Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Please correct answer and don't use hand raiting

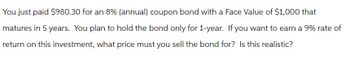

Transcribed Image Text:You just paid $980.30 for an 8% (annual) coupon bond with a Face Value of $1,000 that

matures in 5 years. You plan to hold the bond only for 1-year. If you want to earn a 9% rate of

return on this investment, what price must you sell the bond for? Is this realistic?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose that you bought a 14% Drexler bond with time to maturity of 9 years for $1,379.75 (semiannual coupons, interest rate=8%). After another ½ year, you sold the bond. Assuming that the required rate of return remained at 8%, what would the selling price be? What is the rate of return from this investment? If the interest rate dropped by 25 basis points, what would the selling price be? What would the rate of return from this investment be?arrow_forwardYou are considering the purchase of a perpetual bond that pays you $174 per year for the foreseeable future. If you require a 5.85% rate of return on this bond investment, what is a fair price for the bond that you would be willing to pay today? To nearest $0.01arrow_forwardSuppose you purchase a 10-year bond with 6.64% annual coupons. You hold the bond for 4 years, and sell it immediately after receiving the fourth coupon. If the bond's yield to maturity was 5.17% when you purchased and sold the bond, a. what cash flows will you pay and receive from your investment in the bond per $100 face value? b. what is the annual rate of return of your investment? a. What cash flows will you pay and receive from your investment in the bond per $100 face value? The cash flows from the investment are shown in the following timeline: (Round to the best choice below.) OA. Years Cash Flows O B. Years C. Years Cash Flows Cash Flows - $114.06 O D. Years 0 Cash Flows $107.42 0 0 - $111.26 0 $111.26 1 $6.64 1 $6.64 1 $6.64 1 $6.64 2 $6.64 2 + $6.64 2 + $6.64 2 + $6.64 3 $6.64 3 $6.64 3 $6.64 3 $6.64 b. What is the annual rate of return of your investment? The annual rate of return of your investment is %. (Round to two decimal places.) 4 $114.06 4 $107.42 4 $114.06 4…arrow_forward

- Suppose you purchase a 10-year bond with 6% annual coupons. You hold the bond for fouryears, and sell it immediately after receiving the fourth coupon. If the bond’s yield to maturitywas 5% when you purchased and sold the bond,a. What cash flows will you pay and receive from your investment in the bond per $100 face value?b. What is the internal rate of return of your investment?arrow_forwardSuppose you purchase a 10-year bond with 5% annual coupons. You hold the bond for four years and sell it immediately after receiving the fourth coupon. If the bond's yield to maturity was 3.49% when you purchased and sold the bond, a. What cash flows will you pay and receive from your investment in the bond per $100 face value? b. What is the internal rate of return of your investment? Note: Assume annual compounding. a. What cash flows will you pay and receive from your investment in the bond per $100 face value? The cash flow at time 1-3 is $ (Round to the nearest cent. Enter a cash outflow as a negative number.)arrow_forwardSuppose you purchase a 10-year bond with 6.4% annual coupons. You hold the bond for four years, and sell it immediately after receiving the fourth coupon. If the bond's yield to maturity was 5.5% when you purchased and sold the bond, a. what cash flows will you pay and receive from your investment in the bond per $100 face value? b. what is the annual rate of return of your investment? a. What cash flows will you pay and receive from your investment in the bond per $100 face value? The cash flows from the investment are shown in the following timeline: (Round to the best choice below.) A. Year 0 1 2 3 4 Cash Flows $110.90 $6.40 $6.40 $6.40 $104.50 B. Year 0 1 2 3 4 Cash Flows - $106.78 $6.40 $6.40 $6.40 $110.90 C. Year 0 2 3 4 Cash Flows $104.50 $6.40 $6.40 $6.40 $110.90 OD. Year 1 2 3 Cash Flows $106.78 $6.40 $6.40 $6.40 $110.90 b. What is the annual rate of return of your investment? The annual rate of return of your investment is %. (Round to one decimal place.)arrow_forward

- Suppose you purchase a 10-year bond with 6.3% annual coupons. You hold the bond for four years, and sell it immediately after receiving the fourth coupon. If the bond's yield to maturity was 4.6% when you purchased and sold the bond, A)What cash flows will you pay and receive from your investment in the bond per $100 face value? B)What is the annual rate of return of your investment?arrow_forwardPlease show how to work this out.arrow_forwardYou purchased a bond for 1,100. The bond has a coupon rate of 9 percent, which is paid semiannually. It matures in 17 years and has a par value of 1,000. What is your expected rate of return. How can i solve this with a financial calculator?arrow_forward

- If you buy municipal bond (tax free) that cost $1,000 and will pay a 4.7% coupon every year for the next 10 years (so the maturity date is in 10 years). At maturity the bond returns the original $1,000. If there is a 2.5% annual inflation, a) what real rate of return will you receive? b) How much real $ profit did you make from the bond?arrow_forwardSuppose you purchase a 10-year bond with 6.1 % annual coupons. You hold the bond for four years, and sell it immediately after receiving the fourth coupon. If the bond's yield to maturity was 4.7 % when you purchased and sold the bond, a. What cash flows will you pay and receive from your investment in the bond per $ 100 face value? b. What is the annual rate of return of your investment?arrow_forwardSuppose you purchase a 10-year bond with 6% annual coupons. You hold the bond for four years and sell it immediately after receiving the fourth coupon. If the bond's yield to maturity was 4.01% when you purchased and sold the bond, a. What cash flows will you pay and receive from your investment in the bond per $100 face value? b. What is the internal rate of return of your investment? Note: Assume annual compounding. The cash flow at time 1-3 is $ (Round to the nearest cent. Enter a cash outflow as a negative number.) (Round to the nearest cent. Enter a cash outflow as a negative number.) The cash outflow at time 0 is $ The total cash flow at time 4 (after the fourth coupon) is $ negative number.) b. What is the internal rate of return of your investment? (Round to the nearest cent. Enter a cash outflow as aarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education