FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

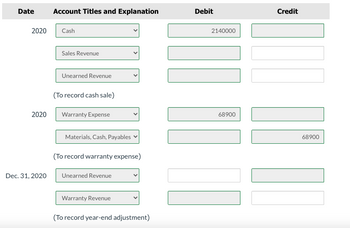

Transcribed Image Text:Date

2020

2020

Dec. 31, 2020

Account Titles and Explanation

Cash

Sales Revenue

Unearned Revenue

(To record cash sale)

Warranty Expense

Materials, Cash, Payables

(To record warranty expense)

Unearned Revenue

Warranty Revenue

(To record year-end adjustment)

Debit

2140000

II

68900

Credit

68900

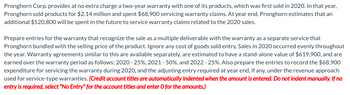

Transcribed Image Text:Pronghorn Corp. provides at no extra charge a two-year warranty with one of its products, which was first sold in 2020. In that year,

Pronghorn sold products for $2.14 million and spent $68,900 servicing warranty claims. At year end, Pronghorn estimates that an

additional $520,800 will be spent in the future to service warranty claims related to the 2020 sales.

Prepare entries for the warranty that recognize the sale as a multiple deliverable with the warranty as a separate service that

Pronghorn bundled with the selling price of the product. Ignore any cost of goods sold entry. Sales in 2020 occurred evenly throughout

the year. Warranty agreements similar to this are available separately, are estimated to have a stand-alone value of $619,900, and are

earned over the warranty period as follows: 2020-25%, 2021-50%, and 2022-25%. Also prepare the entries to record the $68,900

expenditure for servicing the warranty during 2020, and the adjusting entry required at year end, if any, under the revenue approach

used for service-type warranties. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no

entry is required, select "No Entry" for the account titles and enter o for the amounts.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Waterway Company sells televisions at an average price of $ 934 and also offers to each customer a separate 3-year warranty contract for $ 87 that requires the company to perform periodic services and to replace defective parts. During 2020, the company sold 294 televisions and 214 warranty contracts for cash. It estimates the 3-year warranty costs as $21 for pa and accounts for warranties separately. Assume sales occurred on December 31.2020, and parts and $41 for labor, straight-line recognition of warranty revenues ocurs. Part 1 Record any necessary journal entries in 2020. (f no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account tities are automatically indented when amount is entered. Do not indent manually) Account Titles and Explanation Debit Credit eTextbook and Media List of Accounts Save for Later Attempts: 0 of 5 used Submit Answer Part 2 What liability relative to these transactions would appear on the December 31, 2020,…arrow_forwardBest Appliance Store offers a two-year warranty on all appliances sold. The company estimates that 5% of all appliances sold need to be serviced at an average cost of $50 each. At December 31, 2020, the Warranty Liability account had a balance of $19,000. During 2021, the store spends $10,000 repairing 200 appliances. An additional 3,500 appliances are sold in 2021. On the 2021 income statement, warranty expense will be: Oa. $8,750 b. $10,000 CC $8,500 d. $9,000arrow_forwardMetlock Company sells televisions at an average price of $ 939 and also offers to each customer a separate 3-year warranty contract for $ 87 that requires the company to perform periodic services and to replace defective parts. During 2020, the company sold 321 televisions and 261 warranty contracts for cash. It estimates the 3-year warranty costs as $ 20 for parts and $ 30 for labor, and accounts for warranties separately. Assume sales occurred on December 31, 2020, and straight-line recognition of warranty revenues occurs. (a) Record any necessary journal entries in 2020: (b) What liability relative to these transactions would appear on the December 31, 2020, balance sheet and how would it be classified? In 2019, incurred actual costs relative to 2020 television warranty sales of parts and labor. (c) Record any necessary journal entries in 2020 relative to 2019 television warranties. (d) What amounts relative to the 2019 television warranties would appear on the…arrow_forward

