Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

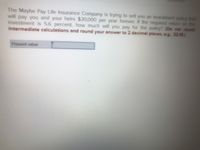

Transcribed Image Text:The Maybe Pay Life Insurance Company is trying to sell you an investment policy that

will pay you and your heirs $30,000 per year forever. If the required return on this

investment is 5.6 percent, how much will you pay for the policy? (Do not round

intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Present value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Solve this questionarrow_forwardExcel Online Activity: Required annuity payments 1 Question 1 0/10 Submit HVideo Excel Online Structured Activity: Required annuity payments Your father is 50 years old and will retire in 10 years. He expects to live for 25 years after he retires, until he is 85. He wants a fixed retirement income that has the same purchasing power at the time he retires as $60,000 has today. (The real value of his retirement income will decline annually after he retires.) His retirement income will begin the day he retires, 10 years from today, at which time he will receive 24 additional annual payments. Annual inflation is expected to be 4%. He currently has $70,000 saved, and he expects to earn 9% annually on his savings. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the question below. Qoen spreadsheet How much must he save during each of the next 10 years (end-of-year deposits) to meet his retirement goal? Do…arrow_forwardA taxpayer has a pension income of £3,100 a month and savings income of £1000. What is the personal savings allowance available? £0 £1,000 £500 £5,000arrow_forward

- Pls help on this question ASAP. Pls do the whole question pls pls pls pls pls i beg.arrow_forwardProblem 7-25 Low-Income Retirement Plan Contribution Credit (LO 7.9) George and Amal file a joint return in 2021 and have AGI of $38,200. They each make a $1,600 contribution to their respective IRAS. Assuming that they are not eligible for any other credits, what is the amount of their Saver's Credit?arrow_forwardQuestion 56 The probability that a 37-year-old white male will live another year is .99828. What premium would an insurance company charge to break even on a one-year $1 million term life insurance policy? Break-even $_______arrow_forward

- QUESTION 5 Katharine Bartle will receive an annuity of $4,090.00 every month for 23 years. How much is this cash flow worth to them today if the payments begin today? Assume a discount rate of 5.00%. Oa. $55,398.13 b. $2,119,880.47 c. $672,837.73 Od. $170,156.69arrow_forwardUse the table below to answer the following questions: Period 4 567 8 9 10 11 Present Value of an Annuity of 1 4% Future Value of an Annuity of 1 5% 5% 8% 10% 4% 8% 10% 3.6299 3.5460 3.3121 3.1699 4.2465 4.3101 4.5061 4.6410 4.4518 4.3295 3.9927 3.7908 5.4163 5.5256 5.8666 6.1051 5.2421 5.0757 4.6229 4.3553 6.6330 6.8019 7.3359 7.7156 6.0021 5.7864 5.2064 4.8684 7.8983 8.1420 8.9228 9.4872 5.7466 5.3349 9.2142 9.5491 10.6366 11.4359 7.4353 7.1078 6.2469 5.7590 10.5828 11.0266 12.4876 13.5795 8.1109 7.7217 6.7101 6.1446 12.0061 12.5779 14.4866 15.9374 8.7605 8.3064 7.1390 6.4951 13.4864 14.2068 16.6455 18.5312 6.7327 6.4632 Bobby receives alimony payments every 6 months and the next payment is tomorrow. Median homes go for $950,000 and he wants to save $190,000 in 4 years. How much money should Bobby put away into an investment each time he receives alimony payments if he can get a 8% return a year? $35,593 O $31,624 O $23,131 O $46,262arrow_forward10. Perpetuities Perpetuities are also called annuities with an extended or unlimited life. Based on your understanding of perpetuities, answer the following questions. Which of the following are characteristics of a perpetuity? Check all that apply. The present value of a perpetuity is calculated by dividing the amount of the payment by the investor's opportunity interest rate. A perpetuity is a series of regularly timed, equal cash flows that is assumed to continue indefinitely into the future. ☐ A perpetuity continues for a fixed time period. In a perpetuity, returns-in the form of a series of identical cash flows-are earned. Your grandfather wants to establish a scholarship in his father's name at a local university and has stipulated that you will administer it. As you've committed to fund a $15,000 scholarship every year beginning one year from tomorrow, you'll want to set aside the money for the scholarship immediately. At tomorrow's meeting with your grandfather and the bank's…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education