FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

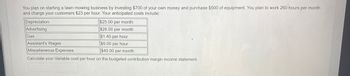

Transcribed Image Text:You plan on starting a lawn mowing business by investing $700 of your own money and purchase $500 of equipment. You plan to work 260 hours per month

and charge your customers $23 per hour. Your anticipated costs include:

$25.00 per month

$26.00 per month

$1.40 per hour

Assistant's Wages

$9.00 per hour

Miscellaneous Expenses

$40.00 per month

Calculate your Variable cost per hour on the budgeted contribution margin income statement.

Depreciation

Advertising

Gas

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- You have a business selling and delivering pizzas to businesses for lunch. You pay $4,000 per month in rent, $320 for utilities, and $2,000 a month for salaries. You also have delivery cars that cost $1,000 per month. Your variable costs are $8 per pizza for ingredients and $4 per pizza for delivery costs. You sell the pizzas for $20 each. Round up if necessary What is the number of pizzas you need to sell to break even for the month If you want to make a profit of 2,000 per month, how many pizzas do you need to sell? Round up if necessary Go back to the original numbers If the price of cheese goes up and your variable costs go by $3 what is your new break even in pizzas if you increase your price to $21 Round up if necessary Golden Company has a fleet of delivery trucks and has the following Overhead costs per month with the miles driven Miles Driven Total Costs March 50.000 194.000 Aprill 40.000 170.200 this is the low May 60.000 217.600 June 70.000 241.000 Use the High-Low method to…arrow_forwardPlease help me with show all calculation thankuarrow_forwardSuppose you are the human resource manager for a cellular phone company with 700 employees. Top management has asked you to implement three additional fringe benefits that were negotiated with employee representatives and agreed upon by a majority of the employees. These include group term life insurance, a group legal services plan, and a wellness center. The life insurance is estimated to cost $390 per employee per quarter. The legal plan will cost $312 semiannually per employee. The company will contribute 40% to the life insurance premium and 75% to the cost of the legal services plan. The employees will pay the balance through payroll deductions from their biweekly paychecks. In addition, they will be charged 1 4 % of their gross earnings per paycheck for maintaining the wellness center. The company will pay the initial cost of $800,000 to build the center. This expense will be spread over 5 years. (a) What total amount should be deducted per paycheck for these new…arrow_forward

- Problem 9) An entrepreneur is considering opening a coffee shop in downtown Pasadena. The building that he is considering will have a monthly lease payment of $3200 and basic utility costs of $600-per month. Two employees will be hired at $10.00/hour/employee (including overhead and benefits). Each employee will work an average of 170 hours per month. The average revenue per customer is estimated at $7.00. The variable cost of serving each customer is estimated at $2.00. (a) Calculate how many customers per month it will take for the coffee shop owner to breakeven. (b) How many customers would need to be served per month to achieve a monthly profit of $5,000?arrow_forwardDon't give solution in image format..arrow_forwardRahularrow_forward

- Mortgage Investor Group is opening an office in Portland, Oregon Fixed monthly costs are office rent ($8,900), depreciation on office furniture ($1,800), utilities (2,200), special telephone lines ($1,100), a connection with an online brokerage service ($2,700), and the salary of a financial planner ($4,400). Variable costs include payments to the financial planner (9% of revenue)advertising (11% of revenue), supplies and postage (4% of revenue), and usage fees for the telephone lines and computerized brokerage service (6% of revenue )arrow_forwardYou run a nail salon. Fixed monthly cost is $5,419.00 for rent and utilities, $5,913.00 is spent in salaries and $1,724.00 in insurance. Also every customer requires approximately $5.00 in supplies. You charge $107.00 on average for each service. You are considering moving the salon to an upscale neighborhood where the rent and utilities will increase to $11,155.00, salaries to $6,372.00 and insurance to $2,220.00 per month. Cost of supplies will increase to $6.00 per service. However you can now charge $171.00 per service. At what point will you be indifferent between your current location and the new location? Submit Answer format: Number: Round to: 2 decimal places. A Restaurant is open only for 25 days in a month. Expenses for the restaurant include raw material for each sandwich at $5.00 per slice, $1,103.00 as monthly rental and $219.00 monthly as insurance. They consider the cost of lost sales as $6.00 per item. They are able to sell any leftover sandwiches for $3. They prepares…arrow_forwardTo recap, W.T.’s planning on the following: Newspaper ad $120 per month Social media manager $100 per month; $1 per job scheduled Payment collection $0.75 per job Gas $4.00 per job Considering his analysis of similar services and to keep things simple, W.T. plans to price all jobs the same and charge $15 per job. Because of this flat rate, he anticipates he’ll likely need to create different types of “jobs”. For example, purchasing a list of items at the grocery store would be one job, while a bundle of 2-3 small errands such as picking up dry cleaning and prescriptions, might be considered one job. We’ll deal with those details later. For now, assume that all jobs are priced at $15 each and all have the associated variable expenses listed above. Because this will be a new business, W.T. knows business will likely be slow at the beginning. Complete the following table assuming W.T. completes 10 jobs in a single month. Item Per Job Total (10…arrow_forward

- James Shaw owns several shaved ice stands that operate in the summer along the Outer Banks of North Carolina. His contribution margin ratio is 60%. If James increases his sales revenue by $25,000 without any increase in fixed costs, by how much will his operating income increase? $25,000 $15,000 $10,000 $5,000arrow_forwardA 90-room motel has an average room rate of $64 and average occupancy of 77%. Its fixed costs are $800,000 a year, and its variable costs total $500,000. The owner wants to increase operating income from current level to $250,000. She decides to do the following adjustments: increase price by $6 spend $30,000 more per year on marketing to compensate for the higher room rate To motivate the staff, the owner also set a $2,000 reward to the best employee Send guest fruits to each room, which costs $5 per room How many rooms does she need to sell per night?arrow_forwardDr. MaGoo performs laser surgery to correct eye vision. He charges $800 for eye surgery (for a pair of eyes): Variable cost per eye surgery (per pair of eyes) are: Medical Supplies $35.00 Nurses time 65.00 Utilities for the machine 10.50 Variable marketing and administrative costs 24.50 The income tax rate is 30% Fixed overhead cost is $100,000 per year. Fixed selling and administrative costs are $25,000 per year. Dr. MaGoo performed 400 corrective eye surgeries last year. a. What is the contribution margin per eye surgery? b. Suppose that Dr. MaGoo wants to make a profit (after tax) of $100,000, how many eye surgeries must be sold? (Round to nearest dollar for tax calculation) c. Suppose that Dr. MaGoo has another option available, which uses a scalpel (cut and sew option) rather than the laser (laser option). This option reduces the fixed costs by $49,950 per year and increases variable cost by $150 per surgery. Assume 333 is the number…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education