Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Please correct answer and don't used hand raiting

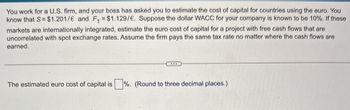

Transcribed Image Text:You work for a U.S. firm, and your boss has asked you to estimate the cost of capital for countries using the euro. You

know that S = $1.201/€ and F₁ = $1.129/€. Suppose the dollar WACC for your company is known to be 10%. If these

markets are internationally integrated, estimate the euro cost of capital for a project with free cash flows that are

uncorrelated with spot exchange rates. Assume the firm pays the same tax rate no matter where the cash flows are

earned.

The estimated euro cost of capital is ☐ %. (Round to three decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Consider the following international investment opportunity. It involves a gold mine that can be opened at a cost, then produces a positive cash flow, but then requires environmental clean-up. Year 0: -64,000 Euros Year 1: 160,000 Euros Year 2: -100,000 Euros The current exchange rate is $1.60 = 1 Euro. The inflation rate in the U.S. is 6 percent and in the euro zone 2 percent. The appropriate cost of capital to a U.S. -based firm for a domestic project of this risk is 8 percent. Find the dollar cash flows to compute the dollar - denominated NPV of this project. And also find the euro - zone cost of capital.arrow_forwardConsider the following international investment opportunity. It involves a gold mine that can be opened at a cost, then produces a positive cash flow, but then requires environmental clean-up. Year 0 + -€64,000 Year 1 Year 2 €160,000 -€100,000 The current exchange rate is $1.60 = €1.00. The inflation rate in the U.S. is 6 percent and in the euro zone 2 percent. The appropriate cost of capital to a U.S.-based firm for a domestic project of this risk is 8 percent. Find the euro-zone cost of capital. Write it down in percent with two decimals places.arrow_forwardEtemadi Amalgamated, a U.S. manufacturing firm, is considering a new project in Portugal. You are in Etemadi's corporate finance department and are responsible for deciding whether to undertake the project. The expected free cash flows, in euros, are shown here: Year 1 2 3 Free Cash Flow (E million) 0 -15 1 8.9 9.5 11.7 You know that the spot exchange rate is $0.87/€. In addition, the risk-free interest rate on dollars is 3.9% and the risk-free interest rate on euros is 56%. Assume that these markets are internationally integrated and the uncertainty in the free cash flows is not correlated with uncertainty in the exchange rate. You determine that the dollar WACC for these cash flows is 8.4%. What is the dollar present value of the project? Should Etemadi Amalgamated undertake the project? (Enter all outflows of cash as negative numbers.)arrow_forward

- You work for a Space Mountain Rollercoasters, which is a firm whose home currency is the Mexican peso (MXN) and that is considering a foreign investment. The investment yields expected after-tax Turkish lira (TRY) cash flows (in millions) as follows: Year 0 Year 1 -TRY1,100 TRY625 Government bond yield Expected inflation Project required return Year 2 TRY625 Assume that Covered Interest Rate Parity holds and that your firm's management believes that Relative Purchasing Power Parity is the best way to predict future exchange rates over this investment's time horizon. You also have the following information: MXN O a. The gain from hedging with forwards is MXN 67.56 million O b. The gain from hedging with forwards is MXN 69.21 million O c. The gain from hedging with forwards is MXN 66.37 million O d. The gain from hedging with forwards is MXN 65.42 million O e. The gain from hedging with forwards is MXN 67.92 million Year 3 10.16% p.a. 7.00% p.a. 14.811% p.a. TRY625 TRY 14.24% p.a. 12.00%…arrow_forwardSuppose you are a British venture capitalist holding a major stake in an e-commerce start-up inSilicon Valley. As a British resident, you are concerned with the pound value of your U.S. equityposition. Assume that if the American economy booms in the future, your equity stake will be worth $1, 000, 000, and the exchange rate will be $1.66 per pound. If the American economy experiences arecession, on the other hand, your American equity stake will be worth $500, 000, and the exchangerate will be $1.86 per pound. You assess that the American economy will experience a boom with a70 percent probability and a recession with a 30 percent probability. Required: a. Estimate yourexposure to the exchange risk. b. Compute the variance of the pound value of your American equityposition that is attributable to the exchange rate uncertainty. c-1. How would you hedge thisexposure? c-2. If you hedge, what is the variance of the pound value of the hedged position?arrow_forwardSuppose you are a British venture capitalist holding a major stake in an e-commerce start-up in Silicon Valley. As a British resident, you are concerned with the pound value of your U.S. equity position. Assume that if the American economy booms in the future, your equity stake will be worth $1001, and the exchange rate will be $1.28/£. If the American economy experiences a recession, on the other hand, your American equity stake will be worth $792, and the exchange rate will be $1.45/£. You assess that the American economy will experience a boom with a 70 percent probability and a recession with the remaining probability.Estimate the Covariance between P and Sarrow_forward

