Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

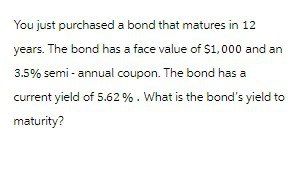

Transcribed Image Text:You just purchased a bond that matures in 12

years. The bond has a face value of $1,000 and an

3.5% semi-annual coupon. The bond has a

current yield of 5.62 %. What is the bond's yield to

maturity?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- An investor has two bonds in his portfolio that have a face value of $1,000 and pay an 11% annual coupon. Bond Y matures in 19 years, while Bond A matures in 1 year. 1. What will the value of the Bond Ybe if the going interest rate is 7%, 8%, and 12%? Assume that only one more interest payment is to be made on Bond A at its maturity and that 19 more payments are to be made on Bond Y. Round your answers to the nearest cent.arrow_forwardYou own a bond that pays $100 in annual interest, with a $1,000 par value. It matures in 15years. The market's required yield to maturity on a comparable-risk bond is 11 percent. a. Calculate the value of the bond. b. How does the value change if the yield to maturity on a comparable-risk bond (i) increases to 16 percent or (ii) decreases to 6 percent? c. Explain the implications of your answers in part b as they relate to interest-rate risk, premium bonds, and discount bonds. d. Assume that the bond matures in 5 years instead of 15 years and recalculate your answers in parts a and b. e. Explain the implications of your answers in part d as they relate to interest-rate risk, premium bonds, and discount bonds.arrow_forwardYou own a bond with a coupon rate of 6.4 percent and a yield to call of 7.3 percent. The bond currently sells for $1,087. If the bond is callable in five years, what is the call premium of the bond?arrow_forward

- A corporate bond pays interest annually and has 3 years to maturity, a face value of $1,000 and a coupon rate of 3.7%. The bond's current price is $997.21. It is callable at a call price of $1,050 in one year. What is the bond's yield to maturity? What is the bond's yield to call?arrow_forwardSuppose you purchase a 10-year bond with 6.3% annual coupons. You hold the bond for four years, and sell it immediately after receiving the fourth coupon. If the bond's yield to maturity was 4.6% when you purchased and sold the bond, A)What cash flows will you pay and receive from your investment in the bond per $100 face value? B)What is the annual rate of return of your investment?arrow_forwardA bond that matures in 12 years has a $ 1000 par value. The annual coupon interest rate is 12 percent and the market's required yield to maturity on a comparable-risk bond is 16 percent. What would be the value of this bond if it paid interest annually? What would be the value of this bond if it paid interest semiannually?arrow_forward

- you are interested in a corporate bond with a current market price of $973.36 and yield to a maturity of 7%. the bond carries a coupon rate of 6%, paid semi annually. if you buy the bond today, how many semi- annual coupon payments will you receive until the final maturity?arrow_forwardSuppose you have a 10-year bond (the bond will mature in 10 years), with a coupon rate of 2.45%. Coupons are paid on a semi-annual basis. The face value of the bond is $1000. Suppose the bond's yield to maturity suddenly increases from 2.13% to 2.63%. What is the impact on the price of the bond in percentage terms? Justify all of your response.arrow_forwardSuppose an investor has a 5-year investment horizon. He purchased an 8-year paying an 8% annual coupon rate while the bond's initial annual yield to maturity is 6%. The bond makes coupon payments semi-annually. The investor expects that he can reinvest the coupon at an annual interest rate of 7%. At the beginning of year 6, he expects the then yield to maturity to be 7%. What is the total return for this bond?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education