FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

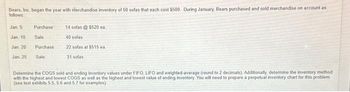

Bears, Inc. began the year with merchandise inventory of 50 sofas that each cost $500. During January, Bears purchased and sold merchandise on account as follows Jan. 5 Jan 10 Jan. 20 Jan. 25 Purchase Sale Purchase Sale 14 sofas @ $520 ea. 40 sofas 22 sofas at $515 ea. 31 sofas Determine the COGS sold and ending inventory values under FIFO, LIFO and weighted-average (round to 2 decimals). Additionally, determine the inventory method with the highest and lowest COGS as well as the highest and lowest value of ending inventory. You will need to prepare a perpetual inventory chart for this problem (see text exhibits 5.5, 5.6 and 5.7 for examples).

Transcribed Image Text:Bears, Inc. began the year with nierchandise inventory of 50 sofas that each cost $500. During January, Bears purchased and sold merchandise on account as

follows

Jan. 5

Jan 10

Jan 20

Jan 25

Purchase

Sale

Purchase

Sale

14 sofas @ $520 ea

40 sofas

22 sofas at $515 ea

31 sofas

Determine the COGS sold and ending inventory values under FIFO, LIFO and weighted-average (round to 2 decimals). Additionally determine the inventory method

with the highest and lowest COGS as well as the highest and lowest value of ending inventory. You will need to prepare a perpetual inventory chart for this problem

(see text exhibits 5.5, 56 and 5.7 for examples)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- XYZ company prepares financial statements monthly and the company uses FIFO method under a perpetual inventory system. The begining inventory for the month of december was 2500 TL (2.500 units at unit cost of 1TL). Journalize the below transactions of XYZ company for the month of December. 1. Purchased 5000 units of inventory on account, FOB destination, at a unit cost of 1.5 TL per unit 2. Sold 4500 units of inventory on account to Customer A, FOB shipping point, for 3 TL per unit. 3. XYZ granted credit to the customer A, who returned 100 units of inventory as they did not match the required specifications. The items were returned to inventory from the most recent purchase price. 4. XYZ bought 1000 units of inventory at a unit cost of 2 TL. The journal entry for item 4 involves a debit to for 2000 TL and the balance of the inventory account equals units, a total of TL. inventory 6650 4100 3100 4650 Purchasesarrow_forwardPlanet Enterprises sells its product for $22.06 per unit and uses the Average Cost, perpetual method for tracking inventory costs. The following sequence of events has occurred during the month of September. Date Event Sep 1 Beginning Inventory: 80 units @ $12.37/unit Sep 3 Purchase 115 units @ $11.2/unit Sep 7 Sell 90 units Sep 11 Purchase 70 units @ $10.53/unit Sep 17 Sell 115 units Sep 23 Purchase 80 units @ $10.73/unit How much is total Cost of Goods Sold for the entire month of September? (round all calculations to the hundredths place; enter your answer rounded to the hundredths place) Answer:arrow_forwardThe following units of a particular item were available for sale during the calendar year: Jan. 1 Inventory 4,000 units at $40 Apr. 19 Sale 2,500 units June 30 Purchase 4,500 units at $44 Sept. 2 Sale 5,000 units Nov. 15 Purchase 2,000 units at $46 The firm uses the weighted average cost method with a perpetual inventory system. Deteremine the cost of goods sold for each sale and the inventory balance after each sale. Present the data in the form illustrated in Exhibit 5.arrow_forward

- Thraya Industries had the following transactions in the month of March. Thraya uses a perpetual inventory system to account for its inventory transactions. All sales and purchases are on account. Date Units Unit Cost Unit Sales Price Mar. 1 Beginning inventory 2,000 litres $6.15/l Mar. 3 Purchase 2,500 litres $6.21/l Mar. 5 Sale 2,300 litres $10.50/l Mar. 10 Purchase 4,000 litres $6.72/l Mar. 20 Purchase 2,500 litres $6.94/l Mar. 30 Sale 5,200 litres $12.50/l Calculate the cost of goods sold, ending inventory, and gross profit for March using the weighted average (WA) method. Round the per-unit cost to two decimal places. Prepare journal entries to record the purchases and sales from parts B and C. Assume all purchases and sales are made on account. Answer the following questions for management. Which inventory method (FIFO or WA) produces the more meaningful inventory amount for…arrow_forwardPlease read and asnwer question using table provided.arrow_forwardNovak Outdoor Stores Inc. uses a perpetual inventory system and has a beginning inventory, as at April 1, of 149 tents. This consists of 51 tents purchased in February at a cost of $213 each and 98 tents purchased in March at a cost of $221 each. During April, the company had the following purchases and sales of tents: Date Apr. 3 (a) 10 17 24 30 (b) Your Answer Units Unit Cost Purchases 204 290 Cost of goods sold Gross profit Ending inventory $ $ Correct Answer (Used) Your answer is incorrect. Gross profit margin Save for Later $276 Determine the cost of goods sold and the cost of the ending inventory using FIFO. 287 19 $ eTextbook and Media Units 78 244 202 Sales Unit Price $393 Calculate Novak Outdoors's gross profit and gross profit margin for the month of April. (Round gross profit margin to 1 decimal place, e.g. 1.2% and gross profit to O decimal places, e.g. 5,275.) 137,902 393 34,153 393 96 Attempts: 2 of 3 used Submit Answerarrow_forward

- Red Company has beginning inventory of 22 units at a cost of $12.00 each on May 1. On May 5, it purchases 9 units at $14.00 per unit. On May 12 it purchases 25 units at $15.00 per unit. On May 15, it sells 39 units for $32 each. Using the FIFO perpetual inventory method, what is the value of the inventory on May 15 after the sale?arrow_forwardDetermine the Ending Inventory and Gross Profit using FIFO and LIFO for the quarter ending 3/31/XX for Company W (a widget reseller) based on the following information (Inventory on 1/14/XX = 0): Action Date Amount Cost Purchase 1/15/XX 150 Widgets $10 per Widget Purchase 2/15/XX 250 Widgets $11 per Widget Purchase 3/15/XX 600 Widgets $12 per Widget Total 1,000 Widgets Sell 3/20/XX 400 Widgets $20 per Widget Sell 3/25/XX 300 Widgets $20 per Widget 700 Widgets FIFO Inventory = LIFO Inventory = FIFO Gross Profit = LIFO Gross Profit =arrow_forwardRussell Retail Group begins the year with inventory of $64,000 and ends the year with inventory of $54,000. During the year, the company has four purchases for the following amounts. Purchase on February 17 $219,000 Purchase on May 6 139,000 Purchase on September 8 169,000 Purchase on December 4 419,000 Required: Calculate cost of goods sold for the year. Beginning inventory Cost of goods available for sale Cost of goods soldarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education