FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

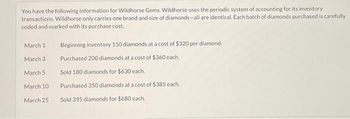

Transcribed Image Text:You have the following information for Wildhorse Gems. Wildhorse uses the periodic system of accounting for its inventory

transactions. Wildhorse only carries one brand and size of diamonds-all are identical. Each batch of diamonds purchased is carefully

coded and marked with its purchase cost.

March 1

March 31

March 5:

March 10-

March 25

Beginning inventory 150 diamonds at a cost of $320 per diamond.

Purchased 200 diamonds at a cost of $360 each.

Sold 180 diamonds for $630 each.

Purchased 350 diamonds at a cost of $385 each.

Sold 395 diamonds for $680 each.

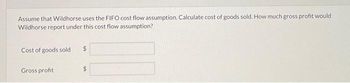

Transcribed Image Text:Assume that Wildhorse uses the FIFO cost flow assumption. Calculate cost of goods sold. How much gross profit would

Wildhorse report under this cost flow assumption?

Cost of goods sold. $

Gross profit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Dorothy's Boards sells a snowboard, Xpert, that is popular with snowboard enthusiasts. Information relating to Dorothy's purchases of Xpert snowboards during September is shown below. During the same month, 126 Xpert snowboards were sold. Dorothy's uses a periodic inventory system. Date Sept. 1 Sept. 12 Sept. 19 Sept. 26 (a) Explanation Inventory Purchases (b) Purchases Purchases Totals Units Unit Cost 29 Cost of goods sold 45 20 Your Answer Correct Answer (Used) 50 e Textbook and Media 144 $95 102 104 105 The ending inventory at September 30 $ Total Cost $ $ 2,755 Compute the ending inventory at September 30 and cost of goods sold using the FIFO and LIFO methods. 4,590 2,080 5,250 $14,675 FIFO The sum of ending inventory and cost of goods sold $ 1,890 12,785 For both FIFO and LIFO, calculate the sum of ending inventory and cost of goods sold. $ FIFO $ LIFO 1.710 12.965 LIFOarrow_forwardNov. 5 Purchased 600 units of product at a cost of $10 per unit. Terms of the sale are 2/10, n/60; the invoice is dated November 5. Nov. 7 Returned 25 defective units from the November 5 purchase and received full credit. Nov. 15 Paid the amount due from the November 5 purchase, less the return on November 7. Prepare journal entries to record each of the merchandising transactions assuming that the periodic inventory system is used Please don't provide answer in image format thank youarrow_forwardMarvin Company has a beginning inventory of 14 sets of paints at a cost of $1.60 each. During the year, the store purchased 6 sets at $1.70, 8 sets at $2.30, 8 sets at $2.60, and 12 sets at $3.10. By the end of the year, 32 sets were sold. a. Calculate the number of paint sets in ending inventory. Number of paint sets b. Calculate the cost of ending inventory under LIFO, FIFO, and the weighted average methods. Note: Round your answers to the nearest cent. Cost of ending inventory under LIFO Cost of ending inventory under FIFO Cost of ending inventory under Weighted Averagearrow_forward

- Use the following information for the Quick Study below. (Algo) (11-14) [The following information applies to the questions displayed below.] Trey Monson starts a merchandising business on December 1 and enters into the following three inventory purchases. Monson uses a perpetual inventory system. Also, on December 15, Monson sells 15 units for $32 each. Purchases on December 7 Purchases on December 14 Purchases on December 21 10 units @ $18.00 cost 20 units @ $24.00 cost 15 units @ $26.00 cost QS 5-11 (Algo) Perpetual: Assigning costs with FIFO LO P1 Required: Determine the costs assigned to the December 31 ending inventory based on the FIFO method.arrow_forwardRequired information Use the following information for the Quick Study below. (Algo) (11-14) Skip to question [The following information applies to the questions displayed below.]Trey Monson starts a merchandising business on December 1 and enters into the following three inventory purchases. Monson uses a perpetual inventory system. Also, on December 15, Monson sells 15 units for $27 each. Purchases on December 7 10 units @ $13.00 cost Purchases on December 14 20 units @ $19.00 cost Purchases on December 21 15 units @ $21.00 cost QS 5-14 (Algo) Perpetual: Inventory costing with specific identification LO P1 Of the units sold, eight are from the December 7 purchase and seven are from the December 14 purchase. Determine the costs assigned to ending inventory when costs are assigned based on specific identification.arrow_forwardcan you please check to see if i did the journal entries correctly? The following inventory transactions occurred at Zapata, Inc., which uses a perpetual inventory system: October 2 Purchased 50 units of inventory from a supplier on credit. The goods cost $30 each and the credit terms were 2/10, n/30. The shipping costs were $100 under the terms FOB destination and Zapata received the inventory on October 3rd. October 4 Returned 5 units of inventory from the October 2nd transaction to the supplier. October 6 Sold 15 of the units purchased on October 2nd for $50 each to customers for cash. October 7 October 10 Accepted a return of one unit of inventory from an October 6th customer for a cash refund. Established a petty cash fund for $300. October 11 October 15 October 28 Paid the supplier for one-half of the inventory purchased on October 2nd, net of any returns. Used $20 out of petty cash to pay for stamps (postage expense). Purchased 10 units of…arrow_forward

- Enter everything inside on the blue boxes please so I'll know how to key it inarrow_forwardConcord Inc. is a retailer using a perpetual inventory system. All sales returns from customers result in the goods being returned to inventory. (Assume that the inventory is not damaged.) Assume that there are no credit transactions; all amounts are settled in cash. You are provided with the following information for Concord Inc. for the month of January. Date Description Quantity Unit Cost orSelling Price Dec. 31 Beginning inventory 160 $21 Jan. 2 Purchase 100 22 Jan. 6 Sale 180 40 Jan. 9 Sale return 10 40 Jan. 9 Purchase 75 24 Jan. 10 Purchase return 15 24 Jan. 10 Sale 50 45 Jan. 23 Purchase 100 26 Jan. 30 Sale 120 51arrow_forwardRequired information Use the following information for the Quick Study below. (Algo) (15-18) [The following information applies to the questions displayed below.] Trey Monson starts a merchandising business on December 1 and enters into the following three inventory purchases. Monson uses a perpetual inventory system. Also, on December 15, Monson sells 29 units for $45 each. Purchases on December 7 Purchases on December 14 Purchases on December 21 QS 5-15A (Algo) Perpetual: Assigning costs with FIFO LO P3 Required: Determine the costs assigned to the December 31 ending inventory based on the FIFO method. Date December 7 December 14 Total December 14 December 15 Totals Total December 15 December 21 19 units @ $18.00 cost 35 units @ $27.00 cost 29 units @ $32.00 cost Goods Purchased Number of Cost Per Units Unit Perpetual FIFO: Goods Purchased 19 at $ 18.00 = $ 342.00 35 at $ 27.00 = $ 945.00 29 at $ 32.00 = $ 928.00 Cost of Goods Sold Number of Units Sold Cost Per Cost of Goods Unit…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education