Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

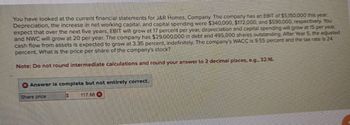

Transcribed Image Text:You have looked at the current financial statements for J&R Homes, Company. The company has an EBIT of $5,150,000 this year.

Depreciation, the increase in net working capital, and capital spending were $340,000, $172,000, and $590,000, respectively. You

expect that over the next five years, EBIT will grow at 17 percent per year, depreciation and capital spending will grow at 15 per year,

and NWC will grow at 20 per year. The company has $29,000,000 in debt and 495,000 shares outstanding. After Year 5, the adjusted

cash flow from assets is expected to grow at 3.35 percent, indefinitely. The company's WACC is 9.55 percent and the tax rate is 24

percent. What is the price per share of the company's stock?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

Answer is complete but not entirely correct.

Share price

$

117.88

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Derry Corporation is expected to have an EBIT of $2,550,000 next year. Depreciation, the increase in net working capital, and capital spending are expected to be $190,000, $95,000, and $195,000, respectively. All are expected to grow at 16 percent per year for four years. The company currently has $14,000,000 in debt and 805,000 shares outstanding. At Year 5, you believe that the company's sales will be $27,600,000 and the appropriate price-sales ratio is 2.2. The company's WACC is 8.5 percent and the tax rate is 22 percent. What is the price per share of the company's stock? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Share pricearrow_forwardDerry Corporation is expected to have an EBIT of $3,100,000 next year. Depreciation, the increase in net working capital, and capital spending are expected to be $245,000, $150,000, and $250,000, respectively. All are expected to grow at 15 percent per year for four years. The company currently has $19,500,000 in debt and 860,000 shares outstanding. After Year 5, the adjusted cash flow from assets is expected to grow at 3.4 percent, indefinitely. The company's WACC is 9.7 percent and the tax rate is 23 percent. What is the price per share of the company's stock? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Share pricearrow_forwardYou have looked at the current financial statements for J&R Homes, Company. The company has an EBIT of $3,850,000 this year. Depreciation, the increase in net working capital, and capital spending were $275,000, $133,000, and $525,000, respectively. You expect that over the next five years, EBIT will grow at 20 percent per year, depreciation and capital spending will grow at 10 per year, and NWC will grow at 15 per year. The company has $22,500,000 in debt and 430,000 shares outstanding. After Year 5, the adjusted cash flow from assets is expected to grow at 3.3 percent, indefinitely. The company's WACC is 9.35 percent and the tax rate is 21 percent. What is the price per share of the company's stock? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Answer is complete but not entirely correct. Share price S 226.59arrow_forward

- Derry Corporation is expected to have an EBIT of $2,950,000 next year. Depreciation, the increase in net working capital, and capital spending are expected to be $230,000, $135,000, and $235,000, respectively. All are expected to grow at 18 percent per year for four years. The company currently has $18,000,000 in debt and 845,000 shares outstanding. After Year 5, the adjusted cash flow from assets is expected to grow at 3.1 percent, indefinitely. The company’s WACC is 9.4 percent and the tax rate is 25 percent. What is the price per share of the company's stock?arrow_forwardDerry Corporation is expected to have an EBIT of $3,150,000 next year. Depreciation, the increase in net working capital, and capital spending are expected to be $250,000, $155,000, and $255,000, respectively. All are expected to grow at 16 percent per year for four years. The company currently has $20,000,000 in debt and 865,000 shares outstanding. After Year 5, the adjusted cash flow from assets is expected to grow at 3.5 percent, indefinitely. The company's WACC is 8.6 percent and the tax rate is 24 percent. What is the price per share of the company's stock? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Share pricearrow_forwardBonza Corporation generated free cash flow of $80 million this year. For the next two years, the company's free cash flow is expected to grow at a rate of 7.5%. After that time, the company's free cash flow is expected to level off to the industry long-term growth rate of 3% per year. If the weighted average cost of capital is 15% and Bonza Corporation has cash of $100 million, debt of $300 million, and 100 million shares outstanding. What is Bonza Corporation's expected terminal enterprise value in year 2? What is Bonza Corporation's expected free cash flow in year 2? What is Bonza Corporation's expected current share price?arrow_forward

- Swampy Ox Real Estate (SORE) has been growing at a constant 7 percent rate for many years, and it expects to continue this growth long into the future. On January 1 of this year, which is the slow part of its selling season, SORE's total assets were $420 million. At the height of its selling season, which is at the end of June, SORE expects total assets to be $520 million. How much of the $520 million in assets represents permanent assets, and how much represents temporary current assets? Round your answer to the nearest dollar. Permanent assets: $ Temporary current assets: $arrow_forwardDerry Corporation is expected to have an EBIT of $1,900,000 next year. Increases in depreciation, the increase in net working capital, and capital spending are expected to be $160,000, $80,000, and $120,000, respectively. All are expected to grow at 15 percent per year for four years. The company currently has $10,000,000 in debt and 800,000 shares outstanding. At Year 5, you believe that the company's sales will be $13,620,000 and the appropriate price-sales ratio is 2.1. The company's WACC is 8.4. percent and the tax rate is 21 percent. What is the price per share of the company's stock? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Share pricearrow_forwardYou have been studying Lucas Corp.’s financial statements. This year, the company has an EBIT of $3.15mil, Depreciation of $295,000, an increase in net working capital of $125,000, and a capital spending of $535,000. You expect that over the next 5 years, EBIT will grow at 15% per year, depreciation and capital spending will grow at 20% per year, and NWC will grow at 10% per year. After year 5, you expect the company’s free cash flow will grow at 3.5% indefinitely. The company has a 21% corporate tax rate and a WACC of 8.9%. a) Compute the free cash flows for the next 5 years. b) Compute the terminal value at the end of year 5. c) What is the company’s enterprise value?arrow_forward

- Mars Corporation is interested in estimating the expected rate of sales growth sustainability and additional financing needed to support improvements fast sales next year. Last year, revenue was $5.5 million; net profit is $500,000; investment in assets is $2,500,000; payables and accruals are $1,000,000; and shareholder equity at the end of the year is $1,500,000 (that is, the equity at the beginning of the year of $1,000,000 plus retained earnings of $500,000). The business does not pay dividends and does not expect to pay dividends in the future. a. Estimate sustainable sales growth rate for Mars Corporation based on the information provided in this issue. Include also the interpretation of the results of your calculations at point a.arrow_forwardYou have looked at the current financial statements for J&R Homes, Company. The company has an EBIT of $2,890,000 this year. Depreciation, the increase in net working capital, and capital spending were $227,000, $92,000, and $425,000, respectively. You expect that over the next five years, EBIT will grow at 18 percent per year, depreciation and capital spending will grow at 23 percent per year, and NWC will grow at 13 percent per year. The company currently has $15.5 million in debt and 415,000 shares outstanding. After Year 5, the adjusted cash flow from assets is expected to grow at 3.5 percent indefinitely. The company's WACC is 8.9 percent and the tax rate is 23 percent. What is the price per share of the company's stock? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) Share pricearrow_forwardBaghibenarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education