FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:ed States)

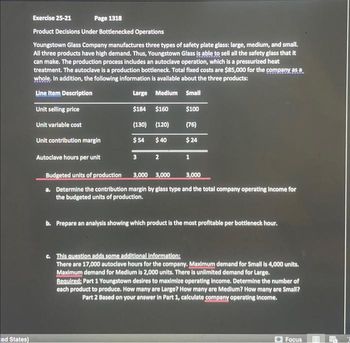

Exercise 25-21

Page 1318

Product Decisions Under Bottlenecked Operations

Youngstown Glass Company manufactures three types of safety plate glass: large, medium, and small.

All three products have high demand. Thus, Youngstown Glass is able to sell all the safety glass that it

can make. The production process includes an autoclave operation, which is a pressurized heat

treatment. The autoclave is a production bottleneck. Total fixed costs are $85,000 for the company as a

whole. In addition, the following information is available about the three products:

Line Item Description

Large Medium Small

Unit selling price

$184 $160 $100

Unit variable cost

(130) (120)

(76)

Unit contribution margin

$54

$40

$24

Autoclave hours per unit

3

2

1

Budgeted units of production

3,000 3,000

3,000

a. Determine the contribution margin by glass type and the total company operating income for

the budgeted units of production.

b. Prepare an analysis showing which product is the most profitable per bottleneck hour.

c. This question adds some additional information:

There are 17,000 autoclave hours for the company. Maximum demand for Small is 4,000 units.

Maximum demand for Medium is 2,000 units. There is unlimited demand for Large.

Required: Part 1 Youngstown desires to maximize operating income. Determine the number of

each product to produce. How many are Large? How many are Medium? How many are Small?

Part 2 Based on your answer in Part 1, calculate company operating income.

Focus

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step 1: Introduction of cost-volume-profit analysis

VIEW Step 2: Compute the operating income of the firm

VIEW Step 3: Compute profitability per bottleneck hour

VIEW Step 4: Compute the number of each product to earn maximum profit

VIEW Step 5: Compute overall profit of the firm (at optimum level)

VIEW Solution

VIEW Step by stepSolved in 6 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Tuttle Motorcycles Inc. manufactures and sells high-priced motorcycles. The Engine Division produces and sells engines to other motorcycle companies and internally to the Production Division. It has been decided that the Engine Division will sell 20,000 units to the Production Division at $1,050 a unit. The Engine Division, currently operating at capacity, has a unit sales price of $2,550 and unit variable costs and fixed costs of $1,050 and $750, respectively. The Production Division is currently paying $2,400 per unit to an outside supplier. What is the minimum transfer price that the Engine Division should accept? (Round your answer to a whole number if needed. Just put the number in the blank. No $ sign.) 2,460arrow_forwardkindly solve the following question i will be very thankfull to help mearrow_forwardMarvel Parts, Incorporated, manufactures auto accessories. One of the company’s products is a set of seat covers that can be adjusted to fit nearly any small car. The company has a standard cost system in use for all of its products. According to the standards that have been set for the seat covers, the factory should work 1,035 hours each month to produce 2,070 sets of covers. The standard costs associated with this level of production are: Total Per Set of Covers Direct materials $ 31,878 $ 15.40 Direct labor $ 6,210 3.00 Variable manufacturing overhead (based on direct labor-hours) $ 4,347 2.10 $ 20.50 During August, the factory worked only 500 direct labor-hours and produced 1,700 sets of covers. The following actual costs were recorded during the month: Total Per Set of Covers Direct materials (5,000 yards) $ 25,500 $ 15.00 Direct labor $ 5,440 3.20 Variable manufacturing overhead $ 4,080 2.40 $ 20.60 At standard, each set of covers…arrow_forward

