FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Hi, I need help with this. It is just for practice for myself

Transcribed Image Text:# Financial Analysis for a Large Supermarket Business

The data provided represents the financial information of a large supermarket business for the years ending 31st December 2020 and 31st December 2019.

## Current Assets and Liabilities

**As of 31/12/2020:**

- **Inventories:** £900 million

- **Trade Receivables:** £687.5 million

- **Cash:** £525 million

- **Total Current Assets:** £2,112.5 million

**As of 31/12/2019:**

- **Inventories:** £775 million

- **Trade Receivables:** £617.5 million

- **Cash:** £562.5 million

- **Total Current Assets:** £1,955 million

**Liabilities for Both Years:**

- **Trade Payables (31/12/2020):** £2,800 million

- **Trade Payables (31/12/2019):** £2,625 million

- **Total Current Liabilities (Both Years):** Remains £2,800 million and £2,625 million respectively

## Revenue and Profit

**As of 31/12/2020:**

- **Revenue:** £16,350 million

- **Cost of Sales:** £14,793.25 million

- **Operating Profit:** £962.5 million

**As of 31/12/2019:**

- **Revenue:** £15,050 million

- **Cost of Sales:** £13,800 million

- **Operating Profit:** £945 million

## Your Task

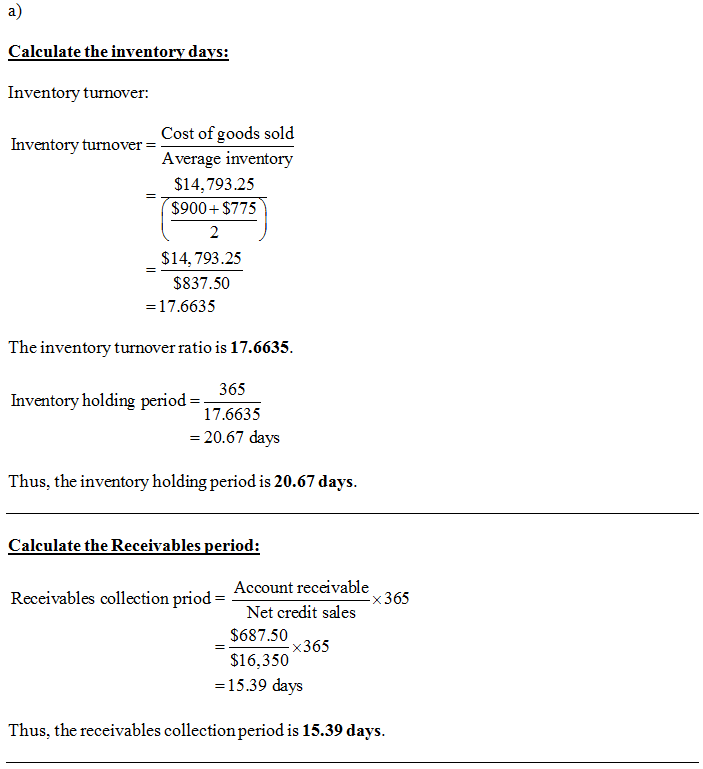

### (a) Calculate the Operating Cash Cycle in Days for the Year Ending 31st December 2020

The operating cash cycle (OCC) is a measure of how long a company takes to turn its inventories into cash. It is calculated using the following components:

- Inventory Days

- Receivables Days

- Payables Days

### (b) Comment on Your Findings and Explain Whether This is Typical for This Type of Business and Why

Consider the nature of supermarket businesses which generally have fast inventory turnover due to the sale of perishable goods. Reflect on the impact of fast inventory turnover and efficient receivable management on the operating cash cycle. Analyze if the OCC aligns with industry standards for supermarkets and explain the reasons behind your findings.

Expert Solution

arrow_forward

Step 1

Inventory: It refers to the items held by an organization which were in various forms like raw material, work-in process, and finished goods. The inventory is generally held for resale or to use in the production process.

Accounts receivable: It is a current asset of an organization. It is the amount due from customers for sale of merchandise or for providing services on credit to them.

Accounts payable: It is the current liability to an organization. It is the amount payable to the suppliers, payable towards outstanding dues etc.

arrow_forward

Step 2

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I'm stuck on how to do the excel formulasarrow_forwardHi, my name is Jennifer. I am having trouble with this same problem. But the sub-parts I need help with are C, D, and E. But more specifically, really just sub-parts D and E. The only parts I see being answered are sub-parts A, B, and C only in the 8 solutions posted. May I please receive help for the top sub-parts of C, D, and E ONLY, please? It would be much appreciated. Thank you. :) -- Jennifer Suttonarrow_forwardIm having an issue with this problem. Thank you!arrow_forward

- Can you further explain this to me to better understand the concept on what I'm supposed to do and what formulas I need to apply.arrow_forwardPlease do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!arrow_forwardPlease do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!Please do not rely too much on chatgpt, because its answer may be wrong. Please consider it carefully and give your own answer. You can borrow ideas from gpt, but please do not believe its answer.Very very grateful!arrow_forward

- Hi, Could you please show me how to solve this with formulas? not excel, I should have clarified. Thanksarrow_forwardwhat exactly is a cookie jar reserve? Does using a cookie jar reserve follow GAAP? Does using a cookie jar reserve appear to be an ethical practice? Support your opinion. Your post should be more than a single sentence.arrow_forwardIt says they answers are wrong from your example.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education