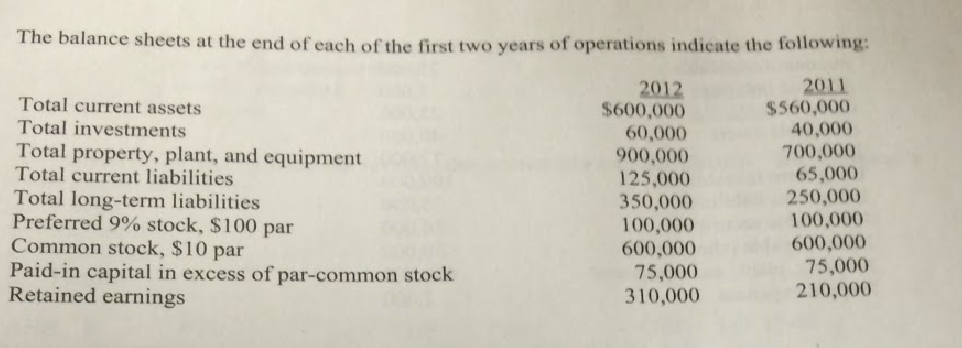

Transcribed Image Text:The balance sheets at the end of each of the first two years of operations indicate the following:

2011

$560,000

40,000

2012

$600,000

60,000

900,000

125,000

350,000

100,000

600,000

75,000

310,000

Total current assets

Total investments

Total property, plant, and equipment

Total current liabilities

700,000

65,000

250,000

100,000

600,000

75,000

Total long-term liabilities

Preferred 9% stock, $100 par

Common stock, $10 par

Paid-in capital in excess of par-common stock

Retained earnings

210,000

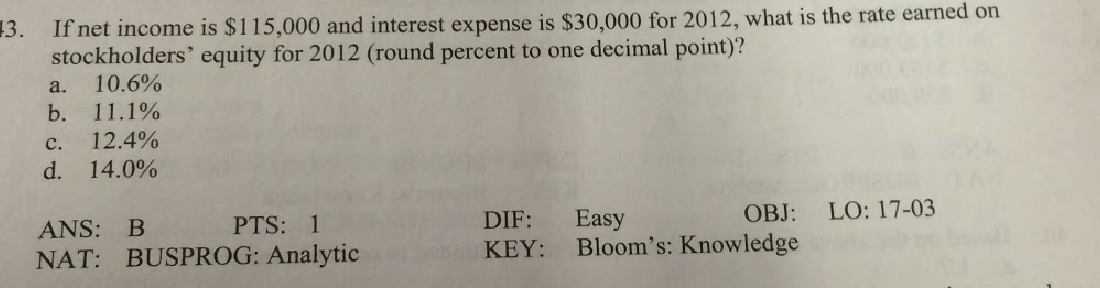

Transcribed Image Text:If net income is $115,000 and interest expense is $30,000 for 2012, what is the rate earned on

stockholders' equity for 2012 (round percent to one decimal point)?

10.6%

3.

a.

11.1%

b.

12.4%

c.

14.0%

d.

LO: 17-03

OBJ:

Easy

Bloom's: Knowledge

DIF:

PTS: 1

ANS: B

KEY:

NAT: BUSPROG: Analytic

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Includes step-by-step video

Trending nowThis is a popular solution!

Learn your wayIncludes step-by-step video

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Similar questions

- sarrow_forwardBrief Exercise 11-14 (Algo) Calculate the cash return on assets (LO11-6) The balance sheet of Cranium Gaming reports total assets of $480,000 and $780,000 at the beginning and end of the year, respectively. Sales revenues are $1.90 million, net income is $73,000, and operating cash flows are $59,000. Calculate the cash return on assets, cash flow to sales, and asset turnover for Cranium Gaming. (Enter your answers in dollars, not millions (i.e., $10.1 million should be entered as 10,100,000).) Cash Return on Assets Numerator/Denominator Cash Flow to Sales Numerator/Denominator Numerator/Denominator Amounts Asset Turnover Amounts Amounts timesarrow_forwardThe following details are provided by a manufacturing company: Investment Useful life Estimated annual net cash inflows for first year Estimated annual net cash inflows for second year Estimated annual net cash inflows for next ten years Residual value Product line OA. 2.74 years OB. 6.36 years O c. 6.71 years OD. 2.24 years $1,030,000 12 years $460,000 $430,000 $190,000 $50,000 Depreciation method Straight-line 12% Required rate of return Calculate the payback period for the investment. (Round your answer to two decimal places.) ...arrow_forward

