FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

How much is the net sales for the current period?

A. 10,559,000

B. 10,492,000

C. 10,491,000

D. 10,542,000

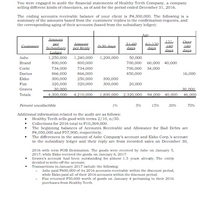

Transcribed Image Text:You were engaged to audit the financial statements of Healthy Teeth Company, a company

selling different kinds of chocolates, as of and for the period ended December 31, 2016.

The ending accounts reccivable balance of your client is P4,300,000. The following is a

summary of the amounts based from the customers' replies to the confirmation requests, and

the corresponding aging of thcir accounts (based from the subsidiary ledger):

Age

Amount

121.

Duer

Amount

31-60

days

per

Subsidiary

Ledaer

1,250,000

Customer

A30 days

180

per Reply

180

days

days

das

Ashe

1,240,000

1,200,000

50,000

Brand

800,000

800,000

700,000 60,000 40,000

Corki

734,000

734,000

700,000 34,000

Darius

866,000

300,000

866,000

250,000

850,000

16,000

Ekko

300,000

Fizz

320,000

320,000

300,000

20,000

Graves

30.000

30.000

Totals

4,300,000

4.210,000

1,800,000 2.320.000

94,000

40,000

46,000

Percent uncollectible

1%

5%

15%

30%

70%

Additional information related to the audit are as follows:

Healthy Tecth sclls good with terms 2/10, n/30.

Collections for 2016 total to P10,369,000.

The beginning balances of Accounts Reccivable and Allowance for Bad Debts are

P4,050,000 and P57,900, respectively.

The differences in the amount of Ashe Compary's account and Ekko Corp.'s account

in the subsidiary ledger and their reply are from recorded sales on December 30,

2016 with term FOB Destination. The goods were reccived by Ashe on January 5,

2017; while Ekko reccived the goods on January 6, 2017.

• Graves's account had been outstanding for almost 1.5 ycars alrcady. The entity

decided to write-off the account.

Transactions in January 2017 include the following:

Ashe paid P600,000 of its 2016 accounts reccivable within the discount period,

while Ekko paid all of their 2016 accounts within the discount period.

Fizz returned P50,000 worth of goods on January 4 pertaining to their 2016

purchases from Healthy Teeth.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Similar questions

- At what nominal rate of interest compounded quarterly will $ 6900 earn $1500 interest in eight years? ○ A.2.9002% ○ B.2.4665% ○ c.2.9547% ○ D.2.9978% ○ E.2.0458%arrow_forwardDomesticarrow_forwardWhat is the future value of $10,000 per year for 10 years invested at 10%? $159,374 $138,824 $170,000 $189,374arrow_forward

- 25. How long will it take money to double itself if invested at 6% compounded annually? A. 13.7 years В. 14.7 years С. 14.2 years D. 15.3 yearsarrow_forwardWhat would the EBITDA of a typical year be if the sales price was lowered by 10%?arrow_forwardYear Net Cash Flow Discount Factor Present Value (using the factor) Present Value (using Excel formula) 0 $ (3,500,000.00) 1 $(3,500,000.00) ($3,500,000.00) 1 $900,000.00 0.90909 $818, 181.00 $818, 181.82 2 $ 900,000.00 0.82645 $743,805.00 $743, 801.65 3 $900,000.00 0.75131 $676, 179.00 $676, 183.32 4 $ 900,000.00 0.68301 $614,709.00 $614,712.11 5 $900,000.00 0.62092 $558, 828.00 $558,829.19 Net Present Value $(88,298.00) $(88,291.91) 3. Now assume that inflation is estimated as a 5% increase each year (starting with Year 1) for the entire 5 years. Calculate the new net cash flow values for each year. Hint: You should start with 5% increase for Year 1 net cash flow.arrow_forward

- Future values. Fill in the future values for the following table, a. Use the future value formula, FV=PVX (1+r)^. b. Use the TVM keys from a calculator. c. Use the TVM function in a spreadsheet. using one of the three methods below:arrow_forwardWhat is the discount rate at which the following cash flows have a NPV of $0? Answer in %, rounding to 2 decimals.Year 0 cash flow = -116,000Year 1 cash flow = 28,000Year 2 cash flow = 43,000Year 3 cash flow = 38,000Year 4 cash flow = 41,000Year 5 cash flow = 40,000Year 6 cash flow = 37,000arrow_forward4arrow_forward

- Year Net Cash Flow Discount Factor Present Value (using the factor) Present Value (using Excel formula) 0 $ (3,500,000.00) 1 $ (3,500,000.00) ($3,500,000.00) 1 $ 900,000.00 0.90909 $ 818,181.00 $818,181.82 2 $ 900,000.00 0.82645 $ 743,805.00 $743,801.65 3 $ 900,000.00 0.75131 $ 676,179.00 $676,183.32 4 $ 900,000.00 0.68301 $ 614,709.00 $614,712.11 5 $ 900,000.00 0.62092 $ 558,828.00 $558,829.19 Net Present Value $ (88,298.00) $ (88,291.91) 3. Now assume that inflation is estimated as a 5% increase each year (starting with Year 1) for the entire 5 years. Calculate the new net cash flow values for each year. start with 5% increase for Year 1 net cash flow. Year Net Cash Flow 0 $…arrow_forwardWhat is the period in years?arrow_forwardEf 06.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education