FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

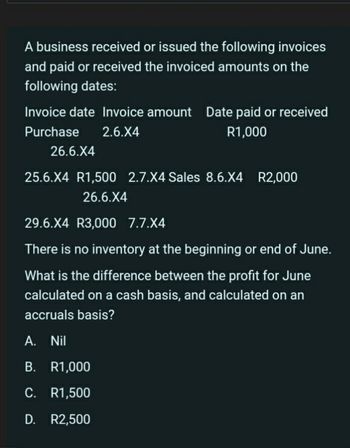

Transcribed Image Text:A business received or issued the following invoices

and paid or received the invoiced amounts on the

following dates:

Invoice date Invoice amount Date paid or received

Purchase 2.6.X4

R1,000

26.6.X4

25.6.X4 R1,500 2.7.X4 Sales 8.6.X4 R2,000

26.6.X4

29.6.X4 R3,000 7.7.X4

There is no inventory at the beginning or end of June.

What is the difference between the profit for June

calculated on a cash basis, and calculated on an

accruals basis?

A. Nil

B. R1,000

C. R1,500

D. R2,500

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Determine the amount to be paid by the buyer for full settlement of each invoice, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period. Merchandise Transportation Paid by Seller Transportation Terms Returns and Allowances (a) $7,100 $348 FOB Shipping Point, 1/10, net 30 $700 (b) $3,800 $124 FOB Destination, 2/10, net 45 $800 a. $ b. $arrow_forwardFrom the general journal, record to the accounts receivable subsidiary ledger and post to the general ledger accounts as appropriate. Record to the accounts receivable subsidiary ledger. Use transaction dates as posting references. Accounts Receivable Subsidiary Ledger Henry Co. Lincoln Co. Now post to the partial general ledger. Use transaction dates as posting references. Partial General Ledger Accounts Receivable 112 Merchandise Inventory 142 Sales 411 Cost of Goods Sold 505arrow_forwardUsing the ordinary dating method, calculate the discount date and the net date for thefollowing transactions.Date of Invoice Terms of Sale Discount Date(s) Net Date13. January 29 2/10, 1/20, n/60arrow_forward

- On January 12th, Gates Gems returned merchandise they received on account from Gem Warehouse in the amount of $800. What is the journal entry to record this transaction? Debit Accounts Payable/Gem Warehouse, $800; credit Purchases Returns and Allowances, $800 Debit Accounts Receivable/Gem Warehouse, $800; credit Purchases, $800 Debit Purchases, $800; credit Accounts Payable/Gem Warehouse, $800 Debit Accounts Receivable/Gem Warehouse, $800; credit Purchases Returns and Allowances $800arrow_forwardPlease answer with detailed workingarrow_forwardDetermining Amounts to be Paid on Invoices Determine the amount to be paid in full settlement of each of the following invoices, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the discount period: نه ن ن ن ن a. b. C. C. d. e. a. $ b. $ 00000 d. $ Merchandise e. S Invoice Amount $18,200 9,100 5,800 2,600 3,600 Freight Paid by Seller $400 - 100 FOB destination, n/30 FOB shipping point, 2/10, n/30 FOB shipping point, 2/10, n/30 FOB shipping point, 1/10, n/30 FOB destination, 1/10, n/30 Customer Returns and Allowances $900 1,100 500 400arrow_forward

- Determining Amounts to be Paid on Invoices Determine the amount to be paid in full settlement of each of the following invoices, assuming that credit for returns and allowances was received prior to payment and that all invoices were paid within the credit period. a. $20,700 b. 10,500 7,800 2,500 1,800 C. d. Merchandise e. a. b. $ d. $ 19,700 e. $ Freight Paid by Seller c. $ 3,762 X X X X $400 100 Terms FOB shipping point, n/30 FOB shipping point, n/30 FOB destination, n/30 FOB shipping point, n/eom FOB destination, n/30 Returns and Allowances $1,000 1,300 700 400arrow_forwardQ.22.arrow_forwardYou are to enter up the sale, purchases, return inwards and returns outwards day book" from the following details. then to post the items to the relevant accounts in the sales and purchases ledgern, The total of the day books are then to be transferred to the account in the general Ledger. 2009 in drawing May 1 Credit sales: T 0mpson Tshs 56,000; L Rodriguez Tshs 148,000; K Barton Tshs 145.000. 3 Credit purchase: P Potter 144.000'. H Harris Tshs 25000 Spencer Tshs 76.000. 7 credit sales K Kelly 89.000; N Mendes Toho 78.000; N lee Tshs 237,000. 9 Credit purchases: B Perkins 24,000; H Haris Tshs 58000 H miles Tshs 123000 11 Good return by to: p Potter Tshs 12000 B. Spencer Tshs22.000. 14 Goods returned to by: T. Thompson Tshs 5.000; K Barton Tshs 11,000; K Kelly Tshs 14000. 17 Credit purchases: H Harris Tshs 54,000; B Perkins Tshs 65000L Nixon Tshs 75.000. 20 Goods returned by us to B Spences Tshs 14000 24 credit sales: K Muhammed Tshs 57000 , K Kelly Tshs 65000, O . Green Tshs 112000 28…arrow_forward

- That is all the information available in the Quetionarrow_forwardwhat is the Credit for partial payment knowing that information?arrow_forwardThe sales journal for Carothers Company is shown below. SALES JOURNAL Date Sales Slip No. Customer Name Post.Ref. AccountsReceivableDebit Sales taxPayableCredit SalesCredit Dec. 1 824 Jim Danta 3,212 312 2,900 7 825 Tom Tome 645 45 600 22 826 Sue Wasco 666 66 600 31 Totals 4,523 423 4,100 Show how the amounts would be posted to the general ledger accounts.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education