- In New York, you can exchange $1 for €0.8575 or £0.7. Suppose that, in Berlin, £1 costs €1.1515. How much profit can you earn on $10,998 using triangle arbitrage?arrow_forwardSuppose you are a British venture capitalist holding a major stake in an e-commerce start-up in Silicon Valley. As a British resident, you are concerned with the pound value of your U.S. equity position. Assume that if the American economy booms in the future, your equity stake will be worth $946, and the exchange rate will be $1.34/£. If the American economy experiences a recession, on the other hand, your American equity stake will be worth $768, and the exchange rate will be $1.39/£. You assess that the American economy will experience a boom with a 80 percent probability and a recession with the remaining probability. Estimate the expected value of the spot rate (in £ X.XXXX)arrow_forwardSuppose you are a British venture capitalist holding a major stake in an e-commerce start-up in Silicon Valley. As a British resident, you are concerned with the pound value of your U.S. equity position. Assume that if the American economy booms in the future, your equity stake will be worth $933, and the exchange rate will be $1.32/£. If the American economy experiences a recession, on the other hand, your American equity stake will be worth $788, and the exchange rate will be $1.39/£. You assess that the American economy will experience a boom with a 50 percent probability and a recession with the remaining probability.Estimate the Covariance between P and S (X.XXX)arrow_forward

- Suppose exchange rate of Japanese yen in US $ is $.010, exchange rate of euro in US $ is $1.34, and exchange rate of euro in Japanese yen is 139 yen and you have $100, 000 to invest. By looking the exchange rates, do you see triangular arbitrage opportunity? What is your profit or loss? Show the work to support your answer.arrow_forwardSuppose you are a British venture capitalist holding a major stake in an e-commerce start-up in Silicon Valley. As a British resident, you are concerned with the pound value of your U.S. equity position. Assume that if the American economy booms in the future, your equity stake will be worth $1,002,540, and the exchange rate will be $1.4/E. If the American economy experiences a recession, on the other hand, your American equity stake will be worth $502,880, and the exchange rate will be $16/E. You assess that the American economy will experience a boom with a 50 percent probability and a recession with a 50 percent probability. a. Estimate your exposure to the exchange risk. (Round final answer to nearest dollar.) Exposure b. Compute the variance of the pound value of your American equity position that is attributable to the exchange rate uncertainty (Round final answer to nearest dollar.) Vanancearrow_forwardSuppose you are a British venture capitalist holding a major stake in an e-commerce start-up in Silicon Valley. As a British resident, you are concerned with the pound value of your U.S. equity position. Assume that if the American economy booms in the future, your equity stake will be worth $1,000,000, and the exchange rate will be $1.40/£. If the American economy experiences a recession, on the other hand, your American equity stake will be worth $500,000, and the exchange rate will be $1.60/£. You assess that the American economy will experience a boom with a 70 percent probability and a recession with a 30 percent probability. What is your estimated exposure to the exchange risk? [Pick the closest number for your answer.] £4,511,976 $4,511,976 -$3,445,231 -£3,445,231arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education