- Selected data from the Carmen Company at year-end are as follows: Total assets Average total assets Net income Sales Average common stockholders' equity Net cash provided by operating activities Shares of common stock outstanding Long-term investments $2,000,000 $2,200,000 $250,000 $1,300,000 $1,000,000 $275,000 10,000 $400,000 Required: Compute the (a) asset turnover, (b) return on total assets, (c) return on common stockholders' equity, and (d) earnings per share on common stock. Assume the company had no preferred stock or interest expense. Round dol values to the nearest cent and other final answers to one decimal place. a. Asset turnover ratio b. Return on total assets c. Return on common stockholders' equity d. Earnings per share on common stock 1000 % % per share Karrow_forwardAssume a company had net income of $79,000 that included a gain on the sale of equipment of $4,000. It provided the following excerpts from its balance sheet: This Year Last Year Current assets: Accounts receivable $ 40,000 $ 46,000 Inventory $ 53,000 $ 50,000 Prepaid expenses $ 13,000 $ 11,000 Current liabilities: Accounts payable $ 38,000 $ 44,000 Accrued liabilities $ 18,000 $ 15,000 Income taxes payable $ 13,000 $ 10,000 If the credits to the company’s accumulated depreciation account were $21,000, then based solely on the information provided, the company’s net cash provided by (used in) operating activities would be: Multiple Choice $63,000. $55,000. $105,000. $97,000.arrow_forwardCapital Investment Analysis: Geddes Companyarrow_forward

- Weighted Average Cost of Capital The December 31, 2018, partial financial statements taken from the annual report for AT&T Inc. (T ) follow. Consolidated Statements of Income Dollars in millions except per share amounts 2018 2017 Operating revenues Service $152,345 $145,597 Equipment 18,411 14,949 Total operating revenues 170,756 160,546 Operating expenses Equipment 19,786 18,709 Broadcast, programming and operations 26,727 21,159 Other cost of services (exclusive of depreciation and amortization show separately below) 32,906 37,942 Selling, general and administrative 36,765 35,465 Abandonment of network assets 46 2,914 Depreciation and amortization 28,430 24,387 Total operating expenses 144,660 140,576 Operating income 26,096 19,970 Other income (expense): Interest expense (7,957) (6,300) Equity in net income of affiliates (48) (128)…arrow_forwardhow did you get these numbers ? Year 2022: Weighted-Average accumulated expenditure Date Amount Capitalization period Weighted Average Accumulated Expenditures 1-Jan-22 $8,100,000 9/9 $8,100,000 31-Jan-22 $450,000 8/9 $400,000 30-Apr-22 $783,000 5/9 $435,000 31-Aug-22 $1,080,000 1/9 $120,000 Total $10,413,000 $9,055,000arrow_forwardG. C. Murphey’s 2016 financial statements show average shareholders’ equity of $20,412 million, net income of $5,040 million, and average total assets of $86,700 million.How much is G. C. Murphey’s return on assets for the year? Question 21 options: A) 4.77% B) 5.81% C) 11.42% D) 24.69%arrow_forward

- Question Content Area What type of analysis is indicated by the following? Increase (Decrease) Current Year Preceding Year Amount Percent Current assets $430,000 $500,000 $(70,000) (14%) Fixed assets 1,740,000 1,500,000 240,000 16 a.vertical analysis b.liquidity analysis c.horizontal analysis d.common-size analysisarrow_forwardThe balance sheet of Computer World reports total assets of $350,000 and $450,000 at the beginning and end of the year, respectively. Sales revenues are $800,000, net income is $100,000, and net cash flows from operating activities are $150,000. What is Computer World's cash return on assets? Multiple Choice 37.5% 25.0% 33.3% 42.9%arrow_forwardwhat was the net capital spending in 2021 and 2022 please avoid solutions image based thnxarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education