Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

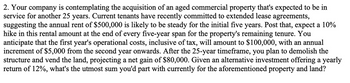

Transcribed Image Text:2. Your company is contemplating the acquisition of an aged commercial property that's expected to be in

service for another 25 years. Current tenants have recently committed to extended lease agreements,

suggesting the annual rent of $500,000 is likely to be steady for the initial five years. Post that, expect a 10%

hike in this rental amount at the end of every five-year span for the property's remaining tenure. You

anticipate that the first year's operational costs, inclusive of tax, will amount to $100,000, with an annual

increment of $5,000 from the second year onwards. After the 25-year timeframe, you plan to demolish the

structure and vend the land, projecting a net gain of $80,000. Given an alternative investment offering a yearly

return of 12%, what's the utmost sum you'd part with currently for the aforementioned property and land?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- An owner of the ATRIUM Tower Office Building is currently negotiating a five-year lease with ACME Consolidated Corporation for 20,000 rentable square feet of office space. ACME would like a base rent of $11 per square foot (PSF) with step-ups of $1 per year beginning one year from now. Required: a. What is the present value of cash flows to ATRIUM under the above lease terms? (Assume a 10% discount rate.) b. The owner of ATRIUM believes that base rent of $11 PSF in (a) is too low and wants to raise that amount to $15 with the same $1 step-ups. However, now ATRIUM would provide ACME a $53,000 moving allowance and $130,000 in tenant improvements (Tls). What would be the present value of this alternative to ATRIUM? c. ACME informs ATRIUM that it is willing to consider a $14 PSF with the $1 annual stepups. However, under this proposal, ACME would require ATRIUM to buyout the one year remaining on its existing lease in another building. That lease is $6 PSF for 20,000 SF per year. If ATRIUM…arrow_forwardA property worth $16 million can be refinanced with an 85% loan at 9.5% over 20 years. The balance on the current loan is $12,148,566. Loan payments are $113,302 per month. The loan balance in 10 years will be $8,396,769. If the property is expected to be sold in 10 years, what is the incremental cost of refinancing? a)11.18% b)12.42% c) 10.45% d) 10.94%arrow_forwardA building is expected to require $1,000,000 in capital improvement expenditures in five years (60 months). The building's net operating cash flow prior to that time is expected to be at least $20,000 at the end of every month. How much of that monthly cash flow must the owners set aside each month in order to have the money available for the capital improvements, assuming monthly interest rate is 1.5%? Group of answer choices $14,332.83 $13,609.73 $12,666.67 $10,393.43arrow_forward

- Consider a firm A that wishes to acquire an equipment. The equipment is expected to reduce costs by $4200 per year. The equipment costs $25000 and has a useful life of 5 years. If the firm buys the equipment, they will depreciate it straight-line to zero over 5 years and dispose of it for nothing. They can lease it for 5 years with an annual lease payment of $5000. If the after-tax interest rate on secured debt issued by company A is 2% and tax rate is 35%, what is the Net Advantage to Leasing (NAL)?(keep two decimal places)arrow_forwardI purchased a house and intend to hold the property indefinitely. I plan to rent the house to generate rent income. The first year’s rent is $15,000, and will grow it at the rate of 10% for 3 years after that. After the initial 4 years, the growth rate in the rent will stabilize at 5%. The maintenance will cost $5,000 a year. The appropriate discount rate is 20%. a. What is the present value of rent income? b. What is the present value of the house? c. What is the present value of maintenance costs?arrow_forwardYou own a lot in Key West, Florida, that is currently unused. Similar lots have recently sold for $1,310,000. Over the past five years, the price of land in the area has increased 5 percent per year, with an annual standard deviation of 31 percent. You have approached a buyer and would like the option to sell the land in 12 months for $1,460,000. The risk- free rate of interest is 5 percent per year, compounded continuously. What is the price of the put option necessary to guarantee your sales price? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Price of put option $ 208,531.70 Marrow_forward

- Munabhaiarrow_forwardConsider a firm A that wishes to acquire an equipment. The equipment is expected to reduce costs by $5700 per year. The equipment costs $29000 and has a useful life of 7 years. If the firm buys the equipment, they will depreciate it straight-line to zero over 7 years and dispose of it for nothing. They can lease it for 7 years with an annual lease payment of $8000. If the after-tax interest rate on secured debt issued by company A is 7% and tax rate is 25%, what is the Net Advantage to Leasing (NAL)?(keep two decimal places) Answer: -18233.59arrow_forwardAfter two years in business, the owners have saved (have a surplus of) $123,750.00. They must decide if they will invest in property or investment bonds. If they invest in a property and a vehicle, the total cost will be $445,500,00, of which $123,750.00 will be required as a down payment. The fixed interest rate on the mortgaged amount is 5.40% compounded semi-annually for a term of 13 years. 5. What is the size of the semi-annual payments required to settle this mortgage? 6. What is the size of the final payment? 7. How long would it take (in months) to settle this loan with regular monthly payments of exactly $2000 instead of the PMT value calculated in Part 5?arrow_forward

- Kuehner estimates that it can lease Parker Road Plaza for $18.50 per square foot (GLA) base rent with a 3 percent overage on gross sales in excess of $200 per square foot (GLA). The company expects rents to increase by 5 percent per year during the lease period and tenant reimbursements to run $8 per square foot (GLA) and to increase at the same rate as rents. Kuehner expects to have the shopping center 70 percent leased during the first year of operation After that, vacancies should average about 5 percent per year. The vacancy losses should be cal-culated on the entire gross potential income, which includes minimum rents, percentage rents and tenant reimbursements. Sales, which are expected to average $210 per square foot (GLA) for the first year of operation, should grow at 6 percent per year. The operating expenses are expected to average $14 per square foot of GLA for the first year and will increase at the same rate as the rents. Kuehner will collect an additional 5 percent of…arrow_forwardA property owner is evaluating the following alternatives for leasing space in his office building for the next five years: Net lease with CPI adjustments. The rent will be $16 per square foot the first year. After the first year, the rent will be increased by the amount of any increase in the CPI. The CPI is expected to increase 7 percent per year. Calculate the effective rent to the owner (after expenses) for the lease using a 10 percent discount rate.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education