Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

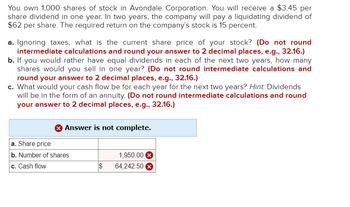

Transcribed Image Text:You own 1,000 shares of stock in Avondale Corporation. You will receive a $3.45 per

share dividend in one year. In two years, the company will pay a liquidating dividend of

$62 per share. The required return on the company's stock is 15 percent.

a. Ignoring taxes, what is the current share price of your stock? (Do not round

intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

b. If you would rather have equal dividends in each of the next two years, how many

shares would you sell in one year? (Do not round intermediate calculations and

round your answer to 2 decimal places, e.g., 32.16.)

c. What would your cash flow be for each year for the next two years? Hint: Dividends

will be in the form of an annuity. (Do not round intermediate calculations and round

your answer to 2 decimal places, e.g., 32.16.)

Answer is not complete.

a. Share price

b. Number of shares

c. Cash flow

1,950.00

$ 64,242.50 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Assume you own shares in Walmart and that the company currently earns $6.80 per share and pays annual dividend payments that total $5.55 a share each year. Calculate the dividend payout for Walmart. Note: Enter your answer as a percent rounded to 2 decimal places. Dividend payout %arrow_forwardJJ Industries will pay a regular dividend of $0.65 per share for each of the next four years. At the end of four years, the company will also pay out a liquidating dividend. If the discount rate is 8 percent, and the current share price is $71, what must the liquidating dividend be? (Do not round intermediate calculations. Round your answer to 2 decimal places. Omit the "$" sign in your response.)arrow_forwardABC Inc. will be in business for only the next 10 years and pays an annual dividend of $2.65 for those ten years? What is the present value of a share of stock for this company if we want a 7% return on the stock? O A. None of the above. B. $18.61 OC. $69.44 O D. $526.96arrow_forward

- Smiling Elephant, Inc., has an issue of preferred stock outstanding that pays a $4.70 dividend every year, in perpetuity. If this issue currently sells for $79.95 per share, what is the required return? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardSuppose you can buy 983 shares of Vertex Pharmaceuticals Incorporated (VRTX) stock on margin at $167 per share. Your initial margin is 51% and you borrow at the 7 percent. You sell your VRTX shares 6 months later for $185 per share. There were no dividends paid and the prices reflect commissions paid. What is your percent return if you buy on margin? [Enter the answer in as a percent (e.g., 5.55% = 5.55) - not a decimal]arrow_forwardYou purchase 110 shares for $40 a share ($4,400), and after a year the price falls to $35. Calculate the percentage return on your investment if you bought the stock on margin and the margin requirement was (ignore commissions, dividends, and interest expense): 15 percent. Use a minus sign to enter the amount as a negative value. Round your answer to one decimal place. % 50 percent. Use a minus sign to enter the amount as a negative value. Round your answer to one decimal place. % 75 percent. Use a minus sign to enter the amount as a negative value. Round your answer to one decimal place. %arrow_forward

- What price would you be willing to pay to purchase 1 share of this stock? (Picture )arrow_forwardYou own 1,000 shares of stock in Avondale Corp. You will receive a $.80 per share dividend in one year. In two years, Avondale will pay a liquidating dividend of $45 per share. The required return on Avondale stock is 10 percent. a. What is the current share price of your stock (ignoring taxes)? b. If you would rather have equal dividends in each of the next two years by creating homemade dividends, what would be the cash flow for Year 1 and Year 2?arrow_forwardMF Corporation has an ROE of 12% and a plowback ratio of 60%. The market capitalization rate is 10%. Required: a. If the coming year's earnings are expected to be $1.50 per share, at what price will the stock sell? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. b. What price do you expect MF shares to sell for in three years? Note: Do not round intermediate calculations. Round your answer to 2 decimal places. a. Price b. Price $ $ 43.00 X 26.40arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education