Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

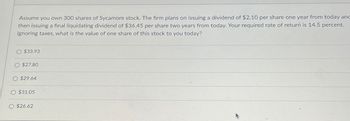

Transcribed Image Text:Assume you own 300 shares of Sycamore stock. The firm plans on issuing a dividend of $2.10 per share one year from today and

then issuing a final liquidating dividend of $36.45 per share two years from today. Your required rate of return is 14.5 percent.

Ignoring taxes, what is the value of one share of this stock to you today?

O $33.93

O $27.80

O $29.64

O $31.05

O $26.62

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- On January 1, you bought 100 shares of ABD stock for $19/share with funds that you borrowed at an annual rate of 8%. The stock paid dividends per share of $1.50 at the end of the first year, and of $2.20 at the end of year two. What rate of return did you earn if you sold the stock for $21/share at the end of year two. Hint: Compute the IRR per share. 14.52% 12.52% 9.99% 13.33% 15.12%.arrow_forwardIn you cash account, you buy 100 shares of XYZ Corporation at a price of $10 per share. Two months later, XYZ pays a dividend $0.21 per share. You sell all 100 shares of XYZ three months later at a price of $12 per share. What is your total return on this trade in dollar amount?arrow_forwardAn investor buys 300 shares of stock selling at $66 per share using a margin of 66%. The stock pays annual dividends of $1.00 per share. A margin loan can be obtained at an annual interest cost of 302 %. Determine what return on invested capital the investor will realize if the price of the stock increases to $88 within six months. What is the annualized rate of return on this transaction? Question content area bottom Part 1 If the price of the stock increases to $88 within six months, the six-month return on this transaction is .......................%. (Round to two decimal places.)arrow_forward

- Gamma Corporation just paid a dividend of $3.00 per share on its common stock. Dividends are expected to grow at an annual rate of 8% for next two years and then at 3% thereafter. If you want minimum return of 10%, what is the most that you would be willing to pay for a share of Gamma Corporation today? o earn a O A. $51.29 O B. $49.99 O C. $48.39 O D. $53.24arrow_forwardassume evco, inc., has a current stock price of $59 and will pay a $1.75 dividend in one year; its equity cost of capital is 13%. what price must you expect evco stock to sell for immediately after the firm pays the dividend in one year to justify its current price? the expected price is $ (round to the nearest cent.)arrow_forwardYou originally purchased Hershey stock at $161. It paid a dividend of $3.00 in the last year. Currently, the stock is selling for $156 per share. What is your total return if you sell the stock today?arrow_forward

- You purchase 100 shares of stock for $40 a share. The stock pays a $2 per share dividend at year-end. a. What is the rate of return on your investment if the end-of-year stock price is (i) $38; (ii) $40; (iii) $44? (Leave no cells blank - be certain to enter "0" wherever required. Enter your answers as a whole percent.) Stock Price Rate of Return 38 40 % 44 %arrow_forwardThis year, Hope Corporation paid a dividend of $0.50 per share. The company expect dividends to increase by 4.5% each year forever. If investors require a return of 12%, what is the value of a Hope Corporation share today? a. $6.67 b. $6.97 c. $4.17 d. $7.47 e. $0.50arrow_forwardCalculate Quick Ratio: AKA the Acid Testarrow_forward

- Rylan Industries is expected to pay a dividend of $5.70 year for the next four years. If the current price of Rylan stock is $31.33, and Rylan's equity cost of capital is 15%, what price would you expect Rylan's stock to sell for at the end of the four years? O A. $26.33 B. $73.72 OC. $21.06 OD. $47.39arrow_forwardAssume Evco, Inc. has a current stock price of $48.64 and will pay a $2.25 dividend in one year; its equity cost of capital is 10%. What price must you expect Evco stock to sell for immediately after the firm pays the dividend in one year to justify its current price? We can expect Evco stock to sell for $. (Round to the nearest cent.)arrow_forwardYou buy Disney stock at $80/ share. It’s worth $85 at the end of the first year and $90 at the end of the second year. You decide to sell it at $90. No dividend is paid, what are the two one-year returns (expressed as a percent)? What is the annualized return or geometric average (it’s a percent) for the two years?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education