Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

You are 25, recently graduated, and have a job paying you $40,000 a year.

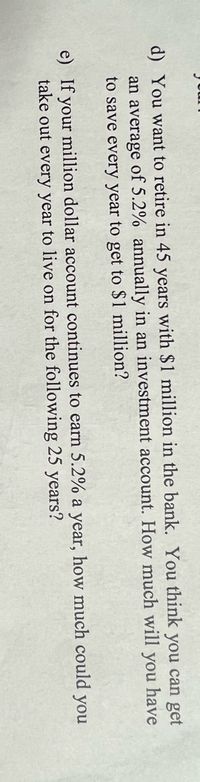

Transcribed Image Text:d) You want to retire in 45 years with $1 million in the bank. You think you can get

an average of 5.2% annually in an investment account. How much will you have

to save every year to get to $1 million?

e) If your million dollar account continues to earn 5.2% a year, how much could you

take out every year to live on for the following 25 years?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Ms. Adams has received a job offer as an administrative assistant. Her base salary will be $50,000. She will receive her first annual salary payment one year from the day she begins to work. In addition, she will get an immediate $10,000 bonus for joining the company. Her salary will grow at 4 percent each year and each year she will receive a bonus equal to 10% of her salary. Ms. Adams is expected to work for 30 years. What is the present value of the offer if the appropriate discount rate is 10% (EAR)?arrow_forwardYou’ve just joined the investment banking firm of Dewey, Cheatum, and Howe. They’ve offered you two different salary arrangements. You can have $79,000 per year for the next two years, or you can have $68,000 per year for the next two years, along with a $24,000 signing bonus today. The bonus is paid immediately, and the salary is paid in equal amounts at the end of each month. If the interest rate is 9 percent compounded monthly, what is the value today of each option? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g., 32.16.)arrow_forwardMichael Scott is 30 years old at the beginning of the year and is thinking about getting an MBA. Michael is currently making $40,000 per year and expects the same for the remainder of his working years (until age 65). If he goes to a business school, he gives up his income for two years and, in addition, pays $20,000 per year for tuition. In return, Michael expects an increase in his salary after his MBA is completed. Suppose that the post-graduation salary increases at a 5% per year and that the discount rate is 8%. What is minimum expected starting salary after graduation that makes going to a business school a positive-NPV investment for Michael? For simplicity, assume that all cash flows occur at the end of each year. This is about time value of money, need excel for formula and solution, u can use shortcut in excel if applicable like PMT NPER and etc.arrow_forward

- You have just finished your undergraduate degree and you have two career options: Option 1: Accepting a job offer with the starting salary of $75,000 per year (paid at the end of the year) and an annual raise of 2% pa (guaranteed). You will work in this company for 40 years. Option 2: Choosing a graduate program which will cost you $28,000 per year for the next two years (paid at the beginning of each year). Following the graduate school, you can get a job that offers the initial salary of $85,000 (paid at the end of the Year 3) with an annual raise of 3% pa (guaranteed). You will work in this company for 38 years. a. If you use the discount rate of 10% pa, which option is more lucrative for you? b.At what discount rate will you be indifferent between these two career options? (Hint: You need to use the incremental cash flows to answer this question) c. If option 2 (i.e., work after grad school) comes with a signing bonus (paid at the beginning of Year 3), at what signing bonus will…arrow_forwardYou are offered a job that pays $37,000 during the first year with an annual increase of 9% per year beginning in the second year. That is, beginning in year 2, your salary will be 1.09 times what it was in the previous year. What can you expect to earn in your fourth year on the job? Round your answer to the nearest dollar.arrow_forwardYou've just been hired by RhombiData. The new job includes company contributions to a qualified savings plan. RhombiData will make an annual contribution of $4,000 in Year 1 (payments are made all at once at the end of the year), but will then raise the amount it contributes by 3.0% annually for 7 years (Years 2 through 8); and then, as a loyalty incentive, will raise the annual increase to 5% annually starting with the Year 9 contribution. You anticipate that the average annual return on all contributions will be 7% compounded annually (which you also consider your discount rate). You plan to retire in 19 years, when RhombiData will have made 19 contributions-making all contributions on the last day of the year, including one on your last day of work. You know your salary amount but are trying to assess the value today of the company contributions to your savings plan. (You are excluding the value of your own savings contributions.) In today's dollars (PV), what are the nineteen (19)…arrow_forward

- Candace just accepted her first job paying a $48,000 salary and is planning to take a $5,000 vacation cruise throughout Europe for 2 weeks. She is debating whether to take the trip now and finance it with a promotion from the travel company offering no payments for a year at a monthly periodic rate of 1%, or wait the year and save to pay for the trip. If she takes the trip now she will start her career 2 weeks late. Approximately how much would she save by waiting a year and not taking her unpaid time from work to travel? $2,480. $634. $1,557. $600.arrow_forwardPaul just graduated from college and landed his first "real" job, which pays $33,200 a year. In 5years, what will he need to earn to maintain the same purchasing power if inflation averages 4 percent The future value, FV, Paul will need to earn if inflation averages 4 percent is blank (Round to the nearest cent.)arrow_forwardPaul just graduated from college and landed his first "real" job, which pays $43.200 a year. In 13 years, what will he need to earn to maintain the same purchasing power if inflation averages 2 percent? The future value, Fv, Paul will need to earn if inflation averages 2 percent is $______ (Round to the nearest cent.) Please answer fast i give you upvote.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education