- Martinez Factory provides a 2-year warranty with one of its products which was first sold in 2025. Martinez sold $909,800 of products subject to the warranty. Martinez expects $124,480 of warranty costs over the next 2 years. In that year, Martinez spent $73,090 servicing warranty claims. Prepare Martinez's journal entry to record the sales (ignore cost of goods sold) and the December 31 adjusting entry, assuming the expenditures are inventory costs. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically Indented when amount is entered. Do not Indent manually. List all debit entries before credit entries.) Date During 2025 12/31/25 Account Titles and Explanation (To record payment for warranty costs incurred) (To record sales) Debit Credit 20arrow_forwardIn 2025, Oriole Corporation began selling a new line of products that carry a two-year warranty against defects. Based upon experience with other products, the estimated warranty costs as a percentage of sales revenue are as follows: First year of warranty. 3% Second year of warranty 5% Sales revenue and actual warranty expenditures for 2025 and 2026 are presented below: Sales revenue Actual warranty expenditures) 2025 $755000 42000 2026 $1051000 72000 What is the estimated warranty liability at the end of 2026? (assume the accrual method)arrow_forwardOn December 31, 2022, Delta Company sells equipment to Tchefunkte Inc. for $125,000. Delta includes a 1-year assurance warranty service with the sale of all its equipment. The customer receives and pays for the equipment on December 31, 2022. Delta estimates the prices to be $122,000 for the equipment and $3,000 for the cost of the warranty. In addition to the assurance warranty, Delta sold an extended warranty for an additional 2 years for $3,000. How much warranty revenue should Delta recognize in 2022?arrow_forward

- Hansabenarrow_forwardBlossom Company sells televisions at an average price of $856 and also offers to each customer a separate 3-year warranty contract for $93 that requires the company to perform periodic services and to replace defective parts. During 2020, the company sold 306 televisions and 256 warranty contracts for cash. It estimates the 3-year warranty costs as $21 for parts and $31 for labor, and accounts for warranties separately. Assume sales occurred on December 31, 2020, and straight-line recognition of warranty revenues occurs. Part 1 Record any necessary journal entries in 2020. (If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) What liability relative to these transactions would appear on the December 31, 2020, balance sheet and how would it be classified? In 2021, Blossom Company incurred actual costs relative to 2020 television…arrow_forwardSanaz Corporation sells computers under a 3-year warranty contract that requires the corporation to replace defective parts and to provide the necessary repair labor. During 2020, the corporation sells for cash 700 computers at a unit price of $2,000. On the basis of past experience, the3-year warranty costs are estimated to be $130 for parts and $170 for labor per unit.(For simplicity, assume that all sales occurred on December 31, 2020.) The warranty is not sold separately from the computer. Required a. Record any necessary journal entries in 2020.b. What liability relative to these transactions would appear on the December 31, 2020, balance sheet and how would it be classified?c. In 2021, the actual warranty costs to Sanaz Corporation were $30,500 for parts and $45,100 for labor. Record any necessary journal entries in 2021arrow_forward

- Lindy Appliance begins operations in 2021 and offers a one-year warranty on all products sold. Total appliance sales in 2021 are $1,600,000, and Lindy estimates future warranty costs in 2022 to be 2% of current sales. Actual warranty costs in 2022 are $25,000. Also in 2022, Lindy has additional sales of $2,400,000 and revises its estimate of warranty costs associated with sales in 2022 to be 1.5%.Required:1. Record the adjusting entry for estimated warranty costs at the end of 2021.2. Record the summary entry for actual warranty expenditures in 2022, assuming all costs were paid in cash.3. Record the adjusting entry for estimated warranty costs at the end of 2022.4. What is the balance in Warranty Liability at the end of 2021 and 2022?arrow_forwardProctor provides 1 year warranty on every chair it produces and sells. On 12-31-19, proctor reported warranty payable of $960,000. During 2019, proctor recognized $640,000 of warranty expense. Warranty claims of $510,000. Tax rate $21%. A) DTC: 201,600 B) DTA: 174, 300 C) DTC: 130, 000 D) DTA: 228,900arrow_forwardFarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education