FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Patterson Limited offers a 12-month warranty for the sale of used motorbikes. On 1 April 2021, the beginning of the financial year, there was a credit balance of $280,000 in its Warranty Provision account. During the year ended 31 March 2022, Patterson Limited incurred $260,000 in warranty costs for spare parts. At 31 March 2022, Patterson Limited estimated its liability for unexpired warranty contracts as $300,000.

Prepare the necessary general

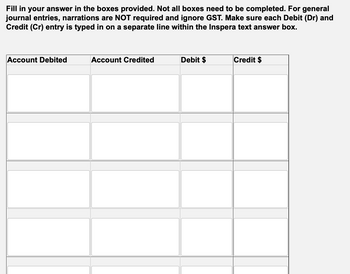

Transcribed Image Text:Fill in your answer in the boxes provided. Not all boxes need to be completed. For general

journal entries, narrations are NOT required and ignore GST. Make sure each Debit (Dr) and

Credit (Cr) entry is typed in on a separate line within the Inspera text answer box.

Account Debited

Account Credited

Debit $

Credit $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lindy Appliance begins operations in 2021 and offers a one-year warranty on all products sold. Total appliance sales in 2021 are $1,600,000, and Lindy estimates future warranty costs in 2022 to be 2% of current sales. Actual warranty costs in 2022 are $25,000. Also in 2022, Lindy has additional sales of $2,400,000 and revises its estimate of warranty costs associated with sales in 2022 to be 1.5%.Required:1. Record the adjusting entry for estimated warranty costs at the end of 2021.2. Record the summary entry for actual warranty expenditures in 2022, assuming all costs were paid in cash.3. Record the adjusting entry for estimated warranty costs at the end of 2022.4. What is the balance in Warranty Liability at the end of 2021 and 2022?arrow_forwardProctor provides 1 year warranty on every chair it produces and sells. On 12-31-19, proctor reported warranty payable of $960,000. During 2019, proctor recognized $640,000 of warranty expense. Warranty claims of $510,000. Tax rate $21%. A) DTC: 201,600 B) DTA: 174, 300 C) DTC: 130, 000 D) DTA: 228,900arrow_forwardDineshbhaiarrow_forward

- Sunnyvale Computer Company sells a line of computers that carry a six-month warranty. Customers are offered the opportunity to buy a two-year extended warranty for an additional charge. During 2024, Sunnyvale received $328,000 from customers for these extended warranties. All sales are on credit, and funds are received evenly throughout the year and the warranties go into effect immediately after purchase. Required: Prepare a summary journal entry to record sales of the extended warranties. Also prepare any other entries associated with the warranties that should be recorded during 2024. 1. Record the $328,000 sale of the extended warranties. 2.Record the recognition of revenue from extended warranties for the year ending December 31, 2024.arrow_forwardcvcrrrrarrow_forwardSwifty Company must make computations and adjusting entries for the following independent situations at December 31, 2026. 1. Its line of amplifiers carries a 3-year warranty against defects. On the basis of past experience, the estimated warranty costs related to dollar sales are first year after sale-2% of sales revenue; second year after sale-3% of sales revenue; and third year after sale-5% of sales revenue. Sales and actual warranty expenditures for the first 3 years of business were: Sales Revenue 2024 $764,500 2025 1,177,800 2026 1,155,500 Warranty Expenditures $6,330 16,190 64,340 Compute the amount that Swifty should report as a liability in its December 31, 2026, balance sheet. Assume that all sales are made evenly throughout each year with warranty expenses also evenly spaced relative to the rates above. Liability that should be reported on December 31, 2026 $ 2. With some of its products, Swifty includes coupons that are redeemable in merchandise. The coupons have no…arrow_forward

- Carla Vista Resellers Ltd. (CVRL) sells gently used and refurbished appliances. The company provides a three-month warranty that is included in the cost of the appliance. Claims under the warranties vary from replacing defective parts to providing customers with new appliances if repairs cannot be made. During 2024, the estimated cost related to the three-month warranties was $36,480, of which $24,000 had been incurred before year end ($18,240 on replacement appliances and $5,760 for parts). For an additional charge of $144, CVRL also offers extended warranty coverage for three years on its refurbished appliances. This amount is expected to cover the costs associated with the extended warranties. During 2024, CVRL sold 480 three-year warranty plans. The costs incurred during the year for repairs and replacements under these plans amounted to $14,400. Based on experience, the company estimates that its total warranty costs over the three-year coverage period will be $43,200, which it…arrow_forwardAdams, Inc. sells widgets that come with an unconditional five-year warranty. According to Adams' best estimates, 7.8% of all units sold will require repair or replacement under that warranty, and the average cost of honoring one warranty claim is $60. During 2023, Adams' first year of operations, 176,000 widgets were sold, 1,278 of which were repaired or replaced under warranty claims. On its December 31, 2023 balance sheet, what amount of warranty liability will Adams report?arrow_forwardEarly in 2020, Larkspur Equipment Company sold 600 Rollomatics at $5,800 each. During 2020, Larkspur spent $21,000 servicing the 2-year assurance warranties that accompany the Rollomatic. All sales transactions are on a cash basis. Prepare 2020 entries for Larkspur assuming that the warranties are not an integral part of the sale (a service-type warranty). Assume that of the sales total, $58,000 relates to sales of warranty contracts.Warranty costs incurred in 2020 were $21,000. Estimate revenues to be recognized on a straight-line basis. Date Account Titles and Explanation Debit Creditarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education