Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

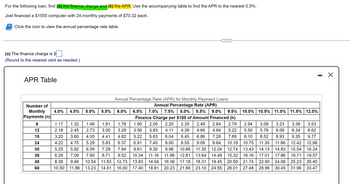

Transcribed Image Text:For the following loan, find (a) the finance charge and (b) the APR. Use the accompanying table to find the APR to the nearest 0.5%.

Joel financed a $1555 computer with 24 monthly payments of $70.32 each.

Click the icon to view the annual percentage rate table.

(a) The finance charge is $

(Round to the nearest cent as needed.)

APR Table

Number of

Monthly

Payments (n)|

6

12

18

24

30

36

48

|

60

4.0%

4.5% 5.0% 5.5%

1.17

2.18

3.20

1.32 1.46

2.45 2.73

3.60 4.00

5.29

6.59

7.90

4.22 4.75

5.25 5.92

6.29

7.09

8.38 9.46

10.54

10.50 11.86 13.23

Annual Percentage Rate (APR) for Monthly Payment Loans

Annual Percentage Rate (APR)

3.53

6.5% 7.0% 7.5% 8.0% 8.5% 9.0% 9.5%

Finance Charge per $100 of Amount Financed (h)

1.61 1.76 1.90 2.05 2.20 2.35 2.49 2.64 2.79 2.94 3.08 3.23 3.38

3.00 3.28 3.56 3.83 4.11 4.39 4.66 4.94 5.22 5.50 5.78 6.06 6.34 6.62

4.41 4.82 5.22 5.63 6.04 6.45 6.86 7.28

7.69 8.10 8.52 8.93 9.35 9.77

5.83 6.37 6.91 7.45 8.00 8.55 9.09 9.64 10.19

10.75 11.30 11.86 12.42 12.98

7.29

7.94 8.61 9.30 9.98 10.66 11.35 12.04 12.74 13.43 14.13 14.83 15.54 16.24

8.71 9.52 10.34 11.16 11.98 12.81 13.64 14.48 15.32 16.16 17.01 17.86 18.71 19.57

11.63 12.73 13.83 14.94 16.06 17.18 18.31 19.45 20.59 21.74 22.90 24.06 25.23 26.40

14.61 16.00 17.40 18.81 20.23 21.66 23.10 24.55 26.01 27.48 28.96 30.45 31.96 33.47

6.0%

—

10.0% 10.5% 11.0% 11.5% 12.0%

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Consider a home mortgage of $125,000 at a fixed APR of 4.5% for 25 years. a. Calculate the monthly payment. b. Determine the total amount paid over the term of the loan. c. Of the total amount paid, what percentage is paid toward the principal and what percentage is paid for interest. ..... a. The monthly payment is $ (Do not round until the final answer. Then round to the nearest cent as needed.)arrow_forwardAs one of the loan officers for Grove Gate Bank, calculate the monthly principal and interest, PI (in $), using this table and the monthly PITI (in $) for the mortgage. (Round dollars to the nearest cent.) AmountFinanced InterestRate Termof Loan(years) MonthlyPI AnnualPropertyTax AnnualInsurance MonthlyPITI $280,000 3.50% 25 $ $6,573 $2,156 $arrow_forwardSome lenders offer loans with biweekly payments rather than monthly payments. Investigate the effect of this on home loans by finding the payment and total interest on a thirty-year simple interest amortized loan of $150,000 at 13% interest. (Round your answers to the nearest cent.) (a) if payments are made monthly payment $ total interest $ (b) if payments are made biweekly payment $ total interest $arrow_forward

- For the car loan described, give the following information. A newspaper advertisement offers a $9,000 car for nothing down and 36 easy monthly payments of $287.50. (a) amount to be paid$ (b) amount of interest$ (c) interest rate %(d) APR (rounded to the nearest tenth of a percent) %arrow_forwardYou are the loan department supervisor for a bank. This installment loan is being paid off early, and it is your task to calculate the rebate fraction, the finance charge rebate (in $), and the payoff for the loan (in $). (Round dollars to the nearest cent.) AmountFinanced Number ofPayments MonthlyPayment PaymentsMade RebateFraction FinanceChargeRebate LoanPayoff $1,900 18 $126.89 13 $ $arrow_forwardYou are the loan department supervisor for a bank. This installment loan is being paid off early, and it is your task to calculate the rebate fraction, the finance charge rebate (in $), and the payoff for the loan (in $). (Round dollars to the nearest cent.) AmountFinanced Number ofPayments MonthlyPayment PaymentsMade RebateFraction FinanceChargeRebate LoanPayoff $4,700 36 $162.33 31 $ $arrow_forward

- As one of the loan officers for Grove Gate Bank, calculate the monthly principal and interest, PI (in $), using this table and the monthly PITI (in $) for the mortgage. (Round dollars to the nearest cent.) AmountFinanced InterestRate Termof Loan(years) MonthlyPI AnnualPropertyTax AnnualInsurance MonthlyPITI $220,000 7.50% 25 $ $6,543 $2,156 $arrow_forwardJami's Home Repair borrows $6,000, at 13.75% interest, for 330 days. Use the exact interest method to find the amount of interest that the bank will collect. (Round to the nearest cent.) Ⓒ$600.00 Ⓒ$640.00 $745.89 Ⓒ$8,200.00arrow_forwardCalculate the DTI ratio (in percent) for a borrower who has a gross monthly income of $4,875 and has a minimum credit car bill of $125, a car lease payment of $276.78 and a student loan payment of $216, and who is applying for a loan with a monthly payment of $2,021.79. (Round your answer to the nearest tenth of a percent.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education