Intermediate Financial Management (MindTap Course List)

13th Edition

ISBN: 9781337395083

Author: Eugene F. Brigham, Phillip R. Daves

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General Accounting

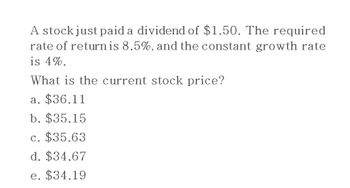

Transcribed Image Text:A stock just paid a dividend of $1.50. The required

rate of return is 8.5%, and the constant growth rate

is 4%.

What is the current stock price?

a. $36.11

b. $35.15

c. $35.63

d. $34.67

e. $34.19

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A stock is trading at $80 per share. The stock is expected to have a yearend dividend of $4 per share (D1 = $4), and it is expected to grow at some constant rate, g, throughout time. The stock’s required rate of return is 14% (assume the market is in equilibrium with the required return equal to the expected return). What is your forecast of gL?arrow_forwardA stock just paid a dividend of D0 = $1.50. The required rate of return is rs = 14.1%, and the constant growth rate is g = 4.0%. What is the current stock price? Select one: a. $12.82 b. $12.97 c. $15.45 d. $18.84 e. $19.15arrow_forwardA stock just paid a dividend of D0 = $1.50. The required rate of return is rs = 8.5%, and the constant growth rate is g = 4.0%. What is the current stock price? Select the correct answer. a. $35.57 b. $36.47 c. $37.37 d. $38.27 e. $34.67arrow_forward

- A stock just paid a dividend of D0 = $1.50. The required rate of return is rs = 10.1%, and the constant growth rate is g = 4.0%. What is the current stock price? $23.11 $23.70 $24.31 $25.57arrow_forwardA stock is expected to pay a dividend of $0.75 at the end of the year. The required rate of return is rs = 10.5%, and the expected constant growth rate is g = 7%. What is the stock's current price? Select the correct answer. a. $22.03 b. $21.43 c. $20.83 d. $20.23 e. $19.63arrow_forwardA stock just paid a dividend of D0 = $1.50. The required rate of return is ?s= 10.1%, and the constant growth rateis g = 4.0%. What is the current stock price?arrow_forward

- A share of common just paid a dividend of $1.00. If the expected long-run growth rate for this stock is 5.4%, and if investors' required rate of return is 13.9%, what is the stock price? A. $11.04 B. $12.40 C. $13.76 D. $15.00 E. $9.42arrow_forwardA stock is expected to pay a dividend of $0.75 at the end of the year. The required rate of return is rs = 10.5%, and the expected constant growth rate is g = 6.4%. What is the stock's current price? a. $17.39 b. $17.84 c. $18.29 d. $18.75 e. $19.22arrow_forwardIf Do= $2.25, g (which is constant) = 3.5%, and Po= $44, what is the stock's expected dividend yield for the coming year? Select the correct answer. Oa. 4.15% b. 4.53% O c. 5.29% d. 4.91% O e. 5.67%arrow_forward

- If D₁ = $2.00, g (which is constant) = 4.7%, and Po = $21.00, then what is the stock's expected dividend yield for the coming year? a. 9.10% O b. 9.97% c. 10.53% d. 8.70% O e. 9.52%arrow_forwardA stock just paid a dividend of D0 = $1.50. The required rate of return is rs = 12%, and the constant growth rate is g = 5%. What is the current stock price, xxx.xx, no $ sign?arrow_forwardWhat is the current price of a share of stock when the current dividend is P4.75, the growth rate is 7%, and the investor's required rate of return is 11%? A. P118.75 B. P 43.16 C. P 46.20 D. P127.06arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT