Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

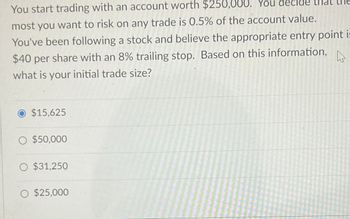

Transcribed Image Text:You start trading with an account worth $250,000. You decide that the

most you want to risk on any trade is 0.5% of the account value.

You've been following a stock and believe the appropriate entry point is

$40 per share with an 8% trailing stop. Based on this information,

what is your initial trade size?

$15.625

○ $50,000

O $31,250

○ $25,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Assume that you have shorted a call option on Intuit stock with a strike price of $40. The option will expire in exactly three months' time. a. If the stock is trading at $55 in three months, what will you owe? b. If the stock is trading at $35 in three months, what will you owe? c. Draw a payoff diagram showing the amount you owe at expiration as a function of the stock price at expiration. a. If the stock is trading at $55 in three months, what will you owe? If the stock is trading at $55 in three months, you will owe $ (Round to the nearest dollar.)arrow_forwardThe common stock of Anthony Steel has a beta of 1.1. The risk-free rate is 5 percent and the market risk premium (rm - rf) is 5 percent. What is the company's cost of common stock, rs? Express your answer in percentage (without the % sign) and round it to two decimal places.arrow_forwardYou are considering purchasing a share of preferred stock with the following characteristics: par value = $100 dividend rate = 12% per year payment schedule = quarterly maturity date = required rate of return = 6% per year current market price = $135 per share Based on this information, answer the following: A. What is the dollar amount of the quarterly dividend on this stock? B. Using the Discounted Cash Flow Method, what is the dollar value of this stock? C. Using the Discounted Cash Flow Method, what is the annual expected return for this stock? D. Based on your answer to part B, should you invest in the stock? Why or why not? E.…arrow_forward

- You bot $1000 stocks on margin using $700 of your own cash and $300 borrowed from your broker. The maintenance margin requirement of 30%. What's the market value of your stocks just before triggering a margin call? 418.57 428.57 500 408.57 468.57 448.57 438.57 458.57arrow_forwardYou are given the following information concerning the trades made on a particular stock. Calculate the money flow for the stock based on these trades. Note: Leave no cells blank - be certain to enter "O" wherever required. A negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answers to the nearest whole number. Price $ 30.33 Volume 30.36 3,600 30.34 3,100 30.33 3,500 29.34 3,650 30.33 4,400 30.24 4,700 Price Up or Down Price Times Volume Positive Money Flow Negative Money Flow Net Money Flow $ 30.33 30.36 30.34 30.33 29.34 30.33 30.24 Money flow at the end of the dayarrow_forwardPlease don't use Ai answer and step by step solutionsarrow_forward

- You expect an RFR of 9 percent and the market return (RM) of 14 percent. Compute the expected return for the following stocks. Round your answers to two decimal places. UIIUWIny SLULKS. nuunu yuui aliswers LU Lwu ue Stock Beta E(R,) 0.80 % 1.35 D -0.30arrow_forwardWhat about for these? (b) Suppose you have purchased some GameStop shares on margin at $5per share. You ask your broker to put in a limit sell order at $7, anda stop loss order at $4.50.i. What will happen if the stock price falls to $4.50?ii. What will happen if the stock price rises to $7?iii. Now suppose you had instead short-sold your GameStop shares(as in the first part of the question). What instructions mightyou give to your broker to minimise your losses and lock in yourgains?arrow_forwardSuppose the market risk premium is 6% and the risk-free interest rate is 5%. Using the data in the table, Starbucks Hershey Autodesk Beta 0.80 0.33 1.72 calculate the expected return of investing in A. Starbucks' stock (Round to two decimalplaces.). B. Hershey's stock. (Round to two decimal places.) C. Autodesk's stock (Round to two decimal places.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education