Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

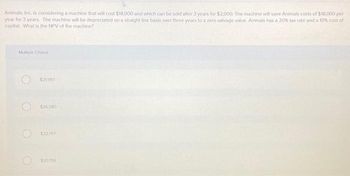

Transcribed Image Text:Animals, Inc. is considering a machine that will cost $18,000 and which can be sold after 3 years for $2,000. The machine will save Animals costs of $18,000 per

year for 3 years. The machine will be depreciated on a straight line basis over three years to a zero salvage value. Animals has a 20% tax rate and a 10% cost of

capital. What is the NPV of the machine?

Multiple Choice

$21997

$26.580

$22,797

$20796

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- The Larkspur Furniture Company needs a new grinder. Compute the present worth for these mutually exclusive alternatives and identify which you would recommend given i-10% per year. Larkspur uses a 10-year planning horizon. Alternati ve A B Initial Cost $4500 $5500 Annual Costs $300 $400 $0 5 years 10 years Salvage Value $500 Life a) PW costs of alternative A b) PW costs of alternative B c) Which one do you recommend? Explain why.arrow_forwardA firm is considering purchasing equipment that will reduce annual costs by P 40,000. The equipment costs P 300,000 and has a salvage value of P 50,000 and a life of 7 yrs. The annual maintenance cost is P 6,000. While not in use by the firm, the equipment can be rented to others to generate an income of P 10,000 per year. If money can be invested for an 8% return, is the firm justified in buying the equipment? Use annual cost method.arrow_forwardHardshell Music, Inc is planning to purchase a high end guitar set that will cost P95,000.00 and would have a useful life of 5 years with zero salvage value. The expected annual cash inflow of the guitar set is P5,000.00. Required: Compute for the Payback period and make your recommendation to Hardshell Music, Inc.arrow_forward

- Belmont Corporation is considering the purchase of a new piece of equipment. The cost savings from the equipment would result in an annual A in net operating income of $210,000. The equipment will have an initial cost of $1,000,000 and an 8-year useful ife, if there is no salvage value of the equipment, what is the accounting rate of return? Multiple Choice O O 21.0% 16.0% O 42.0% O 13.5%arrow_forwardboth parts of the question pleasearrow_forwardThe management of Kunkel Company is considering the purchase of a $21,000 machine that would reduce operating costs by $5,000 per year. At the end of the machine’s five-year useful life, it will have zero salvage value. The company’s required rate of return is 12%. Click here to view Exhibit 12B-1 and Exhibit 12B-2, to determine the appropriate discount factor(s) using table. Required: 1. Determine the net present value of the investment in the machine. 2. What is the difference between the total, undiscounted cash inflows and cash outflows over the entire life of the machine?arrow_forward

- question is in the picturearrow_forwardA new machine costs $798,410 and falls in a 26.50% CCA class. The machine will have zero value after 5 years of use but will save $370,940 annually in operating costs before taxes in those five years. Assume a tax rate of 32.73%. Using a required return of 13.67%, what is the NPV of the machine purchase? Options $210,082 $215,760 $221,437 $227,115 $232,793arrow_forwardakshuarrow_forward

- Hancheta Inc. is considering the purcase of a new vehicle for P350,000. The firm's old vehicle has a book value of P85,000, but can only be sold for P60,000. The new vehicle will be depreciated using a 5 year useful life and the straight line method. It is expected to save P62,000 after taxes from the reduced fuel and maintenance expenses. Tabletop Raul is in the tax bracket and has a 12% cost of capital. Compute for the accounting rate of return on initial investment.arrow_forwardJT Engineering wants to buy a machine that costs $158,000, has a 20-year life, and a $12,000 salvage value. Annual cash inflows are $66,000 and annual cash outflows are $41,000. JT requires a 14% return, which has an annuity present value factor of 6.6231 and a single future amount present value factor of 0.0728. What is the NPV of this purchase to the nearest dollar? Select answer from the options belowarrow_forwardYou must evaluate a proposal to buy a new milling machine. The purchase price of the milling machine, including shipping and installation costs, is $104,000, and the equipment will be fully depreciated at the time of purchase. The machine would be sold after 3 years for $43,000. The machine would require a $5,500 increase in net operating working capital (increased inventory less increased accounts payable). There would be no effect on revenues, but pretax labor costs would decline by $56,000 per year. The marginal tax rate is 25%, and the WACC is 8%. Also, the firm spent $4,500 last year investigating the feasibility of using the machine. a. How should the $4,500 spent last year be handled? I. Last year's expenditure is considered a sunk cost and does not represent an incremental cash flow. Hence, it should not be included in the analysis. II. The cost of research is an incremental cash flow and should be included in the analysis. III. Only the tax effect of the research expenses…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education