FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

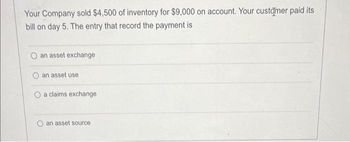

Transcribed Image Text:Your Company sold $4,500 of inventory for $9,000 on account. Your customer paid its

bill on day 5. The entry that record the payment is

an asset exchange

an asset use

O a claims exchange

an asset source

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- prepare these entries for Sarah's plant services. prepare general journal entries for the needed balance dy adjustments for the year ending 30/6/21: A stocktake of the inventory on hand was completed on 30/6/21. The value of the stocktake was $17,000. The inventory asset account as at 30/6/21 before adjustments was $18,000 The allowance for Doubtful debts should be 5% of the balance of Accounts Receivable. The accounts receivable balance at 30/6/21 is $76,120 and the balance of the Allowance for Doubtful Debts was $3,450arrow_forward5. Jack's lawn care used the direct write-off method for accounting for uncollectible accounts. The company writes off $500 on Jane Doe's account. The journal entry to record this will include a debit of $500 to which account?arrow_forwardA business received or issued the following invoices and paid or received the invoiced amounts on the following dates: Invoice date Invoice amount Date paid or received Purchase 2.6.X4 R1,000 26.6.X4 25.6.X4 R1,500 2.7.X4 Sales 8.6.X4 R2,000 26.6.X4 29.6.X4 R3,000 7.7.X4 There is no inventory at the beginning or end of June. What is the difference between the profit for June calculated on a cash basis, and calculated on an accruals basis? A. Nil B. R1,000 C. R1,500 D. R2,500arrow_forward

- question is attached in the ss blow thanks for help thlatpatphat ha arepoacited it top4ipt4op 4itp 4iyp4 o o4i yarrow_forwardSubject: acountingarrow_forwardPresented below are year-end adjusted account balances for Grouper Co. Insurance expense $11,160 Salaries and wages expense 55,230 Rent expense 22,430 Sales discounts 12,590 Inventory 26,260 Sales returns and allowances 15,640 Cost of goods sold 212,780 Sales revenue 411,350 Freight-out 7,930 Prepare the necessary closing entries. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Creditarrow_forward

- Use the following question to answer a question that follows. Lorato and Loago’s Trial Balance as at 31 December 2001 Dr Cr Capital accounts: Lorato 100000 Loago 50000 Current accounts: Lorato 200 Loago 600 Cash drawings for the year: Lorato 15000 Loago 10000 Freehold premises at cost 50000 Inventory at 1 January 2021 75000 Fixtures and Fittings at cost 15000 Purchases and purchase returns 380000 12000 Bank 31600 Sales and sales Returns 6000 508000 Accounts receivables and accounts payables 52400 33300 Carriage inwards 21500 Carriage outwards 3000 Staff salaries 42000 VAT 8700 Office expenses 7500 Provision for doubtful debts 2000 Advertising 5000 Discounts received 1000 Discounts Allowed 1200 Bad debts 1400 Rent and business rates 2800 Accumulated provision for depreciation offixtures and fittings 3000 720000 720000 At 31 December 2021:a. Inventory on hand was valued at P68, 000b.…arrow_forwardan invoice for kitchen appliances is dated December 23 and is paid on January 14 of the following year. credit terms are 2/15,n/45 EOM. The total amount, $497.48 includes a charge for freight and insurance of $62.43. A. What amount should be paid? B.How much is credited to the buyer's account? C. Is any money still owed after the payment?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education