- Gibson Motors manufactures specialty tractors. It has two divisions: a Tractor Division and a Tire Division. The Tractor Division can use the tires produced by the Tire Division. The market price per tire is $75. The Tire Division has the following costs per tire: i (Click the icon to view the costs and additional information.) Read the requirements. Requirement 1. Assume that the Tire Division has excess capacity, meaning that it can produce tires for the Tractor Division without giving up any of its current tire sales to outsiders. If Gibson Motors has a negotiated transfer price policy, what is the lowest acceptable transfer price? What is the highest acceptable transfer price? (Assume the $1 includes only the variable portion of conversion costs.) The lowest acceptable transfer price is the Tire Division's Requirements 1. Assume that the Tire Division has excess capacity, meaning that it can produce tires for the Tractor Division without giving up any of its current tire sales to…arrow_forwardDeli's Fudge Factory currently makes fudge for retail and mail order customers. It also offers a variety of roasted nuts. Fudge sales have increased over the past year, so Deli is considering outsourcing the roasted nuts and using the roasting space to make additional fudge. A reliable supplier has quoted a price of £0.85 per pound for the roasted nuts. The following amounts reflect the in-house manufacturing costs per pound for the roasted nuts: Direct materials Direct labour Unit-related support costs Batch-related support costs Product-sustaining support costs Facility-sustaining support costs Total cost per pound £0.50 0.06 0.10 0.04 0.05 0.15 £0.90 Required: Should Deli's Fudge Factory outsource the roasted nuts? Why or why not? Discuss all items that should be considered. a.arrow_forwardBillings Company produces two products, Product Reno and Product Tahoe. Each product goes through its own assembly and finishing departments. However, both of them must go through the painting department. The painting department has capacity of 2,460 hours per year. Product Reno has a unit contribution margin of $120 and requires 5 hours of painting department time. Product Tahoe has a unit contribution margin of $75 and requires 3 hours of painting department time. There are no other constraints. Refer to the information for Billings Company above. Required: What is the contribution margin per hour of painting department time for each product? What is the optimal mix of products? What is the total contribution margin earned for the optimal mix?arrow_forward

- Please help mearrow_forwardLeach Finishing makes various metal fittings for the construction industry. Three of the fittings, models X-12, X-24, and X-30, require grinding on a patented machine of which Leach has only one. The cost of production information for the three products follow: X-12 Price per fitting Variable cost per fitting Units per hour of grinding The testing machine used for both models has a capacity of 2,870 hours annually. Fixed manufacturing costs are $484,000 annually. Required A Required B X-24 $29 $ 14 18.0 X-12 X-24 X-30 units units units $ 45 X-30 $21 12.5 Required: a. Suppose that Leach Finishing can sell at most 55,600 units of any one fitting. How many units of each fitting model should Leach Finishing produce annually? b. Suppose that Leach Finishing can sell at most 15,300 units of any one fitting. How many units of each fitting should Leach Finishing produce annually? 15 Complete this question by entering your answers in the tabs below. $ 64 $38 10.0 Suppose that Leach Finishing…arrow_forwardTS Electronics is a manufacturer with two departments: computer chips and cell phones. The computer chip that is produced in the Chips Department can be sold to customers at $6.25 per chip. The costs associated with the computer chips are as follows: (Click the icon to view the computer chip costs.) The Cell Phone Department has been purchasing the chips that it needs for $4.00 per chip from Chip Universe, but the manager was thinking that if the Chips Department could supply the chips for less than what Chip Universe is asking, then it would arrange a transfer between departments instead of giving the business to an external company. If the Cell Phone Department needs 240,000 computer chips and current production in the Chips Department is 480,000 chips, should a transfer take place? If so, at what price? (Note: For internal transfers, the selling and administrative costs are reduced to $0.45 per unit.) What other qualitative factors might need to be considered? First, let's determine…arrow_forward

- Fyodor Corporation has a Parts Division that does work for other Divisions in the company as well as for outside customers. The company's Machine Division has asked the Parts Division to provide it with 6,000 special parts each year. The special parts would require $21 per unit in variable production costs. The Machine Division has a bid from an outside supplier for the special parts at $31.20 per unit. In order to have time and space to produce the special part, the Parts Division would have to cut back production of another part-the QR4 that it presently is producing. The QR4 sells for $40 per unit and requires $20 per unit in variable production costs. Packaging and shipping costs of the QR4 are $2 per unit. Packaging and shipping costs for the new special part would be only $0.50 per unit. The Parts Division is now producing and selling 30,000 units of the QR4 each year. Production and sales of the QR4 would drop by 5% if the new special part is produced for the Machine Division.…arrow_forwardPeppertree Company has two divisions, East and West. Division East manufactures a component that Division West uses. The variable cost to produce this component is $1.56 per unit; full cost is $1.98. The component sells on the open market for $4.96. Assuming Division East has excess capacity, what is the lowest price Division East will accept for the component? What is the highest price that Division West will pay for it? (Enter your answers in 2 decimal places.)arrow_forwardHercules Steel Company produces three grades of steel: high, good, and regular grade. Each of these products (grades) has high demand in the market, and Hercules is able to sell as much as it can produce of all three. The furnace operation is a bottleneck in the process and is running at 100% of capacity. Hercules wants to improve steel operation profitability. The variable conversion cost is $15 per process hour. The fixed cost is $200,000. In addition, the cost analyst was able to determine the following information about the three products: Category High Grade Good Grade Regular Grade Budgeted units produced 4,900 4,900 4,900 Total process hours per unit 11 10 9 Furnace hours per unit 4 3 2.5 Unit selling price $270 $260 $240 Direct materials cost per unit $85 $81 $75 The furnace operation is part of the total process for each of these three products. Thus, for example, 4.0 of the 12.0 hours required to process…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education