Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

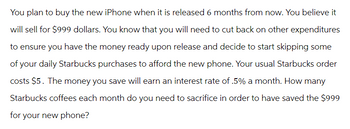

Transcribed Image Text:You plan to buy the new iPhone when it is released 6 months from now. You believe it

will sell for $999 dollars. You know that you will need to cut back on other expenditures

to ensure you have the money ready upon release and decide to start skipping some

of your daily Starbucks purchases to afford the new phone. Your usual Starbucks order

costs $5. The money you save will earn an interest rate of .5% a month. How many

Starbucks coffees each month do you need to sacrifice in order to have saved the $999

for your new phone?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Similar questions

- Nicole wants to save 3500 dollars in the next 2 years to go on a backpacking trip. Interest on her account is 3.6% compunded monthly. How much does she need to deposit at the end of each month?arrow_forwardYou have saved $3,000 for a down payment on a new car. The largest monthly payment you can afford is $300. The loan will have a 9% APR based on end-of-month payments. What is the most expensive car you can afford if you finance it for 48 months? Do not round intermediate calculations. Round your answer to the nearest cent.$ What is the most expensive car you can afford if you finance it for 60 months? Do not round intermediate calculations. Round your answer to the nearest cent. $arrow_forwardMinnie needs to buy a refrigerator. The refrigerator Minnie wants requires a down payment of $2000. The refrigerator is purchased on time, with Minnie planning to pay $2000 at the end of one year and $4000 at the end of 4 years. What is the cash price of the refrigerator if the interest rate is 10% compounded monthly? (Cash = Now)arrow_forward

- Do you want to be one of the first people to take a commercial flight to outer space which means that you need to save $3522922.  However, currently only have 2333723 in your savings account. Based on an analysis of your monthly budget, you can find a way to add 3437 per month to your account until you have enough. You can earn on average 12.2% APR in your account, compounded monthly how many years will you need to work before you can experience the weightlessness of the final frontier?arrow_forwardYou currently don't have a car, but rent a car that's parked just outside your house whenever you need one. Your annual expenditure on rental cars is $2,600. You are now considering purchasing a car that would give you the same level of convenience as your current life style. The car costs $27,000 and can be sold for $5,000 after 10 years. You'd purchase the car with money from your savings account which always earns an interest rate of 6%. Assume that all cash flows occur at the end of each year (maybe because you drive much more around Thanksgiving and Christmas.arrow_forwardYou plan to graduate in 4 years, and then travel to Italy for 3 weeks. The trip will cost $1,500. If you can earn an annual interest rate of 8%, how much do you have to save right now to have enough money for your trip? Instead, the interest rate is 0.667% per month. How much do you need to save right now?arrow_forward

- Ernie Bilko has a business idea. He wants to rent an abandoned gas station for just the months of November and December. He will convert the gas station into a drive-through Christmas wrapping station. Customers will drive in, drop off their gifts, return the next day, and pick up their wrapped gifts. He needs $331,700 to rent the gas station, purchase wrapping paper, hire workers, and advertise. If he borrows this amount at 6.5 interest for those two months, what size lump sum payment will he have to make to pay off the loan? (Round your answer to the nearest cent.) $ _______arrow_forwardSultan’s Used Cars just sold you a clunker (you need it to get to class on time). You financed the $8,000 purchase price for 48 months. They said your payment would be $250. What interest rate did they charge you (assume monthly compounding)?arrow_forwardYou need to buy a new laundry center with a price of $ 22,000 because the one you had no longer works and has no repair, at the moment you do not have the cash available to buy it, so you went to a department store to buy it on credit, The store offers you to pay for the laundry center in 24 months with an annual rate of 17%. What is the amount you will have to pay monthly? Note: Step by step to get to the result, do not skip anything.Note2: If it can be done in excel it is betterarrow_forward

- The local electronics store is offering a promotion "1-year: same as cash," meaning that you can buy a TV now, and wait a year to pay (with no interest). So, if you take home a $1,200 TV today, you will owe them $1,200 in one year. If your bank is offering 4% interest, what is the true cost of the TV to you today? The true cost of the TV to you today is $ (Round to the nearest cent.)arrow_forwardA used car that currently costs $25,000 will have a market value of $8,000 in four years. As a student, you cannot afford to pay $25,000, but you want to have a car while you are going to university for the next four years. Your father agrees to lend you $25,000 on the condition that you pay him $300 at the end of every month for the next four years and $25,000 at the end of the four years. The car dealer provides financing facilities, and you are qualified to get a lease for which you will have to make monthly, end-of-month payments of $650 for 48 months. Which option will leave you better off, assuming your opportunity cost is 6 percent?arrow_forwardYou are looking at purchasing a new computer for online class. Computer A costs $4000 now, and you expect it will last throughout your program without any upgrades. Computer B costs $2500 now and will need an upgrade at the end of two years, which you expect to be $1700. With 8 percent annual interest, compounded monthly, which is the less expensive alternative and by how much, if they provide the same level of service and will both be worthless at the end of the four years?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education