Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

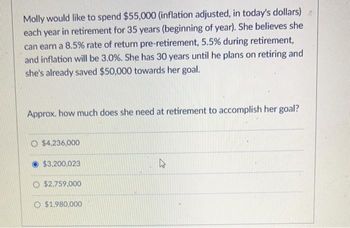

Transcribed Image Text:Molly would like to spend $55,000 (inflation adjusted, in today's dollars)

each year in retirement for 35 years (beginning of year). She believes she

can earn a 8.5% rate of return pre-retirement, 5.5% during retirement,

and inflation will be 3.0%. She has 30 years until he plans on retiring and

she's already saved $50,000 towards her goal.

Approx. how much does she need at retirement to accomplish her goal?

O $4,236,000

$3,200,023

O $2,759,000

O $1,980,000

4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Monica has decided that she wants to build enough retirement wealth, if invested at 8 percent per year, to provide her with $3,500 of monthly income for 20 years. To date, she has saved nothing, but she still has 30 years until she retires. How much money does she need to contribute per month to reach her goal? First compute how much money she will need at retirement, then compute the monthly contribution to reach that goal.arrow_forwardShelly Franks is planning for her retirement, so she is setting up a payout annuity with her bank. She is now 25 years old, and she will retire when she is 65. She wants to receive annual payouts for twenty years, and she wants those payouts to receive an annual COLA of 2.8%. (a) She wants her first payout to have the same purchasing power as does $14000 today. How big should that payout be if she assumes inflation of 2.8% per year? (b) How much money must she deposit when she is 65 if her money earns 8.1% interest per year? (c) How large a monthly payment must she make if she saves for her payout annuity with an ordinary annuity? (The two annuities pay the same interest rate.) (d) How large a monthly payment would she make if she waits until she is 30 before starting her ordinary annuity?arrow_forwardGdarrow_forward

- Mr. Mangano is considering taking early retirement, having saved $400,000. Mr. Mangano wishes to determine how many years the saving will last if he withdraws $60,000 per year at the end of each year. Mr.Mangano's savings can earn 10 percent per year. 11.67 years. 11.35 years 10.90 years 11.53 years. 12.01 yearsarrow_forwardSara Sharp, a 30-year-old insurance broker, decided to start a retirement plan. She figures that her income for the next 20 years will be sufficient to deposit $300 at the end of each month into her retirement plan. She will then let the money sit for another 10 years until she is 60 years old. If Sarah’s retirement plan earns 5.75% compounded monthly, what amount will she have when she turns 60?arrow_forwardBobby has heard the importance of saving early for retirement. He wants to retire in 35 years. But he really likes traveling. Right now, he spends, on average, about $600 a month traveling. He is trying to decide if he should start saving his travel money for retirement now, or if he can continue traveling a few more years before beginning to save. Assume that he can find an annuity that pays 4.75% compounded quarterly. What is his future value if: a) He waits 20 years to start saving? N: P/Y: I%: C/Y: PMT: End or Begin $201,091.59 $658,935.54 $823,669.42 $1,000,000.00arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education