Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

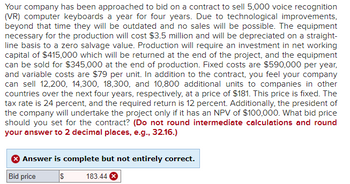

Transcribed Image Text:Your company has been approached to bid on a contract to sell 5,000 voice recognition

(VR) computer keyboards a year for four years. Due to technological improvements,

beyond that time they will be outdated and no sales will be possible. The equipment

necessary for the production will cost $3.5 million and will be depreciated on a straight-

line basis to a zero salvage value. Production will require an investment in net working

capital of $415,000 which will be returned at the end of the project, and the equipment

can be sold for $345,000 at the end of production. Fixed costs are $590,000 per year,

and variable costs are $79 per unit. In addition to the contract, you feel your company

can sell 12,200, 14,300, 18,300, and 10,800 additional units to companies in other

countries over the next four years, respectively, at a price of $181. This price is fixed. The

tax rate is 24 percent, and the required return is 12 percent. Additionally, the president of

the company will undertake the project only if it has an NPV of $100,000. What bid price

should you set for the contract? (Do not round intermediate calculations and round

your answer to 2 decimal places, e.g., 32.16.)

Answer is complete but not entirely correct.

Bid price

$ 183.44 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Arnold Inc. is considering a proposal to manufacture high-end protein bars used as food supplements by body builders. The project requires use of an existing warehouse, which the firm acquired three years ago for $3 million and which it currently rents out for $137,000. Rental rates are not expected to change going forward. In addition to using the warehouse, the project requires an upfront investment into machines and other equipment of $1.4 million. This investment can be fully depreciated straight-line over the next 10 years for tax purposes. However, Arnold Inc. expects to terminate the project at the end of eight years and to sell the machines and equipment for $440,000. Finally, the project requires an initial investment into net working capital equal to 10% of predicted first-year sales. Subsequently, net working capital is 10% of the predicted sales over the following year. Sales of protein bars are expected to be $4.7 million in the first year and to stay constant for eight…arrow_forwardYoyo, Inc. is considering the purchase of a new machine that will reduce manufacturing costs by P15,000 annually. Yoyo will use MACRS to depreciate the machine, and it expects to sell the machine at the end of its 5-year operating life for P10,000. The firm expects to be able to reduce net operating working capital by P15,000 when the machine is installed, but required operating working will reduce to its original level when the machine is sold after 5 years. Yoyo's tax rate is 30% and it uses 12% cost of capital. The applicable depreciation rates are 20%, 19%, 12%, 11%, and 6%. If the machine costs P60,000, a. What is the project's NPV b. What is the project's MIRRarrow_forwardA division of Virginia City Highlands Manufacturing is considering purchasing for $1,500,000 a machine that automates the process of inserting electronic components onto computer motherboards. The annual cost of operating the machine will be $50,000, but it will save the company $370,000 in labor costs each year. The machine will have a useful life of 10 years, and its salvage value in 10 years is estimated to be $300,000. Straight-line depreciation will be used in calculating taxes for this project, and the marginal corporate tax rate is 32 percent. If the appropriate discount rate is 12 percent, what is the NPV of this project?arrow_forward

- Lukow Products is investigating the purchase of a piece of automated equipment that will save $150,000 each year in direct labor and inventory carrying costs. This equipment costs $800,000 and is expected to have a 5-year useful life with no salvage value. The company’s required rate of return is 12% on all equipment purchases. Management anticipates that this equipment will provide intangible benefits such as greater flexibility and higher-quality output that will result in additional future cash inflows. Click here to view Exhibit 14B-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table. Required: 1. What is the net present value of the piece of equipment before considering its intangible benefits? (Enter negative amount with a minus sign. Round your final answer to the nearest whole dollar amount.) 2. What minimum dollar value per year must be provided by the equipment’s intangible benefits to justify the $800,000 investment? (Do not round intermediate…arrow_forwardplease asnwer correctly: Your company has been approached to bid on a contract to sell 5,000 voice recognition (VR) computer keyboards per year for four years. Due to technological improvements, beyond that time they will be outdated and no sales will be possible. The equipment necessary for the production will cost $3.4 million and will be depreciated on a straight-line basis to a zero salvage value. Production will require an investment in net working capital of $395,000 to be returned at the end of the project, and the equipment can be sold for $325,000 at the end of production. Fixed costs are $595,000 per year, and variable costs are $85 per unit. In addition to the contract, you feel your company can sell 12,300, 14,600, 19,200, and 11,600 additional units to companies in other countries over the next four years, respectively, at a price of $180. This price is fixed. The tax rate is 23 percent, and the required return is 10 percent. Additionally, the president of the company…arrow_forwardThe CFO of The Fun Factory is investigating the possibility of investing in a three-dimensional printer that would cost $16,500. The printer would eliminate the need to have prototypes of new toys be produced by a third party. The cost of having the prototypes manufactured by the third party is about $7,161 per year. The printer would have a useful life of five years with no salvage value with expected annual operating costs of $3,300 per year. Required: Compute the simple rate of return on the printer. (Round your answer to 1 decimal place.) Simple rate of return %arrow_forward

- Arnold Inc. is considering a proposal to manufacture high-end protein bars used as food supplements by body builders. The project requires use of an existing warehouse, which the firm acquired three years ago for $2 million and which it currently rents out for $130,000. Rental rates are not expected to change going forward. In addition to using the warehouse, the project requires an upfront investment into machines and other equipment of $1.2 million. This investment can be fully depreciated straight-line over the next 10 years for tax purposes. However, Arnold Inc. expects to terminate the project at the end of eight years and to sell the machines and equipment for $424,000. Finally, the project requires an initial investment into net working capital equal to 10% of predicted first-year sales. Subsequently, net working capital is 10% of the predicted sales over the following year. Sales of protein bars are expected to be $4.9 million in the first year and to stay constant for eight…arrow_forwardLukow Products is investigating the purchase of a piece of automated equipment that will save $130,000 each year in direct labor and inventory carrying costs. This equipment costs $780,000 and is expected to have a 6-year useful life with no salvage value. The company's required rate of return is 10% on all equipment purchases. Management anticipates that this equipment will provide intangible benefits such as greater flexibility and higher-quality output that will result in additional future cash inflows. Click here to view Exhibit 7B-1 and Exhibit 7B-2, to determine the appropriate discount factor(s) using table. Required: 1. What is the net present value of the piece of equipment before considering its intangible benefits? Note: Enter negative amount with a minus sign. Round your final answer to the nearest whole dollar amount. 2. What minimum dollar value per year must be provided by the equipment's intangible benefits to justify the $780,000 investment? Note: Do not round…arrow_forwardRahularrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education