FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

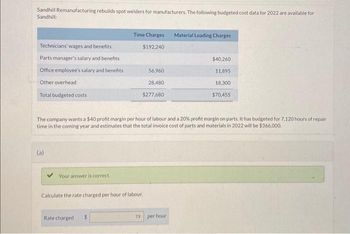

Transcribed Image Text:Sandhill Remanufacturing rebuilds spot welders for manufacturers. The following budgeted cost data for 2022 are available for

Sandhill:

Technicians' wages and benefits

Parts manager's salary and benefits

Office employee's salary and benefits

Other overhead

Total budgeted costs

(a)

Your answer is correct.

Time Charges Material Loading Charges

Rate charged

$192.240

$

56,960

28,480

$277,680

The company wants a $40 profit margin per hour of labour and a 20% profit margin on parts. It has budgeted for 7.120 hours of repair

time in the coming year and estimates that the total invoice cost of parts and materials in 2022 will be $366,000.

Calculate the rate charged per hour of labour.

$40,260

11,895

79 per hour

18,300

$70,455

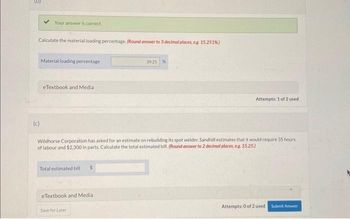

Transcribed Image Text:Your answer is correct.

Calculate the material loading percentage. (Round answer to 3 decimal places, e.g. 15.251%)

(c)

Material loading percentage

eTextbook and Media.

Total estimated bill

Wildhorse Corporation has asked for an estimate on rebuilding its spot welder. Sandhill estimates that it would require 35 hours

of labour and $2,300 in parts. Calculate the total estimated bill. (Round answer to 2 decimal places, e.g. 15.25.)

eTextbook and Medial

39.25 %

Save for Later

Attempts: 1 of 2 used

Attempts: 0 of 2 used

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please solve with steps. Thank you??arrow_forwardPlease help me with correct answer and show calculation thankuarrow_forwardficina Bonita Company manufactures office furniture. An unfinished desk is produced for $37.10 and sold for $65.45. A finished desk can be sold for $75.00. The additional processing cost to complete the finished desk is $6.30. Prepare a differential analysis. Round your answers to two decimal places. Differential AnalysisSell Unfinished (Alternative 1) or Process Further into Finished (Alternative 2) Desks Sell UnfinishedDesks(Alternative 1) Process Further intoFinished Desks(Alternative 2) DifferentialEffects(Alternative 2) Revenues per desk $ $ $ Costs per desk Profit (loss) per desk $ $ $ Should the company sell unfinished desks or process further and sell finished desks?Oficina Bonita Company should.arrow_forward

- H6. Broduer Aquatics manufactures swimming pool equipment. Broduer estimates total manufacturing overhead costs next year to be $2,500,000 The company also estimates it will use 50,000 direct labour hours and incur $1,000,000 of direct labour cost next year. In addition, the machines are expected to be run for 30,000 hours. Compute the predetermined manufacturing overhead rate for next year under the following independent situations: 1. Assume that Brodeur uses direct labour hours as its manufacturing overhead allocation base. 2. Assume that Brodeur suses direct labour cost as its manufacturing overhead allocation base. 3. Assume that Brodeur uses machine hours as its manufacturing allocation basearrow_forwardGive me correct answer with explanation.vkarrow_forwardPlease answer the questions ASAP correctly within 40 min I'll give you multiple upvotes only for perfect step by step n correct answer .arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education