EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

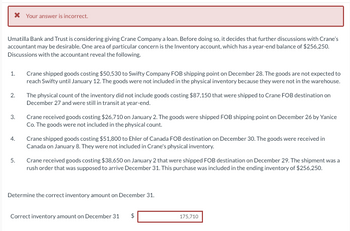

Transcribed Image Text:Umatilla Bank and Trust is considering giving Crane Company a loan. Before doing so, it decides that further discussions with Crane's accountant may be desirable. One area of particular concern is the Inventory account, which has a year-end balance of $256,250. Discussions with the accountant reveal the following:

1. Crane shipped goods costing $50,530 to Swifty Company FOB shipping point on December 28. The goods are not expected to reach Swifty until January 12. The goods were not included in the physical inventory because they were not in the warehouse.

2. The physical count of the inventory did not include goods costing $87,150 that were shipped to Crane FOB destination on December 27 and were still in transit at year-end.

3. Crane received goods costing $26,710 on January 2. The goods were shipped FOB shipping point on December 26 by Yanice Co. The goods were not included in the physical count.

4. Crane shipped goods costing $51,800 to Ehler of Canada FOB destination on December 30. The goods were received in Canada on January 8. They were not included in Crane's physical inventory.

5. Crane received goods costing $38,650 on January 2 that were shipped FOB destination on December 29. The shipment was a rush order that was supposed to arrive December 31. This purchase was included in the ending inventory of $256,250.

Determine the correct inventory amount on December 31.

Correct inventory amount on December 31: $175,710

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Umatilla Bank and Trust is considering giving Sheffield Corp. a loan. Before doing so, it decides that further discussions with Sheffield’s accountant may be desirable. One area of particular concern is the Inventory account, which has a year-end balance of $273,850. Discussions with the accountant reveal the following. 1. Sheffield shipped goods costing $53,860 to Hemlock Company FOB shipping point on December 28. The goods are not expected to reach Hemlock until January 12. The goods were not included in the physical inventory because they were not in the warehouse. 2. The physical count of the inventory did not include goods costing $88,840 that were shipped to Sheffield FOB destination on December 27 and were still in transit at year-end. 3. Sheffield received goods costing $26,690 on January 2. The goods were shipped FOB shipping point on December 26 by Yanice Co. The goods were not included in the physical count. 4. Sheffield shipped goods costing $52,540 to…arrow_forwardUmatilla Bank and Trust is considering giving Sarasota Corp. a loan. Before doing so, it decides that further discussions with Sarasota’s accountant may be desirable. One area of particular concern is the Inventory account, which has a year-end balance of $284,470. Discussions with the accountant reveal the following. 1. Sarasota shipped goods costing $50,150 to Hemlock Company FOB shipping point on December 28. The goods are not expected to reach Hemlock until January 12. The goods were not included in the physical inventory because they were not in the warehouse. 2. The physical count of the inventory did not include goods costing $88,600 that were shipped to Sarasota FOB destination on December 27 and were still in transit at year-end. 3. Sarasota received goods costing $24,100 on January 2. The goods were shipped FOB shipping point on December 26 by Yanice Co. The goods were not included in the physical count. 4. Sarasota shipped goods costing $49,800 to Ehler of…arrow_forwardSplish Brothers Bank and Trust is considering giving Pohl Company a loan. Before doing so, it decides that further discussions with Pohl's accountant may be desirable. One area of particular concern is the Inventory account, which has a year-end balance of $319,000. Discussions with the accountant reveal the following. 1. Pohl shipped goods costing $63,800 to Hemlock Company FOB shipping point on December 28. The goods are not expected to reach Hemlock until January 12. The goods were not included in the physiçal inventory because they were not in the warehouse. The physical count of the inventory did not include goods costing $95,000 that were shipped to Pohl FOB destination on December 27 and were still in transit at year-end. Pohl received goods costing $29,000 on January 2. The goods were shipped FOB shipping point on December 26 by Yanice Co. The goods were not included in the physical count. 3. Pohl shipped goods costing $59,160 to Ehler of Canada FÓB destination on December 30.…arrow_forward

