Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

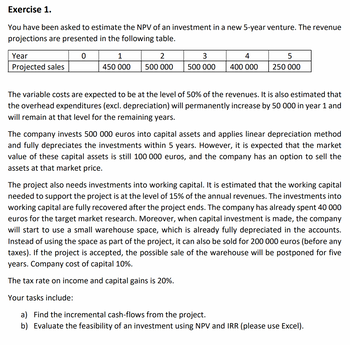

Transcribed Image Text:Exercise 1.

You have been asked to estimate the NPV of an investment in a new 5-year venture. The revenue

projections are presented in the following table.

0

Year

Projected sales

1

2

450 000 500 000

500 000

4

400 000 250 000

The variable costs are expected to be at the level of 50% of the revenues. It is also estimated that

the overhead expenditures (excl. depreciation) will permanently increase by 50 000 in year 1 and

will remain at that level for the remaining years.

The company invests 500 000 euros into capital assets and applies linear depreciation method

and fully depreciates the investments within 5 years. However, it is expected that the market

value of these capital assets is still 100 000 euros, and the company has an option to sell the

assets at that market price.

The project also needs investments into working capital. It is estimated that the working capital

needed to support the project is at the level of 15% of the annual revenues. The investments into

working capital are fully recovered after the project ends. The company has already spent 40 000

euros for the target market research. Moreover, when capital investment is made, the company

will start to use a small warehouse space, which is already fully depreciated in the accounts.

Instead of using the space as part of the project, it can also be sold for 200 000 euros (before any

taxes). If the project is accepted, the possible sale of the warehouse will be postponed for five

years. Company cost of capital 10%.

The tax rate on income and capital gains is 20%.

Your tasks include:

a) Find the incremental cash-flows from the project.

b) Evaluate the feasibility of an investment using NPV and IRR (please use Excel).

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- To project the appropriate anticipated cash flow for a project, we must put all cash flow knowledge together. This includes of the incremental cash flow. OA) the amount but not the timing B) the timing C) the amount D) both the amount and timing 33arrow_forward2. Match each of the following terms with the appropriate definition. The time expected to recover the cash initially invested in a project. A minimum acceptable rate of return on a potential investment. 1. Discounting A return on investment which results in a zero net present value. 2. Net Present Value A comparison of the cost of 3. Capital Budgeting an investment to its projected cash flows at a single point in time. 4. Accounting Rate of Return 5. Net Cash Flow A capital budgeting method focused on the rate of return on a project's average investment. 6. Internal Rate of Return 7. Payback Period The process of restating future cash flows in terms 8. Hurdle Rate of present time value. Cash inflows minus cash outflows for the period. A process of analyzing alternative long-term investments. >arrow_forwardIn a few sentences, answer the following question as completely as you can. Compare discounted cash flow (DCF) and non-discounted cash flow capital budgeting techniques. If you were to evaluate a project, which one of these techniques would you use?arrow_forward

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education