Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

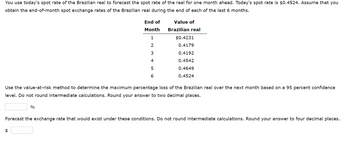

Transcribed Image Text:You use today's spot rate of the Brazilian real to forecast the spot rate of the real for one month ahead. Today's spot rate is $0.4524. Assume that you

obtain the end-of-month spot exchange rates of the Brazilian real during the end of each of the last 6 months.

End of

Month

1

2

3

4

5

6

%

$

Value of

Brazilian real

Use the value-at-risk method to determine the maximum percentage loss of the Brazilian real over the next month based on a 95 percent confidence

level. Do not round intermediate calculations. Round your answer to two decimal places.

$0.4231

0.4179

0.4192

0.4542

0.4649

0.4524

Forecast the exchange rate that would exist under these conditions. Do not round intermediate calculations. Round your answer to four decimal places.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- An exchange rate is 0.7000 and the six‐month domestic and foreign risk‐free interest rates are 5% and 7% (both expressed with continuous compounding). What is the six‐month forward rate? a) 0.7070 b) 0.7177 c) 0.7249 d) 0.6930arrow_forwardAssume the following information is available for the United States and Europe: Nominal interest rate Expected inflation Spot rate One-year forward rate a. Does IRP hold? IRP -Select- $ U.S. 4% 2% $ in this case. b. According to PPP, what is the expected spot rate of the euro in one year? Do not round intermediate calculations. Round your answer to three decimal places. EUROPE 6% 5% $1.13 $1.10 c. According to the IFE, what is the expected spot rate of the euro in one year? Do not round intermediate calculations. Round your answer to three decimal places. d. Reconcile your answers to parts (a) and (c). Parts a and c combined say that the forward rate premium or discount is [-Select- of the euro. ✓the expected percentage appreciation or depreciationarrow_forwardThe spot rate for the Argentine peso is $0.3600 per peso. Over the year inflation in Argentina is 10% and U.S. inflation is 4%. If purchasing power parity holds, at year-end the exchange rate should be approximately ______________ dollars per Real. A. 0.2875 B. 0.2987 C. 0.3384 D. 0.3614arrow_forward

- According to this morning's The National Post, you can exchange $1 for $0.77 U.S. in three months. Thus, the ________ is $1.30 Canadian. A. Backward rate. B. Forward rate. C. Futures rate. D. Triangle rate. E. Spot rate.arrow_forwardSuppose a basket of goods in Paris costs €134 and the same basket purchased in New York costs $151. a. At what exchange rate between euros and dollars is the cost of the basket the same in each city? b. Now suppose that over the next year inflation in France is expected to be 3% while in the U.S. the forecast is for 7% inflation. What exchange rate do you expect a year from now?arrow_forwardToday's spot exchange rate: 1 euro = $1.25.US interest rate (home interest rate) is 7%.EU interest rate (foreign interest rate) is 10%.a) If the IRP (Interest rate parity) holds, what should the forward exchange rate be today?b) Assume that today, you invest $500 in the EU market for one year and at the same time, enter a currency forward contract to sell euro in a year at the forward rate from part a). If today's spot exchange rate is: 1 euro=$1.32 instead of $1.25, show how much profits or losses you make next year.arrow_forward

- eBook You use today's spot rate of the Brazilian real to forecast the spot rate of the real for one month ahead. Today's spot rate is $0.4517. Assume that you obtain the end-of-month spot exchange rates of the Brazilian real during the end of each of the last 6 months. End of Value of Month Brazilian real 1 $0.4255 2 0.4202 3 0.4194 4 0.4502 5 6 0.4598 0.4517 Use the value-at-risk method to determine the maximum percentage loss of the Brazilian real over the next month based on a 5 percent confidence level. Do not round intermediate calculations. Round your answer to two decimal places. % Forecast the exchange rate that would exist under these conditions. Do not round intermediate calculations. Round your answer to four decimal places.arrow_forward17arrow_forwardAssume that the Mexican peso currently trades at 11 pesos to the U.S. dollar. During the year U.S. inflation is expected to average 4%, while Mexican inflation is expected to average 5%. What is the current value of one peso in terms of U.S. dollars? Given the relative inflation rates, what will the exchange rates be 1 year from now? Which currency is expected to appreciate and which currency is expected to depreciate over the next year? The current value of one Mexican peso in terms of U.S. dollars, USS, is US$/MP. (Round to six decimal places.) Given the relative inflation rates, the exchange rate of one U.S. dollar in terms of Mexican pesos, MP, one year from now will be MP/US$. (Round to six decimal places.) Given the relative inflation rates, the exchange rate of one Mexican peso in terms of U.S. dollars, US$, one year from now will be US$ /MP. (Round to six decimal places.) ▼is expected to appreciate, while the is expected to depreciate over the next year. (Select from the…arrow_forward

- You have just agreed to a forward trade that will be settled six months from now. When will the exchange rate for this transaction be determined? A. Today B. Three months from today because that is the halfway point C. Anytime you prefer within the next six months D. Whenever the spot rate six months from today is known E. Six months from nowarrow_forwardAssume the current U.S. dollar-yen spot rate is $0.0088/¥. Further, the current nominal 1-year rate of return in Japan is -0.112% and 0.14% in the United States. What is the estimated forward exchange rate for 270 days? Use maximal decimals in your calculations. ¥113.42/$ ¥113.85/$ ¥113.64/$ ¥113.35/$arrow_forwardQuestion 2 In 6-month from today, a U.S. based company will receive 2,000,000 Australian dollars (AUD) and the company wants to hedge the exchange rate risk. The expected AUD spot rate in 6-month will either appreciate by 5% (p.a) with 40% probability or depreciate by 10% (p.a.) with 60% probability. All rates are continuous compounding (please round your answers to 4 decimals in the exchange rate calculations). As the financial manager of the company, you look at Bloomberg and collect the following information: • U.S. interest rate: . . 4% p.a. 5% p.a. 1 AUD=0.63 USD Spot rate: Call option premium 0.03 USD, with exercise exchange rate 1 AUD-0.65 USD and 6-month maturity Put option premium 0.02 USD, with exercise exchange rate 1 AUD-0.64 USD and 6-month maturity Australian interest rate: 1) Calculate the 6-month forward exchange rate, describe how a forward agreement can be used to hedge the receivable money, and calculate the resulting amount of USD in 6 months.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education