ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

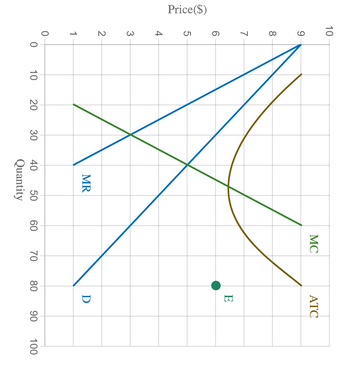

Your business, which has some market power, has the following demand (D), marginal revenue (MR), marginal cost (MC), and average cost (AC)

If the goal of your business is to maximize profit, how much will it produce, and what price will it charge?

-The business will exit the market because it is unable to cover its average costs.

-The business will produce 40 units, and charge a price of $5.

-The business will produce 30 units, and charge a price of $3.

-The business will produce 30 units, and charge a price of $6.

Transcribed Image Text:Price ($)

10

9

8

7

6

5

4

3

2

1

0

0

10

20

30

MR

40

Quantity

50 60

MC

70 80

ATC

E

D

90 100

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- What are some characteristics of perfect competition? Is the Banana market a perfect competition? When you are buying bananas, what is your decision making process? Do you have any favorite brand of banana? How can companies in the market compete? Please name some other examples of perfect competition?arrow_forwardIf a firm is producing at a quantity in which the marginal cost exceeds marginal revenue, the firm must decrease output to increase profit must increase output to increase profit is maximizing profit O must shut-down to increase profitarrow_forwardquestion barrow_forward

- A firms cost and revenue functions look like this in 3 questions below. Total cost: TC = 100 + 2Q + Q2 Marginal cost: MC = 2 + 2Q Price: P=22 What is the profit maximizing output? a. 8 b. 10 c. 12 d. 25 e. All the other answers are wrong. What is the firm's profit? a. -14 b. -6 c. 0 d. 15 e. All then other answers are wrong. What are the fixed costs and variable costs at the profit maximising output? a. FC=0, VC=220 b. FC=100, VC=80 c. FC=80, VC=244 d. FC=100, VC=120 e. All the other answers are wrong.arrow_forwardcan anyone help me with my homework pleasearrow_forwardFill in the Blanks Fill in the blank. "For a firm to be in equilibrium, Marginal Revenue (MR) and Marginal Cost (MC) must be and beyond that level of output Marginal Cost must bearrow_forward

- "A profit maximizing firm seeks to produce at an output where its marginal revenue is equal to its marginal costs." Agree or disagree with this statement.arrow_forwardOnly typed answer and please answer correctly It is possible to lower the average cost of production by expanding output beyond Q0 to Q1. Why wouldn't a firm expand its output to Q1? Group of answer choices a) Demand is not sufficient for consumers to buy Q1. b) The firm would suffer an economic loss at Q1 while it would break even at Q0. c) The firm's marginal revenue would be negative at Q1. d) The firm wants to maximize accounting profit rather than economic profit.arrow_forward6.a) Figure 8.7 shows cost curves for Penny's Parasols, a perfectly competitive firm. At which of the point would Penny's Parasols be certain to close down? A, B, C, D, or E. Explain: b) Figure 8.7 shows cost curves for Penny's Parasols, a perfectly competitive firm. At which point(s) would Penny's Parasols endure economic losses, but continue to produce in the short run? D, F, A, C, or E. Explain: 6.c) Which point in Figure 8.7 represents a break-even situation for a perfectly competitive firm? A, B, C, D, or E. Explain: 6.d) At which point in Figure 8.7 would a perfectly competitive firm earn the same profit, or suffer the same loss, by producing rather than by shutting down? A, B, C, D, or F. Explain: Choose and explain your answer above thoroughly--graphical, algebraically, numerically. Kindly see screenshot attached. Please explain with as much detail as possible, using the graph in your answer.arrow_forward

- . Mr DIY is a new small scale palm oil supplier. There are many small scale palm oil suppliers in the market. The price of oil palm is solely determined by the market demand and supply. Describe the market characteristics of this industry. As Mr DIY is a new firm in the market, his firm is facing a problem of revenue lesser than the total variable costs. Illustrate the situation with an appropriate diagram(s). Evaluate the situation of this firm and provide one suggestion for the firm to sustain in the long run.arrow_forwardDoggy Treats is selling dog treats in a purely competitive market. Its output is 800 treats, which it sells for $10 a treat. At the 800-treat level of output, the marginal cost is $11, the average total cost is $9.00, and the average variable cost is $8.00. Should the firm increase output, decrease output, or not produce? Why? How should the firm determine that optimal level of output?arrow_forwardProblem two Consider the total cost and total revenue given in the following table: Total Total Quantity cost Revenue 0 1 2 3 4 5 6 7 8 9 10 11 13 19 27 37 0 8 16 24 32 40 48 56 a) Calculate the profit for each quantity. How much should the firm produce to maximize profit? b) Calculate the marginal revenue and marginal cost for each quantity. Graph them. c) Can you tell whether this firm is in a competitive industry? If so, can you tell whether the industry is in a long-run equilibrium?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education