Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

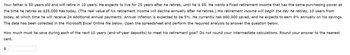

Transcribed Image Text:Your father is 50 years old and will retire in 10 years. He expects to live for 25 years after he retires, until he is 85. He wants a fixed retirement income that has the same purchasing power at

the time he retires as $35,000 has today. (The real value of his retirement income will decline annually after he retires.) His retirement income will begin the day he retires, 10 years from

today, at which time he will receive 24 additional annual payments. Annual inflation is expected to be 5%. He currently has $60,000 saved, and he expects to earn 8% annually on his savings.

The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below.

How much must he save during each of the next 10 years (end-of-year deposits) to meet his retirement goal? Do not round your intermediate calculations. Round your answer to the nearest

cent.

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Mr. X to retire at age 65 and believes that he can live comfortably with an annual pension of $76,000, to be withdrawn at the beginning of each year in his retirement. Suppose his pension account will generate 9% of annual interest rate, and suppose Mr.X believes tgat he will live to 100. In order to have sufficient money for his retirement , what is the minimum amount that Mr. X must have saved up in his pension account at the time of his retirement at of 65?arrow_forwardJohn has decided to start saving for his retirement. Beginning on his twenty-first birthday, John plans to invest $2,000 each birthday into a savings investment earning a 7 percent compound annual rate of interest. He will continue this savings program for a total of 10 years and then stop making payments. But his savings will continue to compound at 7 percent for 35 more years until John retires at age 65. How much will John have at age 35?arrow_forwardBilbo plans to retire in 25 years (t=25) from today and to save $4,000 per month until his retirement with the first saving starting from today (t=0). He expects to have $2,000 monthly expense starting from the first month after year 25 (t=25) through year 50 (t=50). He also wants to leave an amount of inheritance to his son Frodo at year 50 (t=50). The discount rate for Bilbo’s entire life is 6% (APR). Suppose Bilbo strictly follows his financial plan, a) how much savings would Bilbo have in year 25 (t=25)? b) how much at most would Bilbo’s inheritance be in year 50 (t=50)? no excel pleasearrow_forward

- Suppose Lily’s current salary is $72, 000 per year, and she is planning to retire 25 years from now. She anticipates that her annual salary will increase by $1, 800 each year. (That is, in the first year she will earn $72, 000 in the second year $73, 800 in the third year $75, 600 and so forth.) At the end of each of the next 25 years, she plans to deposit 10% of her salary from that year into a retirement fund that earns 6% interest compounded daily. How much money will be in her account at the time of her retirement? Please use factor table and not excelarrow_forwardRyan wants to retire in 10 years when he turns 65 but has determined he will need $1,000,000 to quit his job and live a lifestyle that is comfortable with him. He currently has $350,000 in his 401K and plans to save $850 per month until his 65th birthday. If his investment can earn an average of 9.75% per year, will he make his goal of $1,000,000? Please show your work and inputs if you use a calculator to solve the problem.arrow_forwardBaghibenarrow_forward

- Assume that your father is now 50 years old, plans to retire in 10 years, and expects to live for 25 years after he retires - that is, until age 85. He wants his first retirement payment to have the same purchasing power at the time he retires as $40,000 has today. He wants all of his subsequent retirement payments to be equal to his first retirement payment. (Do not let the retirement payments grow with inflation: Your father realizes that if inflation occurs the real value of his retirement income will decline year by year after he retires). His retirement income will begin the day he retires, 10 years from today, and he will then receive 24 additional annual payments. Inflation is expected to be 6% per year from today forward. He currently has $125,000 saved and expects to earn a return on his savings of 9% per year with annual compounding. To the nearest dollar, how much must he save during each of the next 10 years (with equal deposits being made at the end of each year, beginning…arrow_forwardGabriel plans to retire when he has $1,500,000 in his bank account, and he does not want to work more than 30 years. If this account has a APR of 5.4%, determine the minimum monthly annuity payment he would need to make. Round your answer to the nearest dollar.arrow_forwardSuppose that Paolo is 45 years old and has no retirement savings. He wants to begin saving for retirement, with the first payment coming one year from now. He can save $12,000 per year and will invest that amount in the stock market, where it is expected to yield an average annual return of 8.00% return. Assume that this rate will be constant for the rest of his's life. Paolo would like to calculate how much money he will have at age 65. Using a financial calculator yields a future value of this ordinary annuity to be approximately Paolo would now like to calculate how much money he will have at age 70. Using a financial calculator yields a future value of this ordinary annuity to be approximately at age 65. Paolo expects to live for another 25 years if he retires at age 65, with the same expected percent return on investments in the stock market. Using a financial calculator, you can calculate that Paolo can withdraw retirement at age 65), assuming a fixed withdrawal each year and $0…arrow_forward

- Mia plans to save for retirement starting at the age of 35 (year O). She will make a payment at the beginning of each year until age 64. Starting from age 65, she will withdraw 100,000 USD every year for 20 years until her age of 84. Her account balance will reach to $0 at the beginning of her age 85. The retirement plan Mia is looking at provides a interest rate of 10% annually. What would be the fair annual payment for 30 years of this retirement plan? $5175.61 $4275.33 $5293 $53669arrow_forwardPeter is 65 years old and has just attended his retirement party. He has amassed $1.50 million in retirement savings. He and his spouse have figured out that during retirement, they need to withdraw $100,000 at the end of each year from their retirement savings to maintain the standard of living that they would like to have. If they can earn 5% interest on the unspent balance in their retirement account, how many years will it be before their retirement savings are exhausted? O O 3 30 28 32 24 26 44 % 5 MacBook Pro (0 √ 2⁰ 00 * 8arrow_forwardYour father is 50 years old and will retire in 10 years. He expects to live for 25 years after he retires, until he is 85. He wants a fixed retirement income that has the same purchasing power at the time he retires as $ 45,000 has today. (The real value of his retirement income will decline annually after he retires.) His retirement income will begin the day he retires, 10 years from today, at which time he will receive 24 additional annual payments. Annual inflation is expected to be 3%. He currently has S115, 000 saved, and he expects to earn 9% annually on his savings. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education