Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

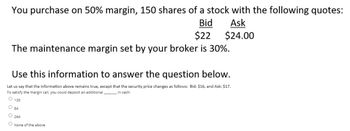

Transcribed Image Text:You purchase on 50% margin, 150 shares of a stock with the following quotes:

Bid

Ask

$24.00

$22

The maintenance margin set by your broker is 30%.

Use this information to answer the question below.

Let us say that the information above remains true, except that the security price changes as follows: Bid: $16, and Ask: $17.

To satisfy the margin call, you could deposit an additional

in cash:

O 120

84

O 264

O None of the above

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- answer c pleasearrow_forwardYou buy a share of stock, write a one-year call option with X = $26, and buy a one-year put option with X = $26. Your net outlay to establish the entire portfolio is $24.60. What is the payoff of your portfolio? What must be the risk-free interest rate? The stock pays no dividends. (Do not round intermediate calculations. Round "risk-free rate" to 2 decimal places.)arrow_forwardPLEASE GIVE ME THE CORRECT ANSWERarrow_forward

- In follow an Ito process with >0, a stock is worth $80 today, if the price of an option that pays the holder $2 exactly the first time the stock price reaches $200, what is the price of an option? Show all calculation.arrow_forwardExplain well all point of question with proper answer.arrow_forwardYou would like to be holding a protective put position on the stock of XYZ Company to lock in a guaranteed minimum value of $240 at year-end. XYZ currently sells for $240. Over the next year, the stock price will either increase by 7% or decrease by 7%. The T-bill rate is 3%. Unfortunately, no put options are traded on XYZ Company. Required: a. How much would it cost to purchase if the desired put option were traded? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. What would be the cost of the protective put portfolio? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forward

- I need only part Darrow_forward3) Can you please answer the question in the photo?arrow_forwardFinance Suppose that you are writing 5 call contracts on TGT with a strike price of $157.50. The premium is $2.50 per share. Answer the following: (1) Will this option be exercised if the stock price at expiration is $159.25? And more importantly, why (or WHY NOT?) Note: in practicing written communication, your brief answer should be in complete sentences in plain English such that an “average Joe” can follow your line of thought. (2) Calculate your TOTAL profit (loss) if TGT stock price at expiration is $159.25 per share.arrow_forward

- The stock price of BAC is currently $150 and a put option with strike price of $150 is $10. A trader goes long 300 shares of BAC stock and long 3 contracts of the put options with strike price of $150. a. What is the maximum potential loss for the trader?[x](sample answer: $105.75)b. When the stock price is $161 on the expiration, what is the trader’s net profit?[y](sample answer: $105.75)arrow_forwardYou have written a call option on Walmart common stock. The option has an exercise price of $81, and Walmart’s stock currently trades at $79. The option premium is $1.60 per contract. a. How much of the option premium is due to intrinsic value versus time value? b. What is your net profit if Walmart’s stock price decreases to $77 and stays there until the option expires? c. What is your net profit on the option if Walmart’s stock price increases to $87 at expiration of the option and the option holder exercises the option?arrow_forwardYou would like to be holding a protective put position on the stock of XYZ Co. to lock in a guaranteed minimum value of $109 at year- end. XYZ currently sells for $109. Over the next year the stock price will increase by 12% or decrease by 12%. The T-bill rate is 6%. Unfortunately, no put options are traded on XYZ Co. a. Suppose the desired put option were traded. How much would it cost to purchase? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Cost to purchase b. What would have been the cost of the protective put portfolio? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Cost of the protective put portfolio c. What portfolio position in stock and T-bills will ensure you a payoff equal to the payoff that would be provided by a protective put with X = 109? Show that the payoff to this portfolio and the cost of establishing the portfolio match those of the desired protective put. (Do not round…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education