Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

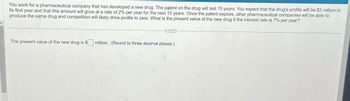

Transcribed Image Text:You work for a pharmaceutical company that has developed a new drug. The patent on the drug will last 15 years. You expect that the drug's profits will be $3 million in

its first year and that this amount will grow at a rate of 2% per year for the next 15 years. Once the patent expires, other pharmaceutical companies will be able to

produce the same drug and competition will likely drive profits to zero. What is the present value of the new drug if the interest rate is 7% per year?

The present value of the new drug is $

million. (Round to three decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Similar questions

- Brewster's is considering a project with a life of 5 years, an initial cost of $150,000, and a discount rate of 10 percent. The firm expects to sell 2,400 units a year at a cash flow per unit of $25. The firm will have the option to abandon this project after three years at which time it could sell the project for $40,000. At what level of sales should the firm be willing to abandon this project at the end of the third year?Answer in Excel Pleasearrow_forwardYou work for a pharmaceutical company that has developed a new drug. The patent on the drug will last 19 years. You expect that the drug's profits will be $4 million in its first year and that this amount will grow at a rate of 3 * 0/o per year for the next 19 years. Once the patent expires, other pharmaceutical companies will be able to produce the same drug and competition will likely drive profits to zero. What is the present value of the new drug if the interest rate is 12% per year? The present value of the new drug is $ (enter your response here) million.arrow_forwardFastCars is debating whether its next car model should be a gas or electric car. Due to factorylimitations, FastCars will only be able to introduce one new model in the next five years• Both models would have a five-year lifecycle, before they would need to be completelyredesigned. Thus FastCars will evaluate the project with a five-year time horizon• The gas model would have the following projected sales and cost of goods sold (in millions):Year 1 2 3 4 5Sales 14 17 19 19 15COGS 10 10 12 10 5 • The electric model would have the following projected sales and cost of goods sold (in millions):Year 1 2 3 4 5Sales 5 10 25 30 30COGS 4 7 15 15 12• Initial capital expenditures for retooling the factory will be 10 million dollars for the gas modeland 20 million dollars for the electric model. This cost will be depreciated fully using the straightline depreciation method over five years• A feasibility study was conducted that cost 1 million dollars and has already been paid for• The company’s…arrow_forward

- Your firm receives an offer from the supplier who provides computer chips used to manufacture cell phones. Due to poor planning, the supplier has an excess amount of chips and is willing to sell $600,000 worth of chips for only $500,000. You already have two years' supply on hand. It would cost you $7,500 today to store the chips until your firm needs them in two years. What implied interest rate would you be earning if you purchased and storearrow_forwardAn investment project requires an initial payment of $500,000, and then will earn a constant return of $45,000 every year forever. Is this a profitable investment project? Oyes, it is profitable O you can't tell with this information Ono, it is not profitablearrow_forwardYOU ARE A FINANCIAL ANALYST FOR A COMPANY THAT IS CONSIDERING A NEW PROJECT. IF THE PROJECT IS ACCEPTED, IT WILL USE A FRACTION OF A STORAGE FACILITY THAT THE COMPANY ALREADY OWNS BUT CURRENTLY DOES NOT USE. THE PROJECT IS EXPECTED TO LAST 10 YEARS, AND THE ANNUAL DISCOUNT RATE IS 10% (COMPOUNDED ANNUALLY). YOU RESEARCH THE POSSIBILITIES, AND FIND THAT THE ENTIRE STORAGE FACILITY CAN BE SOLD FOR €100,000 AND A SMALLER (BUT BIG ENOUGH) FACILITY CAN BE ACQUIRED FOR €40,000. THE BOOK VALUE OF THE EXISTING FACILITY IS €60,000, AND BOTH THE EXISITING AND THE NEW FACILITIES (IF IT IS ACQUIRED) WOULD BE DEPRECIATED STRAIGHT LINE OVER 10 YEARS (DOWN TO A ZERO BOOK VALUE). THE CORPORATE TAX RATE IS 40%. DISCUSS WHAT IS THE OPPORTUNITY COST OF USING THE EXISTING STORAGE CAPACITY?arrow_forward

- you work for a pharmaceutical comapny that developed a new drug. The patent on the drug will last 17 years . You expect the profits to be 1 million in its first year and that the amount will grow 2% for the next 17 years. the present value is if the interest rate is 11%arrow_forward. Consider the problem of investing in a risky project. A project costs $500. The annual cash flow for the first year are $60 and grows at the rate of 3% annually. The risk free rate is 5%. The company WACC is 12%. . Suppose the project has an option to let you wait and decide whether to accept the project. You can invest now or next year or in two years. At the end of 2 years you either invest in the project or lose it since further deferral is not possible. The project analyst has done the calculations and has produced the binomial tree showing the cash flows from the project at future dates. Calculate the NPV of the project. p_up 0.40 $80 $70 $60 $60 $50 $40 ○ $783.21 ○ $563.45 ○ $166.67 ○ $666.67arrow_forwardYou run a construction firm. You have just won a contract to build a government office building. It will take one year to construct it, requiring an investment of $8.96 million today and $5.00 million in one year. The government will pay you $21.50 million upon the building's completion. Suppose the cash flows and their times of payment are certain, and the risk-free interest rate is 6%. a. What is the NPV of this opportunity? b. How can your firm turn this NPV into cash today? a. What is the NPV of this opportunity? The NPV of this opportunity is $ 6.61 million. (Round to two decimal places.) b. How can your firm turn this NPV into cash today? (Select from the drop-down menus.) The firm can borrow $20.28 million today, and pay it back with 6% interest using the $21.50 million it will receive from the government. The firm can use cover its costs today and save next year. This leaves in the bank to earn 6% interest to cover its cost of of the in cash for the firm today. toarrow_forward

- Al_Tech plc is considering investing in a new company, New_tech plc. It has estimated that the new tech company will cost £440,000. Cash flows from increased sales will be £160,000 in the first year. These cash flows will increase by 5% every year. Al_Tech plc estimates that New_tech plc will lose all its technological advantages in five years from now and will lose all its value. Assume that the initial cost is paid now, and all the revenues are received at the end of each year. The company requires a 12% p.a. return for such an investment. a) Calculate the NPV of the investment project. b) Calculate the profitability index and the discounted payback period. c) Should Al_Tech plc consider investing in New_tech plc? What can you say about the internal rate of return to that project? Explain. d) Explain why it is theoretically correct to assume that accepting a project with a positive NPV should increase the value of a company by the NPV of the project.arrow_forwardYour startup has been doing well and you think you’re just a couple of years away from an M&A exit event. You assume you’ll be able to sell the company for about $50mm, the industry average. But you need to raise $3mm now to fund you until then. You’ve received three term sheets, all with the same premoney valuation of $9mm: which one is best, from the standpoint of maximizing the amount of money you will receive from the target exit, and what key reason(s) makes this most favorable? VC Firm: 1.5x participating preferred, no cap Angel Group: Convertible debt, converting at 25% discount to exit value, $18mm conversion value cap Family Office: 3x simple preferred with a $15mm caparrow_forward4. You are considering making a movie. The movie is expected to cost $10.0 million up front and take a year to produce. After that, it is expected to make $5.0 million in the year it is released and $2.0 million for the following four years. What is the payback period of this investment? If you require a payback period of two years, will you make the movie? Does the movie have positive NPV if the cost of capital is 10.0%? **round to one and two decimals**arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education