Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

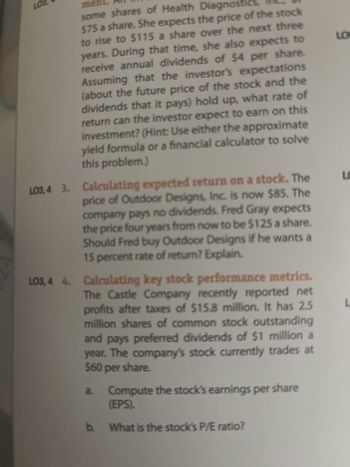

Transcribed Image Text:### Calculating Expected Return on a Stock

**Scenario**: The price of Outdoor Designs, Inc. is now $85. The company pays no dividends. Fred Gray expects the price four years from now to be $125 a share. Should Fred buy Outdoor Designs if he wants a 15 percent rate of return? Explain.

---

### Calculating Key Stock Performance Metrics

**The Castle Company** recently reported net profits after taxes of $15.8 million. It has 2.5 million shares of common stock outstanding and pays preferred dividends of $1 million a year. The company's stock currently trades at $60 per share.

**Tasks:**

- **a.** Compute the stock’s earnings per share (EPS).

- **b.** What is the stock’s P/E ratio?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Suppose that a firm with a stock price of $80 just announced that it expects to pay a $100 per share liquidating dividend in 1 year, although the exact amount of the dividend depends on the performance of the company this year. Assume that the CAPM is a good description of stock price returns and that the stock’s beta is 1.5, the market’s expected return is 12%, and the risk-free rate is 5%. 1) Is the stock priced correctly now? 2) What is the alpha of the stock? 3) What would you expect to happen to the stock price in an efficient market after the announcement? Give typing answer with explanation and conclusionarrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardB1) see picarrow_forward

- 1.A stock is expected to pay a dividend of $2.75 at the end of the year (i.e., D1 = $2.75), and it should continue to grow at a constant rate of 10% a year. If its required return is 14%, what is the stock's expected price 4 years from today? Do not round intermediate calculations. Round your answer to the nearest cent. = $ 2. Computech Corporation is expanding rapidly and currently needs to retain all of its earnings; hence, it does not pay dividends. However, investors expect Computech to begin paying dividends, beginning with a dividend of $1.00 coming 3 years from today. The dividend should grow rapidly—at a rate of 29% per year—during Years 4 and 5, but after Year 5, growth should be a constant 6% per year. If the required return on Computech is 18%, what is the value of the stock today? Do not round intermediate calculations. Round your answer to the nearest cent. = $arrow_forwardSuppose Lilly V, Inc. has just paid a dividend. The next dividend, to be paid in a year, is forecasted to be $4. If the growth rate of dividends is 7% and the discount rate is 11%, at what price will the stock sell? a.Less than $100 b.More than $100 c.$100 d.$111arrow_forward(Common stock valuation) Wayne, Inc.'s outstanding common stock is currently selling in the market for $24. Dividends of $3.01 per share were paid last year, return on equity is 21 percent, and its retention rate is 24 percent. a. What is the value of the stock to you, given a required rate of return of 19 percent? b. Should you purchase this stock? Question content area bottom Part 1 a. Given a required rate of return of 19 percent, the value of the stock to you is $enter your response here. (Round to the nearest cent.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education