- Dogarrow_forwardI. Street Bank is considering giving Fallen Company a loan. Before doing so, it decides that further discussions with Fallen's accountant may be desirable. One area of particular concern is the inventory account, which has a year-end balance of $375,000. Discussions with the accountant reveal the following. 1. Fallen sold goods costing $55,000 to White Company FOB shipping point on December 28. The goods are not expected to reach White until January 12. The goods were not included in the physical inventory because they were not in the warehouse. 2. The physical count of the inventory did not include goods costing $95,000 that were shipped to Fallen FOB destination on December 27 and were still in transit at year-end. 3. Fallen received goods costing $15,000 on January 2. The goods were shipped FOB shipping point on December 26 by Lynch Co. The goods were not included in the physical count. 4. Fallen sold goods costing $41,000 to Benet of Canada FOB destination on December 30. The goods…arrow_forwardSTaaPM x ugth.wileyplus.com/edugen/Iti/main.uni Indeed Monster Jobs Degree Progra High Energy Make 1 Hear Student Da.. Paused d pue S Consumer Center * The Ultimate Guide nancial Calculator. IS Kimmel, Financial Accounting, 8e Help I System Announcements CALCULATOR PRINTER VERSION 4BACK Exercise 6-1 Umatilla Bank and Trust is considering giving Sage Hill Inc. a loan. Before doing so, it decides that further discussions with Sage Hill Inc's accountant may be desirable. One area of particular concern is the Inventory account, which has year-end balance of $253,760. Discussions with the accountant reveal the following. 1. Sage Hill Inc. sold goods costing $55,290 to Hemlock Company FOB shipping point on December 28. The goods are not expected to reach Hemlock until January 12. The goods were not induded in the physical inventory because the were not in the warehouse. 2. The physical count of the inventory did not indude goods costing $96,030 that were shipped to Sage Hill Inc. FOB…arrow_forward

- Concord Bank and Trust is considering giving Alou Company a loan. Before doing so, management decide that further discussions with Alou's accountant may be desirable. One area of particular concern is the inventory account, which has a year-end balance of £277,500. Discussions with the accountant reveal the following. 1 2 3. 4. 5. Alou sold goods costing £38,500 to Comerico Company, FOB shipping point, on December 28. The goods are not expected to arrive at Comerico until January 12. The goods were not included in the physical inventory because they were not in the warehouse. The physical count of the inventory did not include goods costing £94,700 that were shipped to Alou FOB destination on December 27 and were still in transit at year-end. Alou received goods costing £22,100 on January 2. The goods were shipped FOB shipping point on December 26 by Grant Co. The goods were not included in the physical count. Alou sold goods costing £33,400 to Emerick Co., FOB destination, on December…arrow_forwardFirst Bank is considering giving Ivanhoe Company a loan. First, however, it decides that it would be a good idea to have further discussions with Ivanhoe's accountant. One area of particular concern is the inventory account, which has a December 31 balance of $241,660. Discussions with the accountant reveal the following: 1. 2. 4. 3. On December 31, Flint Company had $26,230 of goods held on consignment for Ivanhoe. The goods were not included in Ivanhoe's ending inventory balance. The physical count of the inventory did not include goods that cost $81,700 that were shipped to Ivanhoe, FOB shipping point, on December 27 and were still in transit at year end. Determine the correct inventory amount at December 31. Ivanhoe sold goods that cost $30,100 to Pharoah Company, FOB destination, on December 28. The goods are not expected to arrive at their destination in India until January 12. The goods were not included in the physical inventory because they were not in the warehouse. The…arrow_forwardHelp PLarrow_forward

- Bud Lighting Co. is a retailer of commercial and residential lighting products. Gowen Geter, the company’s chief accountant, is in the process of making year-end adjusting entries for uncollectible accounts receivable. In recent years, the company has experienced an increase in accounts that have become uncollectible. As a result, Gowen believes that the company should increase the percentage used for estimating doubtful accounts from 2% to 4% of credit sales. This change will significantly increase bad debt expense, resulting in a drop in earnings for the first time in company history. The company president, Tim Burr, is under considerable pressure to meet earnings goals. He suggests that this is “not the right time” to change the estimate. He instructs Gowen to keep the estimate at 2%. Gowen is confident that 2% is too low, but he follows Tim’s instructions. Evaluate the decision to use the lower percentage to improve earnings. How would raising the percentage change the financial…arrow_forwardBlock Foods, a retail grocery store, has agreed to purchase all of its merchandise from Square Wholesalers. In return. Block receives a special discount on purchases. Over recent months, Square noticed that purchases by Block had been falling off. At first, Square simply thought that business might be down for Block and was hopeful that their purchases would pick up. When business with Block did not return to a normal level, Square requested financial statements from Block. Squares records indicate that Block purchased 300,000 worth of merchandise during 20-1, the most recent year. Selected information taken from Block's financial statements is as follows: REQUIRED Compute net purchases made by Block during 20-1. Does it appear that Block violated the agreement?arrow_forwardJack Hammer Company completed the following transactions. The annual accounting period ends December 31. Apr. 30 Received $672,000 from Commerce Bank after signing a 12-month, 9.00 percent, promissory note. June 6 Purchased merchandise on account at a cost of $81,000. (Assume a perpetual inventory system.) July 15 Paid for the June 6 purchase. Aug. 31 Signed a contract to provide security service to a small apartment complex starting in September, and collected six months' fees in advance, amounting to $27,000. Dec. 31 Determined salary and wages of $46,000 were earned but not yet paid as of December 31 (ignore payroll taxes). Dec. 31 Adjusted the accounts at year-end, relating to interest. Dec. 31 Adjusted the accounts at year-end, relating to security service. Required: For each listed transaction and related adjusting entry, indicate the accounts, amounts, and effects on the accounting equation. For each item, indicate whether the debt-to-assets ratio is increased or decreased…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,