Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

You have taken out a 30-year loan of $55,000 with 6% interest (APR) compounded monthly and with monthly payments. Calculate the amount of your second principal payment. Round your final answer to one decimal place.

Expert Solution

arrow_forward

Introduction:

An amount or asset borrowed by an entity from an individual or financial institution is known as a loan. Loan consists of principal as well as interest amount to be repaid on a due date.

arrow_forward

Calculation:

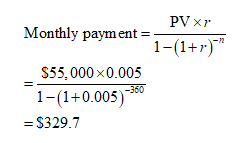

Firstly, calculating monthly payment (PMT):

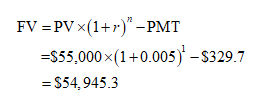

Now, Future Value (FV):

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A loan is repaid with payments of $2560 made at the end of each month for 13 years. If interest on the loan is 14.5%, compounded semi-annually, what is the initial value of the loan? Enter to the nearest cent (two decimals). Do not use $ signs or commas. Answer: NEXT PAGEarrow_forwardFind the amount of the payment necessary to amortize a loan of $32,000 at 4% compounded quarterly in 15 payments. Use TVM solver in calculatorarrow_forwardFind the monthly payment for the loan. (Round your answer to the nearest cent.) $200 loan for 12 months at 14%arrow_forward

- Taking out a 21 year loan at $59,000 with 6% APR compounded monthly, and with monthly payments, calculate the amount of your second principal payment. Round your final answer to one decimal place.arrow_forwardYou have taken out a 20-year loan of $72,000 with 3% interest (APR) compounded monthly and with monthly payments. Calculate the amount of your second principal payment. Round your final answer to one decimal place.arrow_forwardYou just obtained a loan of $12,157 with monthly payments for four years at 5.77 percent interest, compounded monthly. What is the amount of each payment? Instruction: Enter your response rounded to two decimal places. 1 harrow_forward

- If I plan to avail of a loan today and I will pay it P7,338 every start of the month for 6 years charged by an interest rate of 11.6% compounded quarterly. How much money will I take home today if I will avail of the loan, in pesos, answer in two decimal places?arrow_forwardFind the effective interest rate for a loan for four years compounded semiannually at an annual rate of 5%. Click here to view page 1 of the future value table. Click here to view page 2 of the future value table. The effective interest rate is %. (Round to two decimal places as needed.)arrow_forwardRoss Land has a loan of $8,500 compounded quarterly for four years at 4%. What is the effective interest rate for the loan? Click here to view page 1 of the future value table. Click here to view page 2 of the future value table. The effective interest rate is %. (Round to two decimal places as needed.)arrow_forward

- A loan of $1500 is to be repaid by annual payments of $250 to commence at the end of the fifth year and to continue thereafter for as long as necessary. Find the amount of the final payment, if the final payment is to be larger than the regular payments. Assume i = 5%. Round your answer to two decimal places.arrow_forwardHow long will it take to pay off a loan of $47,000 at an annual rate of 8 percent compounded monthly if you make monthly payments of $650? Use five decimal places for the monthly percentage rate in your calculations. The number of years it takes to pay off the loan is enter your response here years. (Round to one decimal place.)arrow_forwardFind the monthly payment needed to amortize a typical $245,000 mortgage loan amortized over 30 years at an annual interest rate of 3.5% compounded monthly. (Round your answers to the nearest cent.)$ Find the total interest paid on the loan.$arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education